In the ever-evolving landscape of finance, investors seek strategies that adapt to market dynamics. Tactical Asset Allocation (TAA) stands out as a dynamic approach, offering flexibility and responsiveness. Let’s dive into the intricacies of TAA, exploring its historical roots, core principles, implementation strategies, and its impact on individual investors.

Introduction

Definition of Tactical Asset Allocation (TAA)

In the dynamic world of financial investments, the pursuit of optimal returns and risk management is an ongoing endeavor. While strategic asset allocation sets a long-term framework for asset class diversification, tactical asset allocation (TAA) introduces a dynamic element to the investment process. TAA involves proactively adjusting asset allocations within a predetermined strategic framework in response to short-term market conditions, economic trends, and emerging investment opportunities.

TAA involves making strategic adjustments to a portfolio based on short-term market forecasts. Unlike traditional methods, it emphasizes flexibility and responsiveness.

Importance in Investment Strategy

Understanding the pivotal role TAA plays in shaping investment strategies is crucial for navigating today’s complex financial markets.

Historical Perspective

Origins of Asset Allocation

The concept of asset allocation itself dates back to the seminal work of Harry Markowitz in the 1950s. Markowitz introduced the idea of diversification and the importance of allocating assets across different classes to optimize returns for a given level of risk. This laid the groundwork for strategic asset allocation, the foundation upon which Tactical Asset Allocation would later build.

Emergence of Tactical Asset Allocation

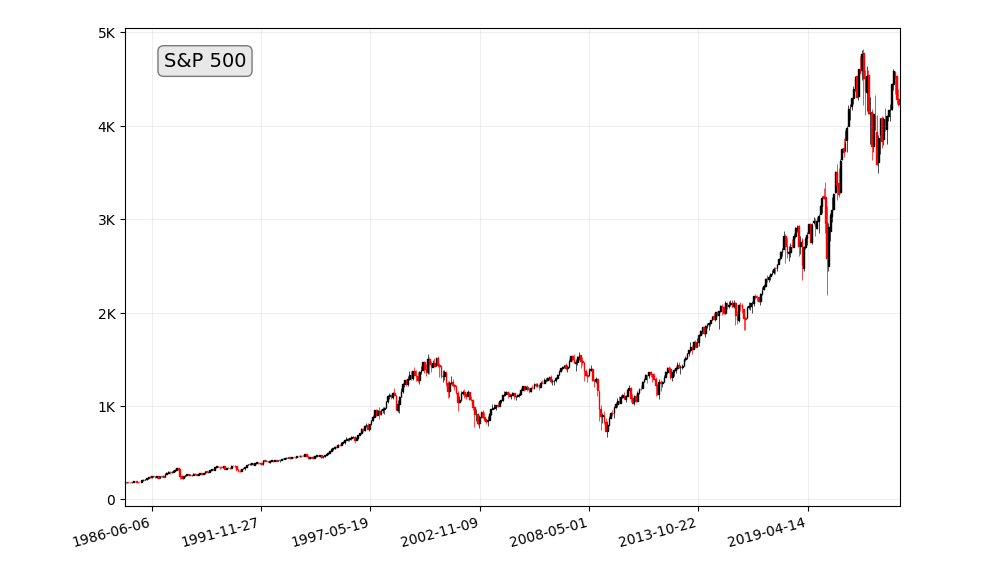

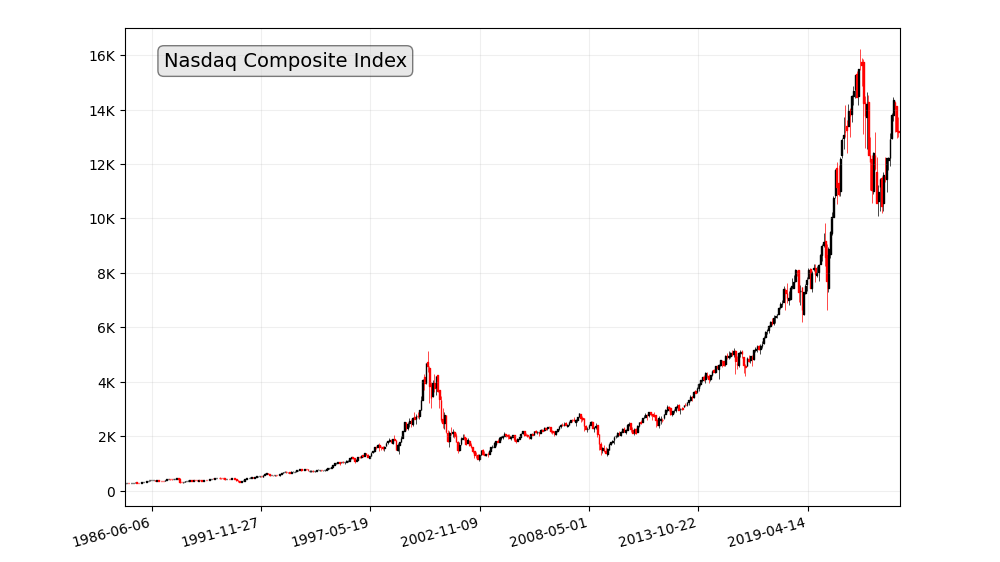

TAA gained prominence in the 1970s and 1980s, driven by shifts in market dynamics and a growing recognition that traditional, static asset allocation strategies had limitations. During this period, the investment landscape was marked by increased volatility, inflationary pressures, and changing interest rate environments. Investors sought more dynamic approaches to adapt to these evolving conditions, giving rise to TAA as a strategy that could actively respond to short-term market movements.

Rise of Modern Portfolio Theory (MPT)

The 1990s saw the widespread acceptance of Modern Portfolio Theory, which emphasized the importance of combining assets in a portfolio based on their expected returns and correlations. TAA gained further traction as investors recognized the potential benefits of actively adjusting allocations to capitalize on market inefficiencies and changing risk-return dynamics.

Technological Advancements

The late 20th century and early 21st century witnessed significant technological advancements that transformed the landscape of financial markets. The advent of sophisticated analytical tools, quantitative models, and algorithmic trading empowered investors to implement TAA strategies with increased precision and efficiency. These technological developments allowed for more nuanced analyses and quicker decision-making in response to changing market conditions.

Global Financial Crises and TAA Evolution

The global financial crises in the early 21st century, notably the dot-com bubble in the early 2000s and the financial crisis of 2008, underscored the limitations of traditional, buy-and-hold strategies. TAA gained renewed attention as investors sought ways to navigate through periods of heightened market volatility and economic uncertainty. The crises highlighted the need for more adaptive and risk-aware approaches, leading to a resurgence of interest in TAA strategies.

Academic Research and TAA Validation

Academic research has played a crucial role in validating the efficacy of TAA strategies. Studies have explored the historical performance of TAA approaches, showcasing their ability to enhance risk-adjusted returns and provide valuable insights into the benefits of dynamic asset allocation. As the body of research continues to grow, TAA has become a subject of academic scrutiny and refinement.

Integration of Behavioral Finance

The integration of behavioral finance principles has further enriched TAA strategies. Understanding investor behavior, cognitive biases, and market sentiment has become integral to effective tactical decision-making. Behavioral finance insights have enabled TAA practitioners to better anticipate market trends and deviations from fundamental values.

Contemporary Applications

In the present day, TAA is widely recognized as a valuable tool within the broader spectrum of portfolio management. Asset managers, institutional investors, and individual investors alike incorporate TAA as part of their overall investment strategies, acknowledging its ability to adapt to market conditions and optimize risk-adjusted returns.

Core Principles of Tactical Asset Allocation

Understanding the Theoretical Basis of Tactical Asset Allocation

TAA draws upon the Efficient Market Hypothesis (EMH) and the concept of market inefficiencies. The EMH posits that asset prices reflect all available information, making it inherently difficult to consistently outperform the market through passive investing. However, the EMH also acknowledges that market inefficiencies can arise due to various factors, such as investor biases, behavioral anomalies, and information asymmetries.

TAA seeks to exploit these market inefficiencies by identifying periods when asset prices deviate from their fundamental values. By actively adjusting asset allocations, TAA aims to capture excess returns from undervalued asset classes while minimizing exposure to overvalued ones.

Dynamic Portfolio Adjustments

The essence of TAA lies in its ability to dynamically adjust portfolios, responding to market changes promptly.

Risk Management Strategies

TAA is not just about returns; it’s equally about managing risks effectively. Exploring the risk management aspect adds depth to its application.

Market Timing Considerations

Timing is everything in finance. TAA’s approach to market timing distinguishes it from conventional strategies.

TAA Strategies: Dynamic Approaches to Asset Allocation

TAA encompasses a range of strategies, each with its unique approach to identifying and exploiting market inefficiencies. Some common TAA strategies include:

- Sector Rotation: This strategy involves shifting asset allocations between different market sectors based on their relative performance and future growth prospects.

- Market Timing: This strategy seeks to time the market by predicting market movements and adjusting asset allocations accordingly.

- Relative Strength Investing: This strategy focuses on identifying and investing in assets that are exhibiting relative strength compared to their peers or the broader market.

- Risk-Based TAA: This strategy dynamically adjusts asset allocations based on changes in risk tolerance or market volatility.

- Model-Based TAA: This strategy utilizes quantitative models to identify undervalued assets, predict market movements, and optimize asset allocations.

Implementing Tactical Asset Allocation

The successful implementation of TAA requires a combination of theoretical understanding, practical expertise, and disciplined execution. Key considerations include.

Asset Class Selection

Choosing the right mix of assets is the cornerstone of TAA. We delve into the factors that guide effective asset class selection.

Tools and Technologies

In the digital age, technology plays a pivotal role. We explore the tools and technologies aiding investors in implementing TAA seamlessly.

Monitoring and Review

Continuous monitoring and periodic reviews are essential for successful TAA. This section outlines best practices for staying on top of your investment game.

Data and Information Gathering

Access to reliable and timely market data and economic information is crucial for identifying investment opportunities and making informed decisions.

Performance Measurement and Evaluation

Regularly monitoring the performance of TAA strategies against benchmarks and strategic asset allocations is essential to assess effectiveness and make necessary adjustments.

Discipline and Risk Management

Maintaining discipline in adhering to the TAA process and effectively managing risk are critical for long-term success.

Pros and Cons of TAA

Benefits of Tactical Asset Allocation

TAA offers several potential benefits to investors, including:

- Potential for Enhanced Returns: By capturing excess returns from undervalued assets, TAA can potentially enhance overall portfolio returns.

- Improved Risk Management: TAA can help mitigate risks by adjusting asset allocations away from overvalued or underperforming asset classes.

- Increased Diversification: TAA can enhance portfolio diversification by dynamically adjusting asset allocations to exploit market inefficiencies.

Risks of Tactical Asset Allocation

TAA also carries inherent risks, including:

- Increased Transaction Costs: Active asset adjustments can lead to higher transaction costs, which may impact overall returns.

- Potential for Market Timing Errors: Accurately predicting market movements is challenging, and mistimed asset adjustments can lead to losses.

- Increased Complexity: TAA requires a high level of expertise and market knowledge, making it more complex than traditional asset allocation approaches.

Tactical Asset Allocation vs. Strategic Asset Allocation

Asset allocation is a fundamental aspect of portfolio management, and two prominent approaches that investors often consider are Tactical Asset Allocation (TAA) and Strategic Asset Allocation (SAA). Both strategies aim to optimize portfolio performance, but they differ in their philosophies and methodologies.

Tactical Asset Allocation

Tackling Short-Term Opportunities

Tactical Asset Allocation involves actively adjusting portfolio allocations based on short-term market conditions. The key premise is to capitalize on changing market trends and mispricings. Investors employing TAA are proactive, regularly reassessing their portfolios and making strategic shifts to take advantage of emerging opportunities or to manage short-term risks.

Tactics in TAA:

a. Market Analysis:

TAA relies on thorough market analysis, assessing factors such as economic indicators, interest rates, and geopolitical events to make short-term allocation decisions.

b. Relative Strength:

Relative strength analysis is a common tactic in TAA. It involves comparing the performance of different assets and allocating more capital to those showing strong relative strength.

c. Risk Management:

TAA incorporates dynamic risk management strategies to adjust portfolio exposure based on changing market conditions and the investor’s risk tolerance.

Strategic Asset Allocation

Long-Term Perspective for Balanced Growth

Strategic Asset Allocation takes a more long-term approach, focusing on establishing a fixed asset allocation based on an investor’s financial goals, risk tolerance, and time horizon. Once set, this allocation is maintained through various market conditions, with periodic rebalancing to bring the portfolio back to its target weights.

Strategies in SAA:

a. Diversification:

SAA emphasizes broad diversification across asset classes to spread risk. The goal is to create a balanced portfolio that aligns with the investor’s risk profile and long-term objectives.

b. Rebalancing:

Regular rebalancing is a crucial aspect of SAA. When certain asset classes outperform or underperform, rebalancing ensures that the portfolio remains in line with the investor’s strategic allocation targets.

c. Passive Investing:

Strategic Asset Allocation often aligns with a passive investment strategy, utilizing index funds or exchange-traded funds (ETFs) to represent different asset classes.

Contrasting Features

a. Time Horizon:

TAA is typically focused on short-term opportunities, reacting to market fluctuations, while SAA adopts a more long-term perspective, taking into account an investor’s overall financial goals.

b. Flexibility:

TAA is characterized by flexibility and adaptability, allowing for quick adjustments based on market movements. In contrast, SAA is more rigid, with a set allocation that remains relatively constant over time.

c. Active vs. Passive:

TAA often involves active management and may include frequent buying and selling, while SAA often aligns with a passive strategy, aiming to capture long-term market trends without frequent adjustments.

When to Choose Each Approach

a. Tactical Asset Allocation:

– When investors are comfortable with active management and monitoring of short-term market conditions.

– In periods of heightened market volatility, where short-term opportunities may arise.

– For investors with a higher risk tolerance and a more hands-on approach to portfolio management.

b. Strategic Asset Allocation:

– When investors have a long-term investment horizon and are less concerned with short-term market fluctuations.

– For those seeking a more passive, set-and-forget approach to investing.

– When the emphasis is on a balanced, diversified portfolio to achieve stable, long-term growth.

Understanding how TAA and SAA can complement each other offers a holistic perspective on portfolio management.

Common Mistakes to Avoid

Neglecting a Clear Strategy

One of the fundamental mistakes in TAA is embarking on it without a clear and well-defined strategy. Investors should articulate their investment goals, risk tolerance, and time horizon before implementing TAA. A lack of a coherent strategy may lead to impulsive decisions and hinder the overall effectiveness of TAA.

Overreacting to Short-Term Movements

TAA involves adjusting allocations based on short-term market movements, but overreacting to every fluctuation can be detrimental. Mistaking short-term noise for long-term trends may lead to unnecessary portfolio turnover, increased transaction costs, and potential capital erosion. Patience and a disciplined approach are crucial in TAA to avoid reactive decision-making.

Ignoring the Importance of Research

Effective TAA requires thorough research and analysis. Ignoring the underlying fundamentals of the assets being considered can result in poor decision-making. Investors should conduct comprehensive due diligence, considering factors such as economic indicators, valuation metrics, and market sentiment before making tactical adjustments.

Lack of Risk Management

TAA without a robust risk management strategy can expose investors to excessive risk. Failing to set clear risk parameters, diversify adequately, or establish stop-loss levels can lead to significant losses. Implementing risk management practices is essential to protect the portfolio from adverse market movements.

Focusing Solely on Short-Term Performance

While TAA is geared towards short-term adjustments, investors should not lose sight of their long-term objectives. Constantly chasing short-term performance without considering the broader investment horizon can lead to suboptimal decision-making and hinder the achievement of long-term financial goals.

Timing the Market Incorrectly

Attempting to time the market perfectly is a common mistake in TAA. Markets can be unpredictable, and mistiming entries or exits can result in missed opportunities or losses. Instead of trying to predict market tops or bottoms, investors should focus on the overall trend and adjust their allocations accordingly.

Neglecting Diversification

A lack of diversification is a critical error in TAA. Overconcentrating in a specific asset class or region can expose the portfolio to heightened risk. Diversifying across different asset classes and geographies helps spread risk and enhances the resilience of the portfolio.

Emotional Decision-Making

Emotional decision-making is a common pitfall in TAA. Reacting to fear or greed rather than relying on a systematic strategy can lead to suboptimal outcomes. Investors should cultivate discipline and objectivity, sticking to their predetermined strategy regardless of short-term market fluctuations.

Lack of Regular Review and Adjustment

TAA requires ongoing monitoring and adjustment. Neglecting to regularly review the portfolio and make necessary adjustments based on evolving market conditions can result in missed opportunities or prolonged exposure to underperforming assets.

Overlooking External Factors

External factors, such as geopolitical events or economic indicators, can significantly impact TAA decisions. Overlooking these factors or failing to adapt to changing external conditions may lead to ineffective tactical adjustments.

TAA in Different Market Conditions

Bull Markets: Capitalizing on Momentum

In bull markets characterized by rising stock prices and positive investor sentiment, TAA can be employed to capture and capitalize on upward momentum. Investors may allocate more funds to equities, particularly sectors demonstrating strength, while reducing exposure to less-performing or overvalued assets. TAA allows for a proactive stance, helping investors ride the wave of optimism and optimize returns during bullish phases.

Bear Markets: Preserving Capital and Identifying Opportunities

During bear markets marked by declining stock prices and heightened uncertainty, TAA becomes a valuable tool for preserving capital and identifying potential opportunities. Investors can shift allocations away from riskier assets, such as equities, toward safer havens like bonds or even alternative investments. TAA strategies may involve defensive positioning and adopting a more conservative stance to mitigate potential losses.

High Volatility: Adapting to Market Swings

In periods of high market volatility, TAA shines by allowing investors to adapt quickly to market swings. Volatile conditions may present short-term opportunities for profit, but they also carry increased risk. TAA enables investors to adjust their asset allocations in response to sudden market shifts, potentially avoiding losses or capturing gains during volatile periods.

Low-Interest Rate Environments: Seeking Yield

In environments characterized by low-interest rates, such as during central bank monetary easing, TAA can be used to seek alternative sources of yield. Investors may allocate more funds to dividend-paying stocks, high-yield bonds, or other income-generating assets. TAA allows for a flexible approach to income generation, adapting to the prevailing interest rate environment.

Inflationary Periods: Protecting Purchasing Power

During inflationary periods, TAA can help investors protect their purchasing power by adjusting allocations to hedge against rising prices. Investments in commodities, real assets, or inflation-protected securities may be considered within TAA strategies. By actively managing allocations, investors can navigate the challenges posed by inflation and position their portfolios accordingly.

Deflationary Pressures: Emphasizing Safe Havens

In contrast, during deflationary pressures, TAA can guide investors toward safe-haven assets such as government bonds or other low-risk securities. By recognizing the potential impact of deflation on asset values, TAA allows for a defensive posture to safeguard capital in the face of economic contraction.

Global Economic Uncertainty: A Tactical Approach to Risk Management

In times of heightened global economic uncertainty, TAA becomes a crucial tool for risk management. Investors can dynamically adjust their asset allocations based on geopolitical events, trade tensions, or other global uncertainties. TAA strategies may involve reducing exposure to international markets or increasing allocations to defensive assets, aligning with the prevailing risk landscape.

Conclusion

Tactical asset allocation represents a dynamic approach to asset allocation, aiming to capture excess returns and manage risks by proactively adjusting asset allocations in response to market conditions. While TAA offers the potential for enhanced returns, it also carries inherent risks and requires a deep understanding of market dynamics, risk management principles, and disciplined execution. Investors should carefully consider their risk tolerance, investment goals, and expertise before embarking on a TAA strategy.

FAQs

- Is Tactical Asset Allocation suitable for long-term investors?

- TAA can be adapted for long-term goals, but understanding the balance between short-term tactics and long-term objectives is crucial.

- How often should I review my TAA strategy?

- Regular reviews, at least quarterly, are advisable to ensure your TAA aligns with current market conditions.

- Can TAA be automated using algorithms?

- Yes, many investors use algorithmic approaches for TAA, leveraging technology for timely adjustments.

- What are the typical costs associated with implementing TAA?

- Costs may vary based on tools and platforms used. It’s essential to factor in transaction costs and any fees associated with professional advice.

- Are there specific asset classes that are more suitable for TAA?

- TAA can be applied to various asset classes, including stocks, bonds, and commodities. The suitability depends on individual goals and risk tolerance.