In today’s rapidly evolving financial landscape, the importance of teaching financial literacy from a young age cannot be overstated. The earlier children start learning about money and investing, the better equipped they are for future financial success. This article explores the essential investment tools for 3-year-olds, focusing on how to set a strong financial foundation for their future.

Essential Investment Tools for 3-Year-Olds: Equipping Them for Financial Success

Why Start Investing Early?

Starting to invest at a young age offers numerous advantages. Children who grasp the basics of saving and investing early are more likely to develop sound financial habits, make informed decisions, and secure their financial future.

Here are some of the benefits of teaching kids about investing early:

- It helps them develop healthy financial habits. Learning about investing can help kids understand the importance of saving money, budgeting, and investing for the future. These are all important financial habits that can help them avoid debt and build wealth over time.

- It gives them a head start on their financial goals. Whether your child wants to buy a house, start a business, or retire early, investing early can help them achieve their goals faster.

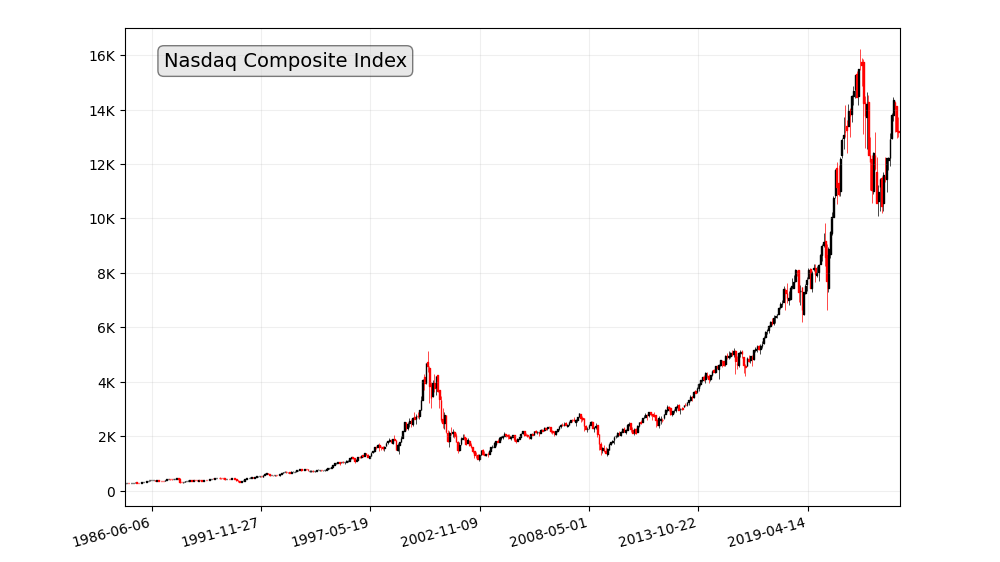

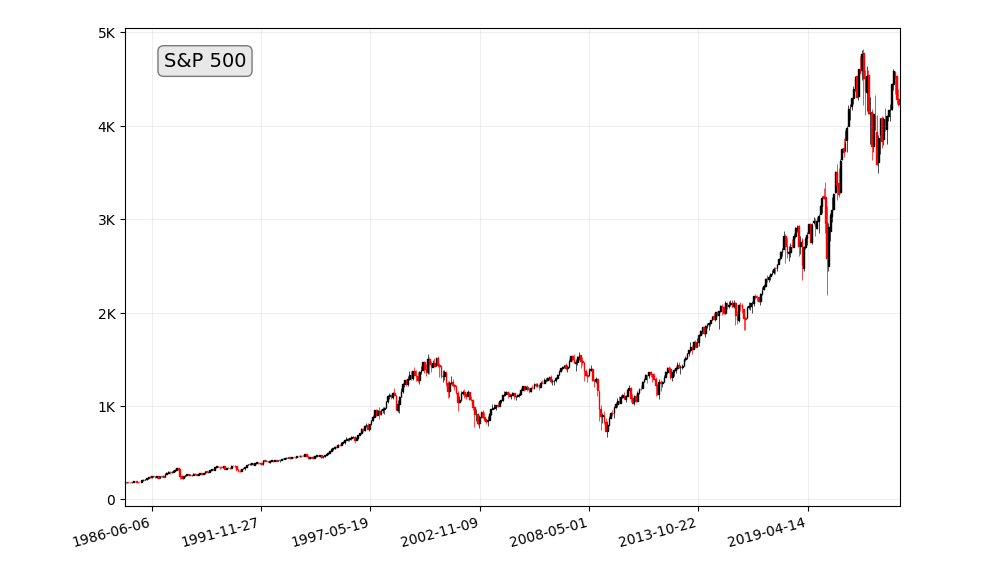

- It teaches them about the power of compound interest. Compound interest is when your earnings start earning their own earnings. Over time, compound interest can have a significant impact on your investment returns.

By teaching children the value of money and the benefits of investing, parents can instill a lifelong financial understanding.

Setting the Foundation: Financial Literacy

Before diving into investment tools, it’s crucial to establish a solid foundation of financial literacy. This includes teaching kids about the concepts of earning, saving, spending, and investing. Use simple, relatable examples to explain these ideas, ensuring that children understand the basics.

The Importance of Saving

Savings is often the first step in a child’s financial journey. Introducing your child to the concept of saving money through a piggy bank or a savings account can be a fun and educational experience. It teaches them the importance of setting money aside for future needs and goals.

Investment Tools for Young Children

Savings Accounts

Savings accounts specially designed for children are an excellent way to introduce them to the world of finance. These accounts typically offer low minimum balances and educational incentives, making saving money enjoyable and educational.

UTMA/UGMA accounts

UTMA/UGMA accounts are custodial accounts that allow adults to give money or property to minors. UTMA/UGMA accounts can be used to invest in a variety of different assets, including stocks, bonds, and mutual funds.

Piggy Banks

Piggy banks are a classic way for young children to save. They allow kids to physically see their savings grow as they deposit coins and small bills. Encourage your child to save a portion of any money they receive, like allowances or gifts, in their piggy bank.

Investment Bonds

Investment bonds are a low-risk option for children’s investments. These bonds typically have a fixed interest rate, providing a secure way to save and grow your child’s money over time.

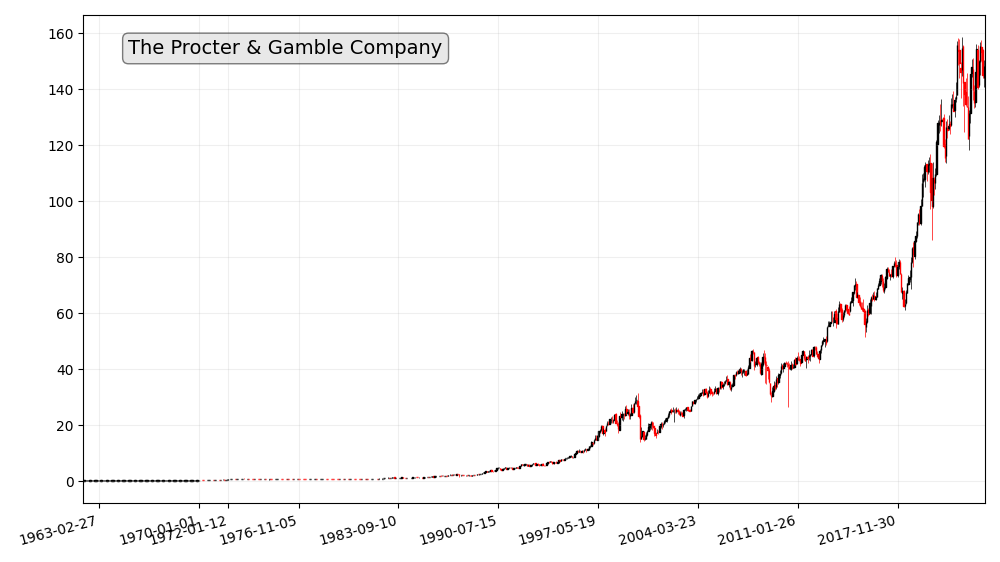

Stock Investments

While not typically recommended for very young children, introducing the concept of stocks can be done in a simplified way. You can discuss how companies work, and how owning a share means owning a piece of a company.

Choosing the Right Tools

Selecting the right investment tools depends on your child’s age, financial goals, and risk tolerance. Consider discussing options with a financial advisor who specializes in child investments to ensure you make informed decisions.

Teaching Financial Responsibility

Incorporate lessons about money management and budgeting as part of your child’s financial education. Teach them the value of making informed spending choices, differentiating between wants and needs.

Talking to your kids about money and investing can be a bit daunting, but it’s important to start early. Here are a few tips:

- Make it simple. Start by teaching your child basic financial concepts like saving, spending, and sharing. Once they have a good understanding of these concepts, you can start talking about investing.

- Use real-world examples. When you’re talking to your child about investing, try to use real-world examples that they can understand. For example, you could talk about how investing in a company that makes your favorite cereal could help you buy more cereal in the future.

- Make it fun. There are a number of books and games available that can help you teach your child about investing in a fun and engaging way.

Instilling Patience and Persistence

Teaching children that investments take time to grow and require patience is essential. Encourage them to set long-term goals and show them how consistent savings and investment can help achieve those goals.

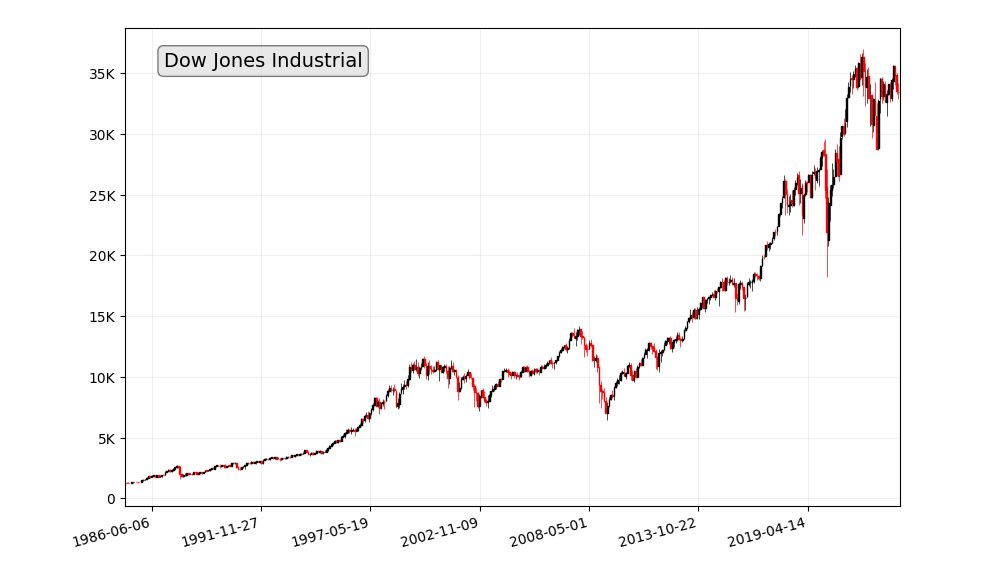

When you’re investing for your child, you should choose investments with a long-term horizon. This means choosing investments that you’re willing to hold for at least five years, or even longer. This is because the stock market can be volatile in the short term, but it has historically trended upwards over the long term.

How Parents Can Get Involved

Parents play a crucial role in their child’s financial education. By demonstrating responsible financial behavior and discussing money matters openly, you set a positive example for your child to follow.

Encouraging Goal Setting

Help your child set financial goals, whether it’s saving for a special toy or a college fund. Goal setting instills the importance of working toward something and the satisfaction of achieving it.

Balancing Risk and Reward

As children get older, you can introduce them to the concept of risk and reward. Explain how different investments carry different levels of risk and potential returns.

Teach your child about the importance of diversification. Diversification is the process of spreading your money across different asset classes and investment sectors. This helps to reduce your risk if one asset class or sector underperforms.

Tracking Progress

Regularly review your child’s investments and savings together. Show them how their money has grown and discuss any changes or adjustments to their financial strategy.

Preparing for the Future

By starting early and investing wisely, children can set themselves up for a financially secure future. The skills and knowledge they gain will benefit them throughout their lives.

Conclusion

Teaching your 3-year-old about essential investment tools is an investment in their future. By starting early and focusing on financial literacy, saving, and age-appropriate investment tools, you give your child the tools they need for financial success.

FAQs

1. When is the best time to start teaching my child about investments?

The sooner, the better. It’s never too early to introduce basic financial concepts to your child. Even at a young age, you can start with simple ideas about saving and spending.

2. Are there special investment options for children?

Yes, there are savings accounts and investment bonds specifically designed for children. These are often a great starting point.

3. How can I make learning about money fun for my child?

Use games, visual aids like piggy banks, and age-appropriate stories to make financial learning engaging and enjoyable.

4. What’s the most important lesson to teach a young child about money?

The value of saving. Teach your child that saving a portion of their money is a responsible and rewarding practice.

5. How can I continue my child’s financial education as they get older?

As your child grows, you can gradually introduce more complex financial concepts, such as investing in stocks and setting financial goals. Adapt their financial education to their age and understanding.