Investing in real estate is a tried and tested strategy, but the choice between Land Banking and Traditional Real Estate can significantly impact your returns and overall investment experience. In this article, we’ll explore the nuances of both approaches, examining their pros and cons, financial considerations, risk management strategies, and more.

Land Banking vs. Traditional Real Estate: A Comparison

Introduction

Real estate investment is a multifaceted journey, and understanding the fundamental differences between Land Banking and Traditional Real Estate is crucial. Land Banking involves purchasing undeveloped land with the expectation of future appreciation, while Traditional Real Estate typically revolves around developed properties for rental income or long-term value growth.

What is Land Banking?

Land banking is the practice of purchasing undeveloped land with the intention of holding it for a long period of time, typically 5 to 10 years, before selling it for a profit. The goal of land banking is to capitalize on the appreciation of land values over time.

What is Traditional Real Estate Investing?

Traditional real estate investing involves purchasing developed properties, such as houses, apartments, or commercial buildings. The investor can then generate income from these properties through rent or resale.

Land Banking vs. Traditional Real Estate Comparison Table

Here is a table that summarizes the key differences between land banking and traditional real estate investing:

| Feature | Land Banking | Traditional Real Estate Investing |

|---|---|---|

| Investment horizon | Long-term (5-10 years or more) | Short-term (1-5 years) |

| Risk | High | Moderate |

| Return | Potentially high | Moderate |

| Liquidity | Low | High |

| Income potential | None | Rental income or resale profit |

| Maintenance costs | Low | High |

| Expertise required | Moderate | High |

Pros and Cons of Land Banking

Potential for High Returns

Land Banking offers the potential for substantial returns, especially if the purchased land becomes a desirable location for development. The key is patience and strategic selection.

Lack of Immediate Cash Flow

Unlike traditional real estate, Land Banking often lacks immediate cash flow through rental income. Investors must be prepared for a more extended investment horizon.

Mitigating Risks in Land Banking

Successful Land Banking involves mitigating risks through thorough research, understanding local development plans, and diversifying land holdings. It’s a long-term play that demands strategic thinking.

Benefits of Land Banking

There are several potential benefits to land banking, including:

- Low carrying costs: Land requires very little maintenance, so carrying costs are typically low.

- Potential for high returns: Land values have historically appreciated over time, so there is the potential for high returns on investment.

- Hedge against inflation: Land can be a good hedge against inflation, as the value of land typically increases as the cost of living increases.

- Diversification: Land banking can be a good way to diversify your investment portfolio.

Risks of Land Banking

There are also several potential risks associated with land banking, including:

- Illiquidity: Land can be difficult to sell quickly, so it is an illiquid investment.

- Market fluctuations: Land values can fluctuate, so there is a risk of losing money if you sell your land at an inopportune time.

- Unforeseen costs: There can be unforeseen costs associated with land banking, such as property taxes or environmental remediation.

- Lack of income: Land does not generate income, so you will need to have another source of income while you are waiting for your land to appreciate.

Pros and Cons of Traditional Real Estate

Rental Income as a Steady Source of Cash Flow

Traditional Real Estate provides a steady source of cash flow through rental income, making it an attractive option for those seeking regular returns.

Market Fluctuations Affecting Property Values

The traditional real estate market is subject to fluctuations, impacting property values. Investors need to navigate market dynamics to maximize returns.

Long-Term Appreciation Potential

Investing in well-chosen properties can lead to long-term appreciation, offering a hedge against inflation and potential profitability upon resale.

Risks of Traditional Real Estate Investing

There are also several potential risks associated with traditional real estate investing, including:

- Vacancy risk: There is always a risk that your property will be vacant and you will not be able to collect rent.

- Tenant problems: Tenants can be difficult to deal with and can cause damage to your property.

- Maintenance costs: Properties require ongoing maintenance, which can be expensive.

- Liquidity risk: Properties can be difficult to sell quickly, so they are not a very liquid investment.

Benefits of Traditional Real Estate Investing

There are also several potential benefits to traditional real estate investing, including:

- Potential for rental income: Rental properties can generate a steady stream of income.

- Potential for resale profit: Properties can potentially appreciate in value and be sold for a profit.

- Tangible asset: Real estate is a tangible asset that you can own and control.

- Tax advantages: There are a number of tax advantages to real estate investing.

Financial Considerations

Understanding the financial requirements of Land Banking and Traditional Real Estate is crucial for making informed investment decisions.

Initial Investment Requirements for Land Banking

Land Banking often requires substantial initial investments, and investors should be prepared for the long-term commitment without expecting immediate returns.

Financing Options for Traditional Real Estate Investments

Traditional Real Estate provides more financing options, including mortgages and loans, making it accessible to a broader range of investors.

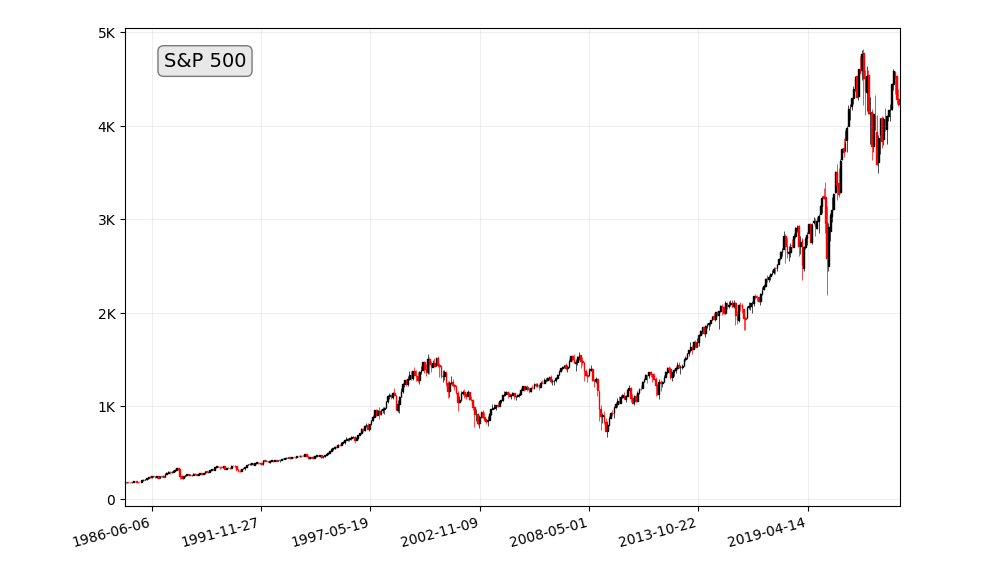

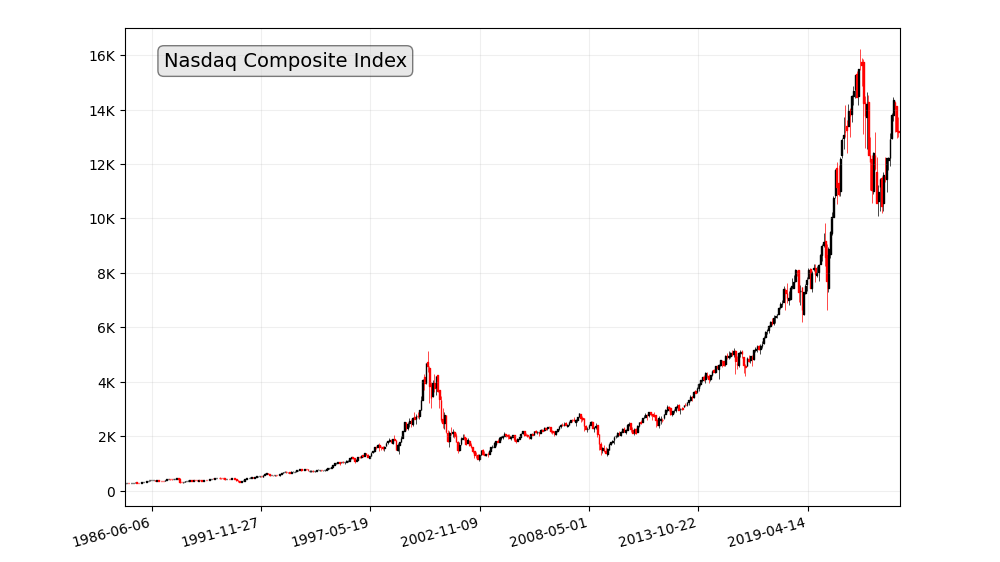

Return on Investment (ROI) Comparisons

Comparing the return on investment between Land Banking and Traditional Real Estate involves considering factors such as appreciation, rental income, and market conditions.

The typical Return on Investment (ROI) you can expect for land banking is 10%, while the typical ROI for traditional rental properties is 5%. However, it is important to note that these are just averages and the actual ROI can vary depending on a number of factors, such as the specific property, the location of the property, and the overall market conditions.

Land banking is a riskier investment than traditional rental properties, but it also has the potential for higher returns. This is because land values have historically appreciated at a faster rate than property values. For example, from 1970 to 2020, the median value of farmland in the United States increased by an average of 5.5% per year, while the median value of owner-occupied homes increased by an average of 3.8% per year.

Of course, there is no guarantee that land values will continue to appreciate at this rate in the future. However, the fact that land is a finite resource and that demand for land is likely to increase as the population grows suggests that land banking has the potential to be a lucrative investment.

Traditional rental properties are a less risky investment than land banking, but they also have the potential for lower returns. This is because rental income is typically lower than the potential capital appreciation of land. However, rental properties can provide a steady stream of income, which can be helpful for investors who are looking for a more predictable return on their investment.

Here is a table summarizing the typical ROI and risk of land banking and traditional rental properties:

| Investment Strategy | Typical ROI | Risk |

|---|---|---|

| Land Banking | 10% | High |

| Traditional Rental Properties | 5% | Moderate |

Ultimately, the best investment strategy for you will depend on your individual circumstances and goals. If you are looking for a long-term investment with the potential for high returns, land banking may be a good option for you. However, if you are looking for a more liquid investment with the potential for rental income, traditional real estate investing may be a better choice.

Risk Management

Both Land Banking and Traditional Real Estate come with their unique set of risks, and effective risk management is essential for a successful investment strategy.

Diversification in Land Banking

Diversifying land holdings across different locations can help mitigate risks associated with market-specific challenges or changes in development plans.

Strategies for Minimizing Risks in Traditional Real Estate

In traditional real estate, risk management involves factors like property maintenance, market research, and having contingency plans for unforeseen circumstances.

Market Trends

Understanding current market trends is crucial for making informed investment decisions in both Land Banking and Traditional Real Estate.

Current Trends in Land Banking

Land Banking trends may be influenced by factors such as urbanization, infrastructure development, and environmental considerations.

Influencing Factors in the Traditional Real Estate Market

Traditional real estate is influenced by factors like economic conditions, interest rates, and demographic shifts, impacting property demand and values.

Tax Implications

Investors should be aware of the tax implications associated with Land Banking and Traditional Real Estate.

Tax Benefits in Land Banking

Land Banking may offer tax benefits, such as lower property tax rates for undeveloped land, depending on local regulations.

Tax Considerations in Traditional Real Estate Transactions

Traditional Real Estate transactions come with their own set of tax considerations, including income tax on rental income and capital gains tax upon property resale.

Flexibility and Liquidity

Flexibility and liquidity play a crucial role in determining the suitability of an investment strategy.

Liquidity Challenges in Land Banking

Land Banking often lacks liquidity, as selling undeveloped land may take time, and the returns are realized over the long term.

Selling and Buying Flexibility in Traditional Real Estate

Traditional Real Estate provides more flexibility in buying and selling, offering investors the option to enter or exit the market relatively quickly.

Legal Considerations

Navigating legal aspects is essential in both Land Banking and Traditional Real Estate.

Land-Use Regulations in Land Banking

Understanding local land-use regulations is crucial in Land Banking to ensure compliance and minimize legal risks.

Legal Aspects of Traditional Real Estate Transactions

Traditional real estate transactions involve legal processes such as property transfers, title searches, and contract negotiations, requiring legal expertise.

Case Studies

Examining successful case studies can provide insights into the real-world application of Land Banking and Traditional Real Estate.

Success Stories in Land Banking

Highlighting instances where strategic Land Banking resulted in significant returns, showcasing the potential of this investment approach.

Notable Traditional Real Estate Investments

Examining well-known traditional real estate investments, emphasizing the diverse opportunities within this market.

Community Impact

Understanding the impact of investment choices on the community is essential for responsible investing.

Land Banking’s Role in Community Development

Exploring how Land Banking can contribute to community development by influencing local infrastructure and planning.

Traditional Real Estate’s Impact on Neighborhoods

Examining the effects of traditional real estate on neighborhoods, considering factors like gentrification and community revitalization.

Environmental Factors

Considering environmental factors is increasingly important in today’s investment landscape.

Land Conservation in Land Banking

Discussing how Land Banking can contribute to land conservation efforts, aligning with environmentally conscious investment practices.

Sustainable Practices in Traditional Real Estate

Exploring sustainable practices within traditional real estate, such as green building initiatives and energy-efficient property management.

Future Predictions

Predicting future trends can assist investors in making forward-thinking decisions.

Emerging Trends in Land Banking and Real Estate

Highlighting emerging trends, such as the rise of eco-friendly developments in Land Banking and technology integration in traditional real estate.

Predictions for the Next Decade

Speculating on the trajectory of both Land Banking and Traditional Real Estate over the next decade, considering economic, technological, and social factors.

Conclusion

In conclusion, the choice between Land Banking and Traditional Real Estate depends on individual financial goals, risk tolerance, and investment horizon. Both approaches offer unique opportunities and challenges, and understanding these nuances is key to making informed investment decisions.

FAQs

- Is Land Banking a risky investment?

- Answer: Land Banking carries risks, but strategic planning and diversification can mitigate them.

- Can I earn a steady income from Land Banking?

- Answer: Unlike traditional real estate, Land Banking may not provide immediate cash flow, but it offers the potential for high returns over time.

- What are the tax implications of traditional real estate investments?

- Answer: Traditional real estate investments may have tax considerations, including income tax on rental income and capital gains tax upon property resale.

- How long should I hold onto Land Banking investments for maximum returns?

- Answer: The optimal holding period for Land Banking investments depends on factors like location, development plans, and market trends.

- Is traditional real estate more suitable for short-term or long-term investments?

- Answer: Traditional real estate can be suitable for both short-term and long-term investments, depending on individual goals and market conditions.