In the dynamic landscape of the global equity market, stock indices stand as beacons of market performance, providing investors with a comprehensive overview of industry trends and economic health. These carefully constructed baskets of stocks serve as benchmarks against which individual companies and investment portfolios are measured.

Unveiling Stock Index Components: Demystifying the Market’s Cornerstones

Understanding the Building Blocks of Stock Indices

What are Stock Indices?

Stock indices, also known as equity indices, are statistical measures that track the performance of a group of selected stocks. They represent a diversified snapshot of a particular sector, industry, or the overall market.

The Role of Stock Indices in the Market

Stock indices play a pivotal role in the financial world, serving as:

- Performance Benchmarks: Investors use indices to gauge the overall performance of their portfolios and compare their returns against market benchmarks.

- Market Indicators: Indices provide insights into the overall health of the economy and the performance of specific sectors or industries.

- Investment Tools: Passive investment vehicles, such as index funds and ETFs, track stock indices, allowing investors to gain exposure to a diversified portfolio without the need for individual stock selection.

Deconstructing Stock Index Composition

The composition of a stock index is carefully determined by a committee of experts who consider various factors, including:

Market Capitalization and Index Weight

Market capitalization, the total market value of a company’s outstanding shares, plays a crucial role in determining a stock’s weight within an index. Companies with larger market capitalizations typically hold a more significant weight in the index.

Sector Representation and Industry Diversification

Indices are often designed to reflect the overall sector composition of the market or a specific industry. This ensures that the index provides a representative view of the sector or industry it tracks.

Review and Rebalancing

Indices undergo periodic reviews to ensure that their composition remains relevant and reflects the current market landscape. This process involves adding or removing stocks and adjusting their weights to maintain the index’s desired characteristics.

Exploring Major Stock Indices

The global equity market is home to a diverse array of stock indices, each with its unique focus and characteristics. Here are a few notable examples:

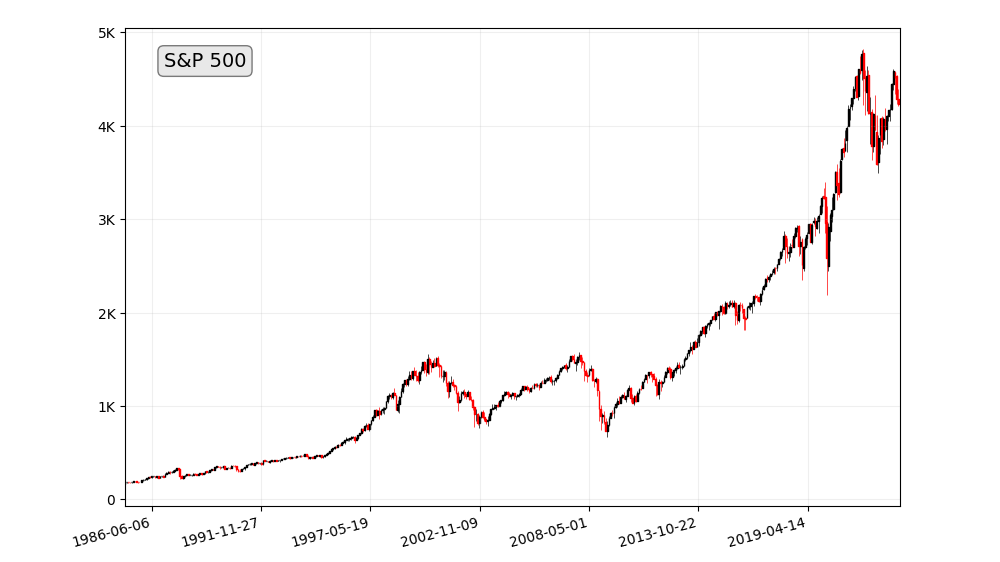

S&P 500 Index: A Benchmark for the U.S. Market

The S&P 500 Index tracks the performance of 500 of the largest U.S. companies across various industries. It is widely considered the benchmark for the U.S. equity market and is used extensively by investors and financial institutions.

Deciphering the Structure of the S&P 500

The S&P 500, maintained by S&P Dow Jones Indices, is a market-capitalization-weighted index, meaning the weight of each company within the index is determined by its market value. This approach ensures that larger companies with greater market influence hold a more significant presence within the index.

To qualify for inclusion in the S&P 500, a company must meet specific criteria, including:

- Market Capitalization: The company must have a market capitalization of at least $14.5 billion.

- Liquidity: The company’s shares must be traded frequently and in sufficient volume to ensure adequate liquidity.

- Financial Performance: The company must have a track record of profitability and financial stability.

- Domicile: The company must be headquartered in the United States.

Delving into the Composition of the S&P 500

The S&P 500 covers a diverse range of industries, providing a comprehensive overview of the U.S. equity market. The index’s sector representation closely mirrors the broader market, with the following sectors holding significant weight:

- Information Technology (IT): Approximately 20% of the index’s weight

- Healthcare: Approximately 15% of the index’s weight

- Financials: Approximately 12% of the index’s weight

- Consumer Discretionary: Approximately 11% of the index’s weight

- Industrials: Approximately 8% of the index’s weight

The Dynamic Nature of the S&P 500

The composition of the S&P 500 is not static; it undergoes periodic reviews to ensure that it remains representative of the evolving market landscape. The index committee, a panel of experts, evaluates companies based on their market capitalization, liquidity, and financial performance. Companies that no longer meet the inclusion criteria or that are deemed to be no longer representative of their respective industries are removed from the index, while new companies that meet the criteria are added.

The S&P 500: A Cornerstone of Investment Strategies

The S&P 500 plays a pivotal role in various investment strategies, serving as a benchmark for both passive and active investors:

- Passive Investing: Passive investors who seek to track the overall market often choose to invest in index funds or exchange-traded funds (ETFs) that mirror the performance of the S&P 500. This approach offers a diversified and cost-effective way to gain exposure to a broad market segment.

- Active Investing: Active investors, who aim to outperform the market through stock selection and portfolio management, often use the S&P 500 as a benchmark to evaluate their performance. By comparing their returns to the index, active investors can assess their ability to beat the market.

Dow Jones Industrial Average: A Legacy of Market Performance

The Dow Jones Industrial Average (DJIA) is one of the oldest stock market indices, tracking the performance of 30 large U.S. companies. It has a long and storied history, providing insights into the evolution of the U.S. economy.

Delving into the Structure of the DJIA

Unlike the S&P 500, which is a market-capitalization-weighted index, the DJIA is a price-weighted index. This means that the weight of each company within the index is determined by its share price, rather than its market capitalization. As a result, companies with higher share prices tend to hold a more significant influence on the index’s performance.

Unearthing the Selection Criteria for DJIA Components

To qualify for inclusion in the DJIA, companies must meet stringent criteria, including:

- Industry Representation: The company must be a leading player in its industry and have a significant impact on the overall market.

- Financial Performance: The company must have a proven track record of profitability and financial stability.

- Market Capitalization: The company must have a substantial market capitalization, ensuring its relevance to the broader market.

- Trading Volume: The company’s shares must be traded frequently and in sufficient volume to ensure adequate liquidity.

- Public Image: The company must maintain a positive public image and a reputation for ethical business practices.

The Dynamic Nature of the DJIA

The DJIA’s composition is not static; it undergoes periodic reviews to ensure that it remains representative of the evolving U.S. economy. The index committee, a group of experts from S&P Dow Jones Indices, evaluates companies based on their financial performance, industry representation, and overall impact on the market. Companies that no longer meet the inclusion criteria or that are deemed no longer representative of their respective industries are removed from the index, while new companies that meet the criteria are added.

The DJIA, with its carefully chosen components and dynamic structure, has become an integral part of the financial landscape. Its long history and enduring relevance make it a valuable resource for investors, economists, and market participants alike. The DJIA continues to provide insights into the health of the U.S. economy, the performance of major industries, and the overall direction of the market, serving as a beacon in the ever-evolving world of finance.

Nasdaq Composite Index: A Focus on Technology and Growth

The Nasdaq Composite Index tracks the performance of all stocks listed on the Nasdaq stock exchange, with a strong emphasis on technology and growth companies. It is a barometer of the technology sector’s health and performance.

In the dynamic realm of financial markets, the Nasdaq Composite Index stands as a symbol of innovation and technological prowess. This comprehensive index, encompassing over 2,500 stocks listed on the Nasdaq stock exchange, serves as a barometer of the technology sector’s health and a gauge for the overall growth potential of the U.S. economy.

Delving into the Structure of the Nasdaq Composite Index

Unlike the S&P 500 and the Dow Jones Industrial Average, which are market-capitalization-weighted indices, the Nasdaq Composite Index employs a modified capitalization-weighted approach. This means that the weight of each company within the index is determined not only by its market capitalization but also by its listing date and the number of shares available for trading. This approach ensures that newer and smaller companies, often driving innovation in the technology sector, have a meaningful presence in the index.

Unearthing the Eligibility Criteria for Nasdaq Composite Components

To qualify for inclusion in the Nasdaq Composite Index, companies must meet specific criteria, including:

- Listing Requirements: The company must be listed on the Nasdaq stock exchange and maintain compliance with its listing requirements.

- Financial Performance: The company must have a demonstrated track record of financial stability and profitability.

- Market Capitalization: The company must have a minimum market capitalization of $500 million.

- Trading Activity: The company’s shares must be traded frequently and in sufficient volume to ensure adequate liquidity.

- Industry Representation: The company must operate in a technology-related industry, such as information technology, biotechnology, or telecommunications.

The Dynamic Nature of the Nasdaq Composite Index

The Nasdaq Composite Index is not static; it undergoes periodic reviews to ensure that it remains representative of the evolving technology landscape. The Nasdaq Listing Qualifications Committee, a panel of experts, evaluates companies based on their financial performance, industry representation, and overall impact on the technology sector. Companies that no longer meet the inclusion criteria or that are deemed no longer representative of their respective industries are removed from the index, while new companies that meet the criteria are added.

The Nasdaq Composite Index, with its carefully selected components and dynamic structure, has become an indispensable tool for understanding the ever-evolving landscape of technology. Its significance extends beyond its role as a performance benchmark; it serves as a window into the technological advancements, innovation, and economic growth that shape the modern world. For investors, economists, and market participants alike, the Nasdaq Composite Index remains a beacon, illuminating the path towards a future driven by technological progress.

Utilizing Stock Indices for Investment Strategies

Stock indices play a significant role in various investment strategies:

Passive Investing and Index Funds

Passive investing involves tracking a specific index, such as the S&P 500, through index funds or exchange-traded funds (ETFs). This approach offers a diversified and cost-effective way to gain exposure to a broad market segment.

Active Investing and Index Benchmarks

Active investors, who aim to outperform the market through stock selection and portfolio management, often use indices as benchmarks to evaluate their performance. By comparing their returns to the index, active investors can assess their ability to beat the market.

Diversification and Risk Management

Stock indices provide a diversified approach to investing, reducing risk by spreading exposure across multiple companies and industries. This diversification helps to mitigate the impact of individual company or sector performance on an investment portfolio.

Conclusion: The Significance of Stock Index Components

Summary of Key Points

- Stock indices are carefully constructed baskets of stocks that represent a diversified snapshot of a particular sector, industry, or the overall market.

- The composition of a stock index is determined by a committee of experts who consider factors such as market capitalization, sector representation, and industry diversification.

- Stock indices play a crucial role in the financial world, serving as performance benchmarks, market indicators, and investment tools.

Insights for Investors and Market Participants

Understanding the components and characteristics of stock indices is essential for investors and market participants. By delving into the composition and selection criteria of these indices, investors can make informed decisions about their investment strategies and portfolio allocations.

Stock indices provide a valuable lens through which to observe the dynamics of the equity market, offering insights into sector trends, economic health, and overall market performance. By staying abreast of index movements and understanding the factors that influence their composition, investors can navigate the market with greater confidence and make informed choices aligned with their long-term financial goals.

FAQs

- What is the purpose of stock index components?

- Stock index components reflect the performance of a group of stocks, offering insights into market trends and providing a basis for investment decisions.

- How often do stock indices update their components?

- The frequency of updates varies, but indices typically review and update their components periodically to ensure relevance and accuracy.

- Can individual investors benefit from tracking components?

- Yes, tracking components allows individual investors to identify trends, diversify portfolios, and make informed investment decisions.

- Are there risks associated with investing in index components?

- Yes, market volatility and economic factors can pose risks. Investors should be aware of potential challenges when investing in index components.

- How can I stay informed about changes in stock index components?

- Stay updated through financial news, market reports, and official announcements from the entities managing the indices.