Investors worldwide are constantly seeking opportunities to grow their wealth, and understanding the dynamics of global stock market indices plays a crucial role in this pursuit. In this comprehensive exploration, we’ll delve into the basics of stock market indices, dissect major global indices, analyze factors influencing their movements, and discuss the future trends that could shape the financial landscape.

Exploring Global Stock Market Indices

Introduction

The world of finance is vast and dynamic, with global stock market indices acting as barometers for economic health and investor sentiment. This article aims to unravel the complexities surrounding these indices, providing both novice and seasoned investors with valuable insights.

Understanding Stock Market Indices

The Basics of Stock Market Indices

Before diving into the intricacies of global indices, let’s establish a foundational understanding of what stock market indices are and how they function.

How Indices Reflect Market Performance

Indices serve as benchmarks, reflecting the overall performance of a specific group of stocks. But how exactly do they capture the essence of market movements?

Significance of Global Stock Market Indices

Global stock market indices play a pivotal role in the financial world, offering several benefits:

- Performance Indicators: They act as gauges of the overall health of the global economy, reflecting the collective performance of a wide range of companies across diverse industries and geographies.

- Investment Benchmarks: They provide a yardstick against which investors can measure the performance of their own investment portfolios.

- Risk Management Tools: They can be employed as risk management tools, allowing investors to diversify their portfolios across global markets and mitigate country-specific risks.

Major Global Stock Market Indices

As we embark on our journey, we’ll spotlight some of the most influential global indices, starting with the renowned S&P 500, offering a snapshot of the U.S. market.

S&P 500: A Snapshot of the U.S. Market

The S&P 500, comprising 500 of the largest publicly traded companies in the U.S., holds a special place in the hearts of investors.

The Standard & Poor’s 500, often abbreviated as the S&P 500, stands as a stalwart benchmark for assessing the health and performance of the U.S. stock market. Comprising 500 of the largest publicly traded companies in the United States, the S&P 500 provides investors, analysts, and policymakers with a comprehensive snapshot of the nation’s economic landscape. In this article, we will explore the significance, composition, and influence of the S&P 500 on the U.S. financial market.

- Overview of the S&P 500:The S&P 500, launched in 1957, is a market-capitalization-weighted index that reflects the performance of a broad cross-section of industries. Its components include some of the most prominent and influential companies across various sectors, making it a reliable gauge of the overall health of the U.S. equity market.

- Composition and Diversity:The diversity of the S&P 500 is one of its defining features. The index encompasses companies from sectors such as technology, healthcare, finance, consumer discretionary, and more. This broad representation helps mitigate the impact of poor performance in a single sector on the overall index.

- Market Capitalization Weighting:The S&P 500 is a market-capitalization-weighted index, meaning that the companies with the highest market capitalization—calculated by multiplying the share price by the number of outstanding shares—have a more substantial impact on the index’s value. This approach reflects the market’s consensus on the relative importance of each included company.

- Influence on Investment Strategies:Due to its diverse composition and broad representation of the U.S. economy, the S&P 500 plays a pivotal role in shaping investment strategies. Many index funds and exchange-traded funds (ETFs) are designed to replicate the performance of the S&P 500, providing investors with a convenient way to gain exposure to the overall U.S. equity market.

- Economic Indicator:The S&P 500 is often regarded as a leading economic indicator. Changes in the index’s value are closely monitored by investors, economists, and policymakers to assess the overall economic health of the United States. A rising S&P 500 is generally considered a positive signal for the economy, while a declining index may indicate potential challenges.

- Global Impact:Given the global nature of many S&P 500 companies, the index’s movements can have repercussions beyond U.S. borders. Investors worldwide pay attention to the S&P 500 as a barometer of global economic conditions, making it a crucial reference point in international financial markets.

- Quarterly Earnings Reports:The S&P 500 companies, being some of the largest and most influential in the world, release quarterly earnings reports. These reports can significantly impact the index’s value, as investors assess the financial health and performance of these key players.

- Volatility and Risk Management:Investors often turn to the S&P 500 for insights into market volatility and risk management. The CBOE Volatility Index (VIX), often referred to as the “fear index,” is derived from S&P 500 options prices and serves as a gauge of market expectations for future volatility.

FTSE 100: Unveiling the British Market

Across the Atlantic, the FTSE 100 takes center stage. What insights does this index provide into the British market, and why is it closely monitored by investors worldwide?

The Financial Times Stock Exchange 100 Index, commonly known as the FTSE 100, stands as a prominent indicator of the health and performance of the British stock market. Comprising 100 of the largest publicly traded companies on the London Stock Exchange, the FTSE 100 is a vital benchmark for investors, analysts, and policymakers seeking insights into the economic landscape of the United Kingdom. In this article, we will explore the significance, composition, and impact of the FTSE 100 on the British financial market.

- Historical Background: Established in 1984, the FTSE 100 has become synonymous with the British stock market. The index is maintained by the FTSE Russell, a global index provider, and is widely recognized both domestically and internationally.

- Composition and Diversity: The FTSE 100 is composed of the 100 largest companies listed on the London Stock Exchange, measured by market capitalization. These companies span various sectors, including finance, energy, healthcare, consumer goods, and telecommunications. The diverse representation provides a comprehensive view of the UK’s economic landscape.

- Market Capitalization Weighting: Similar to the S&P 500 in the United States, the FTSE 100 is a market-capitalization-weighted index. This means that companies with higher market capitalization exert a more significant influence on the index’s value. As such, changes in the share prices of large companies can have a substantial impact on the overall index.

- Global Recognition: The FTSE 100 is recognized globally as a key indicator of the British market’s performance. Its movements are closely watched by investors worldwide, providing insights into the health of the UK economy and serving as a crucial reference point for international investment decisions.

- Economic Barometer: The FTSE 100 serves as a barometer for the broader UK economy. Movements in the index are often interpreted as indicators of economic strength or challenges. A rising FTSE 100 is generally seen as a positive signal, reflecting optimism about economic prospects, while a declining index may suggest concerns or uncertainties.

- Influence on Investment Strategies: The FTSE 100 is a critical factor in shaping investment strategies for both individual and institutional investors. Funds, such as index trackers and ETFs, are designed to replicate the performance of the FTSE 100, allowing investors to gain exposure to a broad cross-section of the British market.

- Currency and Global Markets: As the FTSE 100 is composed of multinational companies, its performance is influenced not only by domestic factors but also by global economic conditions. Changes in currency values, global trade dynamics, and geopolitical events can impact the FTSE 100, making it sensitive to a range of international factors.

- Volatility and Risk Management: Investors often turn to the FTSE 100 as a measure of market volatility and for risk management purposes. The volatility index, derived from FTSE 100 options prices, provides insights into market expectations for future price fluctuations.

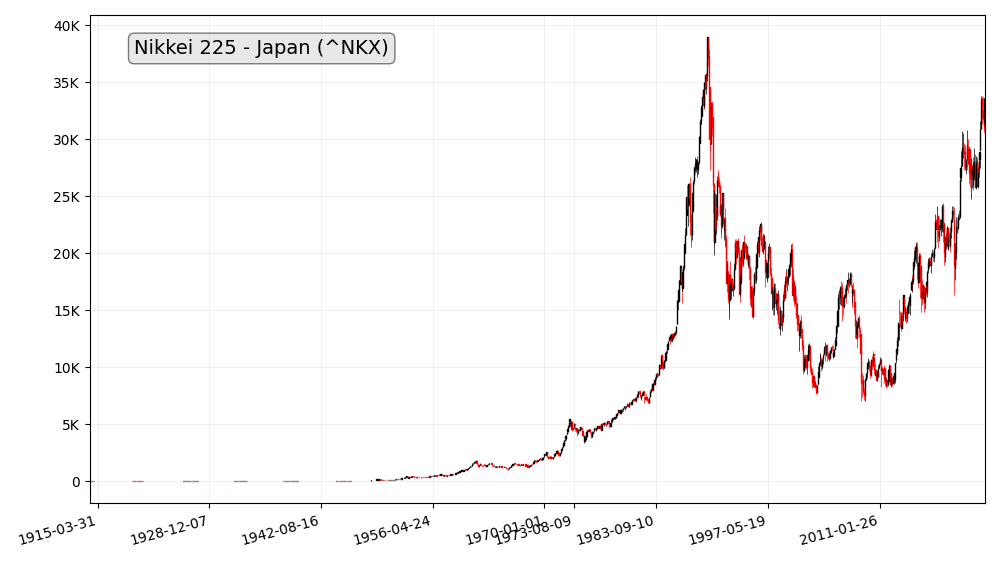

Nikkei 225: Insights into Japanese Equities

Our exploration extends to the East with a focus on the Nikkei 225, providing a window into the Japanese stock market and its unique characteristics.

The Nikkei 225, Japan’s premier stock market index, is a beacon that illuminates the performance and trends of the country’s equity market. Comprising 225 of the largest and most influential companies listed on the Tokyo Stock Exchange, the Nikkei 225 serves as a key indicator for investors, analysts, and policymakers seeking a nuanced understanding of Japan’s economic landscape. In this article, we will delve into the significance, composition, and impact of the Nikkei 225 on Japanese equities.

Historical Evolution: The Nikkei 225, short for the Nikkei Stock Average, made its debut in 1950 and has since become synonymous with Japan’s financial markets. It is managed and calculated by the Nikkei Inc., a media company that also oversees other financial indices and information services.

Composition and Selection Criteria: The Nikkei 225 includes 225 of the largest and most liquid companies listed on the Tokyo Stock Exchange. These companies span diverse sectors, including automotive, technology, finance, and manufacturing. The selection is based on market capitalization, ensuring that the index provides a comprehensive representation of the Japanese stock market.

Market Capitalization Weighting: Similar to other major indices like the S&P 500, the Nikkei 225 is a price-weighted index. This means that the impact of each component on the index is proportional to its stock price. While differing from the market-capitalization-weighted approach, it still offers a valuable snapshot of the overall market trends.

Economic Indicator: The Nikkei 225 is not only a reflection of the Japanese stock market but is often viewed as an economic indicator for the nation. Movements in the index are closely observed for insights into Japan’s economic health, providing an indication of investor sentiment, economic growth, and corporate performance.

Influence on Investment Strategies: Investors, both domestic and international, frequently use the Nikkei 225 as a benchmark for their investment strategies. Financial products such as index funds and exchange-traded funds (ETFs) are designed to replicate the performance of the Nikkei 225, allowing investors to gain exposure to a broad array of Japanese equities.

Global Recognition: The Nikkei 225 enjoys global recognition as a key indicator of the Japanese market. Its movements are closely monitored by international investors and fund managers, making it an essential reference point for those looking to understand and navigate the Japanese economic landscape.

Sensitivity to Economic Factors: Given Japan’s position as one of the world’s largest economies, the Nikkei 225 is sensitive to a variety of economic factors. Changes in interest rates, currency values, and global economic conditions can all impact the index, making it a dynamic and responsive indicator.

Volatility and Risk Management: Like other major indices, the Nikkei 225 serves as a tool for assessing market volatility and managing investment risk. The volatility index derived from Nikkei 225 options prices, known as the “Nikkei Volatility,” provides insights into market expectations for future price fluctuations.

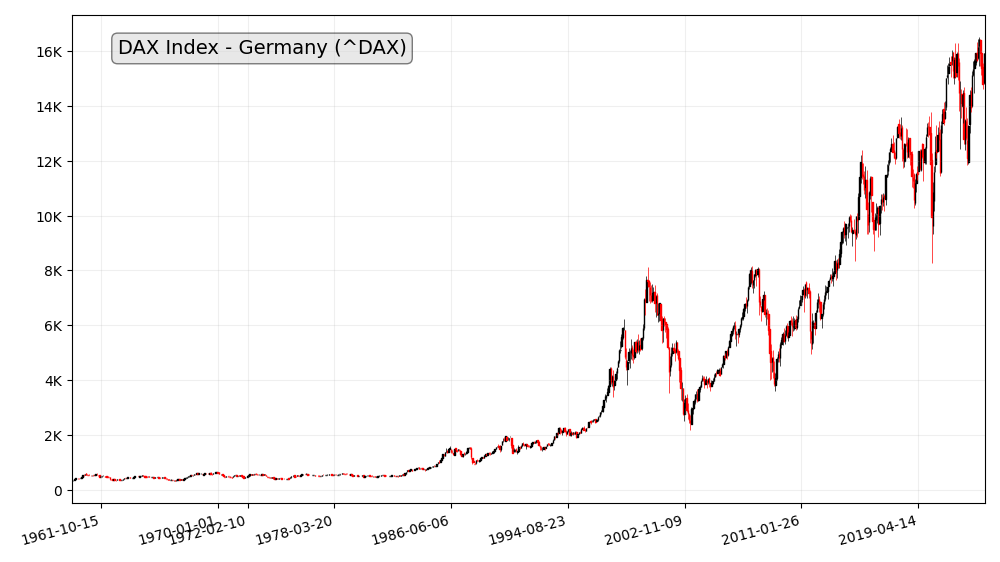

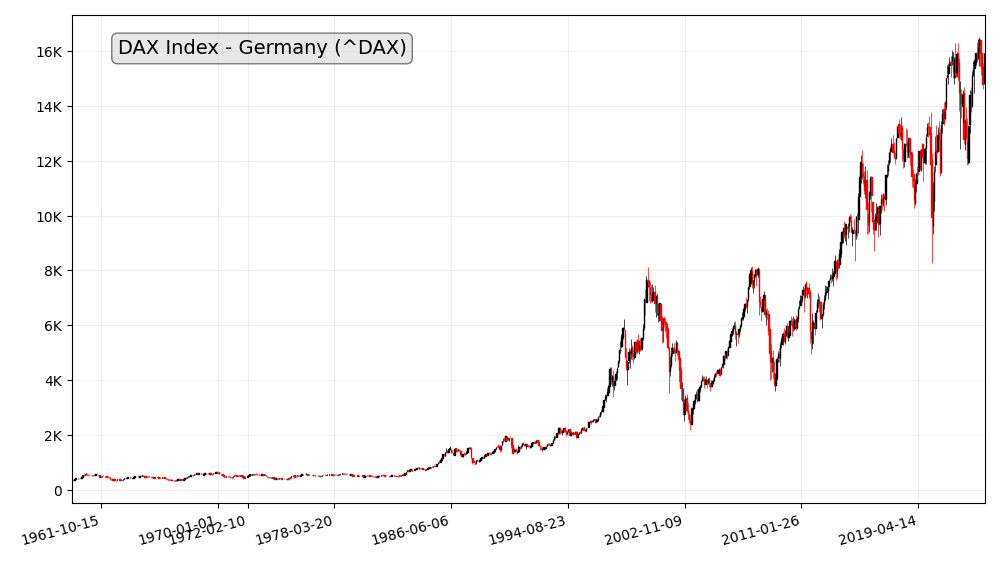

DAX Index: A Glimpse into German Stocks

Heading to Europe, the DAX Index reveals the performance of German stocks. What economic factors influence its movements, and why is it vital for global investors?

The DAX Index, standing as the benchmark for the German stock market, provides investors, analysts, and policymakers with a comprehensive view of the performance and trends within Germany’s equity landscape. Comprising 30 of the largest and most liquid companies listed on the Frankfurt Stock Exchange, the DAX Index is a crucial indicator for those seeking insights into Germany’s economic health. In this article, we will explore the significance, composition, and impact of the DAX Index on German stocks.

Historical Origins: The DAX, short for Deutscher Aktienindex (German Stock Index), was introduced in 1988. Developed and maintained by the Frankfurt Stock Exchange, the DAX quickly became the primary benchmark for tracking the performance of Germany’s leading publicly traded companies.

Composition and Selection Criteria: The DAX Index comprises 30 blue-chip companies listed on the Frankfurt Stock Exchange. These companies, referred to as the DAX 30, represent a diverse range of sectors, including automotive, finance, technology, and healthcare. The selection criteria are based on factors such as market capitalization, liquidity, and historical trading volume.

Market Capitalization Weighting: Similar to other major indices, the DAX is a market-capitalization-weighted index. This means that the impact of each component on the index is proportionate to its market capitalization. As a result, larger companies hold more significant influence over the overall value of the index.

Economic Indicator: The DAX Index is not merely a reflection of the German stock market; it serves as a crucial economic indicator for the nation. Movements in the index are often interpreted as signals of Germany’s economic health, providing insights into investor sentiment, economic growth, and corporate performance.

Influence on Investment Strategies: The DAX 30 plays a pivotal role in shaping investment strategies for both domestic and international investors. Financial instruments such as exchange-traded funds (ETFs) and index funds are designed to replicate the performance of the DAX, allowing investors to gain exposure to a diversified portfolio of German equities.

Global Recognition: The DAX enjoys global recognition as a leading indicator of the German stock market. Its movements are closely monitored by international investors and fund managers, offering insights into the economic strength and performance of one of Europe’s largest economies.

Sensitivity to Economic Factors: Given Germany’s position as an economic powerhouse in Europe, the DAX is sensitive to various economic factors. Changes in interest rates, currency values, and global economic conditions can influence the performance of the DAX, making it a dynamic and responsive indicator.

Volatility and Risk Management: As with other major indices, the DAX serves as a tool for assessing market volatility and managing investment risk. The Volatility Index (VDAX), derived from DAX options prices, offers insights into market expectations for future price fluctuations, aiding investors in risk assessment and management.

NASDAQ Composite Index

The Nasdaq Composite Index tracks the performance of all stocks listed on the Nasdaq stock exchange, including large, mid-cap, and small-cap companies. It is heavily weighted towards technology stocks.

The NASDAQ Composite Index, often referred to simply as the NASDAQ, stands as a beacon of technological and innovative prowess within the financial markets. Comprising thousands of companies, it is a barometer for the performance of the technology sector and a reflection of the entrepreneurial spirit that defines the modern economy. In this article, we will explore the significance, composition, and impact of the NASDAQ Composite Index on the world of finance.

Historical Roots: The NASDAQ Composite Index, launched in 1971, is one of the younger major stock indices. Operated by the NASDAQ OMX Group, it was the first electronic stock market, pioneering a new era in trading by introducing electronic communication networks (ECNs) and revolutionizing how stocks are bought and sold.

Composition and Diversity: The NASDAQ Composite is not limited to a specific number of companies; instead, it includes all stocks listed on the NASDAQ stock exchange. This diversity allows the index to represent a wide range of sectors, with a particular emphasis on technology, biotechnology, and internet-based companies.

Technology and Innovation Hub: Often dubbed as the “tech-heavy” index, the NASDAQ Composite is synonymous with innovation. It includes some of the world’s most renowned technology giants, such as Apple, Amazon, Microsoft, and Alphabet (Google), as well as a plethora of smaller, cutting-edge companies driving advancements in various industries.

Market Capitalization Weighting: The NASDAQ Composite is a market-capitalization-weighted index, meaning that companies with higher market capitalizations carry more significant influence over the index’s value. This structure reflects the market’s collective opinion on the relative importance of each included company.

Influence on Investment Strategies: The NASDAQ Composite plays a crucial role in shaping investment strategies, particularly for those seeking exposure to the dynamic world of technology and innovation. Numerous exchange-traded funds (ETFs) and mutual funds are designed to replicate the performance of the NASDAQ, providing investors with diversified access to this influential sector.

Entrepreneurial Spirit: Beyond being a mere financial indicator, the NASDAQ Composite embodies the entrepreneurial spirit. It is a platform where start-ups and emerging companies can go public and raise capital, contributing to the continuous evolution and transformation of the global business landscape.

Global Recognition: The NASDAQ Composite is recognized globally as a key benchmark for technology and innovation. Its movements are closely monitored by investors, analysts, and policymakers worldwide, offering insights into the health and trends of the tech sector and the broader economy.

Volatility and Risk Perception: The NASDAQ Composite’s association with technology and growth-oriented companies makes it inherently more volatile than some other indices. The Volatility Index (VXN), derived from NASDAQ options prices, helps investors gauge market expectations for future price fluctuations and manage the associated risks.

Biotechnology and Healthcare: In addition to technology, the NASDAQ Composite has a significant representation of biotechnology and healthcare companies. This inclusion further amplifies its role as a comprehensive indicator of innovation across various sectors.

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is a price-weighted index of 30 large-cap companies listed on stock exchanges in the United States. It is one of the oldest and most widely followed stock market indices.

The Dow Jones Industrial Average (DJIA), often referred to simply as the Dow, is a venerable and iconic index that has been a stalwart presence in the world of finance for over a century. Comprising 30 of the largest and most influential publicly traded companies in the United States, the Dow is a barometer that provides investors, analysts, and the general public with insights into the overall health of the U.S. stock market. In this article, we will explore the historical significance, composition, and impact of the Dow Jones Industrial Average.

Historical Origins: Created in 1896 by financial journalist Charles Dow and his business partner Edward Jones, the Dow Jones Industrial Average is one of the oldest and most widely followed stock market indices. Initially comprising just 12 companies, the Dow has evolved over the years to include 30 blue-chip companies representing various sectors of the U.S. economy.

Composition and Selection Criteria: The Dow’s composition includes companies that are leaders in their respective industries, reflecting the overall health of the U.S. economy. While not exhaustive, the Dow’s 30 companies are chosen based on their reputation, size, and prominence. Changes to the Dow’s composition are infrequent and are made by the Dow Jones Index Committee.

Market Price-Weighted Index: The Dow is a price-weighted index, meaning that the relative influence of each component is determined by its stock price rather than its market capitalization. This makes it unique among major indices, such as the S&P 500, which are market-capitalization-weighted. The Dow’s structure can lead to a higher influence from higher-priced stocks.

Diverse Sector Representation: The Dow is designed to represent a cross-section of the U.S. economy, and as such, it includes companies from various sectors, including technology, healthcare, finance, and manufacturing. This diversity allows the index to provide a snapshot of the overall economic health of the nation.

Economic Indicator: Widely regarded as a key economic indicator, the Dow is often used to gauge the general health of the U.S. stock market and, by extension, the broader economy. Movements in the Dow are closely monitored for insights into investor sentiment, economic trends, and potential market shifts.

Influence on Investment Strategies: The Dow plays a significant role in shaping investment strategies for both individual and institutional investors. Investment products such as index funds and exchange-traded funds (ETFs) are designed to replicate the performance of the Dow, allowing investors to gain exposure to a diverse array of U.S. blue-chip stocks.

Global Recognition: The Dow Jones Industrial Average is recognized globally as a symbol of U.S. economic strength. Its movements are closely watched by investors worldwide, and its influence extends beyond American borders, impacting international markets and investment decisions.

Volatility and Risk Perception: The Dow’s status as a leading indicator makes it a useful tool for assessing market volatility and managing investment risk. The CBOE Volatility Index (VIX), often referred to as the “fear index,” is derived from options prices on the S&P 500 but is widely used as a gauge of overall market volatility, including the Dow.

Hang Seng Index

The Hang Seng Index is a key benchmark for the Hong Kong stock market, tracking the performance of 50 of the largest and most liquid companies listed on the Hong Kong Stock Exchange.

The Hang Seng Index (HSI), a cornerstone of the financial markets in Hong Kong, stands as a robust indicator of the region’s economic health and market performance. Comprising a diverse array of leading companies, the HSI provides investors, analysts, and policymakers with a comprehensive snapshot of Hong Kong’s dynamic and influential financial landscape. In this article, we will explore the significance, composition, and impact of the Hang Seng Index.

Historical Evolution: Established in 1969 by the Hang Seng Bank, the Hang Seng Index has grown to become a key benchmark for the Hong Kong Stock Exchange (HKEX). Initially starting with only 33 constituents, the index has expanded over the years to include a broader spectrum of companies representing various industries.

Composition and Selection Criteria: The Hang Seng Index comprises 50 of the largest and most liquid companies listed on the HKEX. These companies are selected based on factors such as market capitalization, trading volume, and overall market influence. The diverse composition of the HSI includes companies from sectors such as finance, real estate, technology, and utilities.

Market Capitalization Weighting: Similar to other major indices globally, the Hang Seng Index is a market-capitalization-weighted index. This means that the influence of each component on the index is proportional to its market capitalization. Larger companies, by market value, have a more significant impact on the index’s movements.

Influence on Hong Kong’s Financial Landscape: The Hang Seng Index plays a pivotal role in shaping Hong Kong’s financial landscape. As a reflection of the region’s economic health, the HSI is a barometer for investor sentiment and a crucial indicator for policymakers assessing the overall stability and performance of the Hong Kong economy.

Global Recognition: While primarily focused on Hong Kong-listed companies, the Hang Seng Index enjoys global recognition. Its movements are closely monitored by international investors, fund managers, and analysts, serving as a vital reference point for those seeking insights into the economic health and market trends of the Asia-Pacific region.

China’s Impact on the HSI: Given Hong Kong’s proximity to mainland China, the Hang Seng Index is influenced by developments in the broader Chinese economy. Changes in economic policies, trade relations, and geopolitical events impacting China can have a ripple effect on the HSI, making it sensitive to regional and global economic dynamics.

Volatility and Risk Perception: As with any major index, the Hang Seng Index is subject to market volatility. The Volatility Index (VHSI), derived from options prices on the HSI, provides insights into market expectations for future price fluctuations, aiding investors in assessing and managing risk.

Technology and Financial Sector Emphasis: In recent years, the Hang Seng Index has seen an increased emphasis on technology and financial sector companies, reflecting the evolving nature of the Hong Kong economy. The inclusion of innovative and dynamic companies in these sectors aligns with global trends in technology-driven economies.

Shanghai Stock Exchange Composite Index (SSE 300)

The SSE 300 is a stock market index that tracks the performance of 300 of the largest and most liquid A-shares listed on the Shanghai Stock Exchange (SSE). It is a key benchmark for the Chinese equity market.

The Hang Seng Index (HSI), a cornerstone of the financial markets in Hong Kong, stands as a robust indicator of the region’s economic health and market performance. Comprising a diverse array of leading companies, the HSI provides investors, analysts, and policymakers with a comprehensive snapshot of Hong Kong’s dynamic and influential financial landscape. In this article, we will explore the significance, composition, and impact of the Hang Seng Index.

- Historical Evolution: Established in 1969 by the Hang Seng Bank, the Hang Seng Index has grown to become a key benchmark for the Hong Kong Stock Exchange (HKEX). Initially starting with only 33 constituents, the index has expanded over the years to include a broader spectrum of companies representing various industries.

- Composition and Selection Criteria: The Hang Seng Index comprises 50 of the largest and most liquid companies listed on the HKEX. These companies are selected based on factors such as market capitalization, trading volume, and overall market influence. The diverse composition of the HSI includes companies from sectors such as finance, real estate, technology, and utilities.

- Market Capitalization Weighting: Similar to other major indices globally, the Hang Seng Index is a market-capitalization-weighted index. This means that the influence of each component on the index is proportional to its market capitalization. Larger companies, by market value, have a more significant impact on the index’s movements.

- Influence on Hong Kong’s Financial Landscape: The Hang Seng Index plays a pivotal role in shaping Hong Kong’s financial landscape. As a reflection of the region’s economic health, the HSI is a barometer for investor sentiment and a crucial indicator for policymakers assessing the overall stability and performance of the Hong Kong economy.

- Global Recognition: While primarily focused on Hong Kong-listed companies, the Hang Seng Index enjoys global recognition. Its movements are closely monitored by international investors, fund managers, and analysts, serving as a vital reference point for those seeking insights into the economic health and market trends of the Asia-Pacific region.

- China’s Impact on the HSI: Given Hong Kong’s proximity to mainland China, the Hang Seng Index is influenced by developments in the broader Chinese economy. Changes in economic policies, trade relations, and geopolitical events impacting China can have a ripple effect on the HSI, making it sensitive to regional and global economic dynamics.

- Volatility and Risk Perception: As with any major index, the Hang Seng Index is subject to market volatility. The Volatility Index (VHSI), derived from options prices on the HSI, provides insights into market expectations for future price fluctuations, aiding investors in assessing and managing risk.

- Technology and Financial Sector Emphasis: In recent years, the Hang Seng Index has seen an increased emphasis on technology and financial sector companies, reflecting the evolving nature of the Hong Kong economy. The inclusion of innovative and dynamic companies in these sectors aligns with global trends in technology-driven economies.

MSCI World Index

The MSCI World Index is a broad-based index that tracks the performance of large and mid-cap stocks from 23 developed countries. It is widely considered the most representative benchmark for the global equity market.

The MSCI World Index stands as a powerful and influential benchmark in the realm of global investing, providing investors with a panoramic view of equities from around the world. Comprising a diverse array of companies representing both developed and emerging markets, the MSCI World Index serves as a comprehensive indicator for investors, analysts, and policymakers seeking insights into the performance and trends of the global equity landscape. In this article, we will explore the historical significance, composition, and impact of the MSCI World Index.

- Historical Evolution: The MSCI World Index, launched in 1969 by Morgan Stanley Capital International (MSCI), has evolved over the decades to become a prominent benchmark for global equities. Initially encompassing only five developed markets, the index has expanded its scope to include companies from 23 developed countries, providing a more comprehensive representation of the global equity market.

- Composition and Selection Criteria: The MSCI World Index comprises a broad spectrum of companies from developed countries, including the United States, Japan, the United Kingdom, Germany, and others. The index covers various sectors such as technology, finance, healthcare, and consumer goods. Companies are selected based on their market capitalization, liquidity, and overall market influence.

- Market Capitalization Weighting: The MSCI World Index is a market-capitalization-weighted index, mirroring the methodology of many major indices globally. This means that the influence of each constituent on the index is proportional to its market capitalization. Larger companies, by market value, exert a more significant impact on the overall value of the MSCI World Index.

- Global Representation: One of the defining features of the MSCI World Index is its global representation. The index includes companies from North America, Europe, Asia, and the Pacific region, providing investors with exposure to a diverse range of economies, industries, and currencies. This global scope makes the MSCI World Index a comprehensive tool for assessing worldwide market trends.

- Influence on Investment Strategies: The MSCI World Index is integral to shaping investment strategies for institutional and individual investors alike. Numerous investment products, including index funds and exchange-traded funds (ETFs), are designed to replicate the performance of the MSCI World Index, offering investors a convenient way to gain diversified exposure to global equities.

- Economic Indicator: Widely recognized as a key economic indicator, the MSCI World Index is often used to assess the overall health of the global economy. Movements in the index are closely monitored for insights into investor sentiment, economic growth prospects, and potential market shifts.

- Diversity and Sector Allocation: The MSCI World Index’s composition spans a multitude of industries, reflecting the diversity of the global economy. Investors can find companies from technology, healthcare, financial services, consumer discretionary, and other sectors, offering a well-rounded representation of the world’s major industries.

- Volatility and Risk Management: As a reflection of global equities, the MSCI World Index can be subject to market volatility. Investors often refer to volatility indices derived from options on the MSCI World Index, such as the MSCI World Volatility Index, to gauge market expectations for future price fluctuations and manage associated risks.

Investing in Global Stock Market Indices

Direct Investment through Index Funds or ETFs

Investors can directly invest in global stock market indices through index funds or exchange-traded funds (ETFs). These investment vehicles passively track a particular index, providing a convenient and cost-effective way to gain exposure to a diversified basket of global stocks.

Indirect Investment through Managed Funds or Strategies

Alternatively, investors can opt for managed funds or strategies that actively seek to outperform global stock market indices. These strategies may employ various investment techniques, such as stock picking, sector rotation, or tactical asset allocation, to generate excess returns.

Potential Risks and Considerations of Global Stock Market Investing

Investing in global stock markets involves inherent risks, including:

Currency Fluctuations and Exchange Rate Risks

Investments in foreign markets are exposed to currency fluctuations, which can erode returns or amplify losses due to exchange rate movements.

Political and Economic Risks of Foreign Markets

Political instability, economic downturns, or regulatory changes in foreign countries can adversely impact the performance of overseas investments.

Conclusion

In conclusion, global stock market indices serve as invaluable tools for investors navigating the complex financial landscape. Understanding the nuances of these indices empowers individuals to make informed investment decisions, seizing opportunities while mitigating risks.

FAQs

- What is the significance of tracking global stock market indices?

- Understanding the broader market trends helps investors make informed decisions and identify potential investment opportunities.

- How often do stock market indices experience significant changes?

- The frequency of changes varies, influenced by economic events, geopolitical factors, and market sentiment.

- Are there any risks associated with investing in global indices?

- Yes, like any investment, global indices carry risks, including market volatility and geopolitical uncertainties.

- What role do technological advancements play in shaping index movements?

- Technological advancements, such as algorithmic trading and artificial intelligence, can impact market dynamics and index movements.

- How can investors navigate market volatility when investing in global indices?

- Diversification, strategic planning, and staying informed are key strategies to navigate market volatility.

One reply on “Exploring Global Stock Market Indices”

[…] Stock indices, also known as equity indices, are statistical measures that track the performance of a group of selected stocks. They represent a diversified snapshot of a particular sector, industry, or the overall market. […]