Economic downturns are an inevitable part of the financial cycle, and whether you’re a seasoned investor or just dipping your toes into the stock market, understanding how to prepare for these challenging times is critical. Think of it as packing an umbrella before the rain starts—not only does it keep you dry, but it also helps you stay calm when the clouds roll in.

When markets wobble due to economic stress, emotions can run high, leading to irrational decisions. That’s why proactive planning beats reactive panic every single time. In this article, we’ll dig deep into the ins and outs of economic downturns, explore how they shake up the stock market, identify red flags before things get messy, and equip you with solid strategies to ride out the storm with confidence.

So, if you’re worried about the next recession or simply want to make your portfolio storm-proof, this is the guide you need right now.

Preparing for Economic Downturn Risks in the Stock Market

Understanding Economic Downturns

Definition and Causes of Economic Downturns

An economic downturn, commonly referred to as a recession, marks a period where the economy contracts rather than grows. Typically measured over two consecutive quarters of negative GDP growth, downturns can spell trouble not just for businesses and governments, but for everyday investors like you and me.

Several factors can trigger a downturn. It could be rising interest rates making borrowing more expensive, high inflation eroding purchasing power, geopolitical tensions shaking consumer confidence, or a major crisis like a global pandemic disrupting supply chains. Sometimes, it’s a combination of all of the above. Whatever the root cause, the outcome tends to be the same—slower economic activity, job losses, and, yes, a jittery stock market.

Understanding the root causes of past downturns helps investors anticipate future risks. For example, the 2008 Global Financial Crisis stemmed from reckless lending and a housing bubble. In contrast, the COVID-19 recession was sparked by a sudden halt in global activity. Each crisis has unique triggers, but the result—economic shrinkage—is consistent.

What’s important to remember is that economic downturns are cyclical. They come and go. Smart investors use them as opportunities rather than obstacles.

Historical Patterns and Their Relevance Today

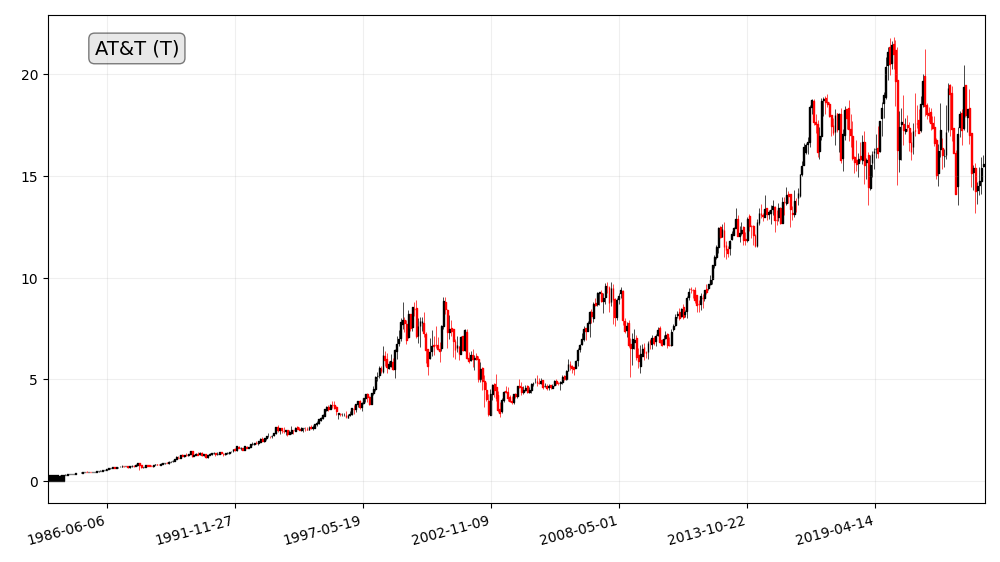

History might not repeat itself exactly, but it often rhymes. That old saying rings especially true in the stock market. By studying how markets reacted to past downturns, we can draw valuable insights about what may happen next.

Take the dot-com crash of 2000. Technology stocks were wildly overvalued, and when the bubble burst, many companies disappeared overnight. Fast forward to 2008, and financial institutions bore the brunt. In both cases, certain sectors were hit hardest, and investors who had diversified or held cash reserves were better off.

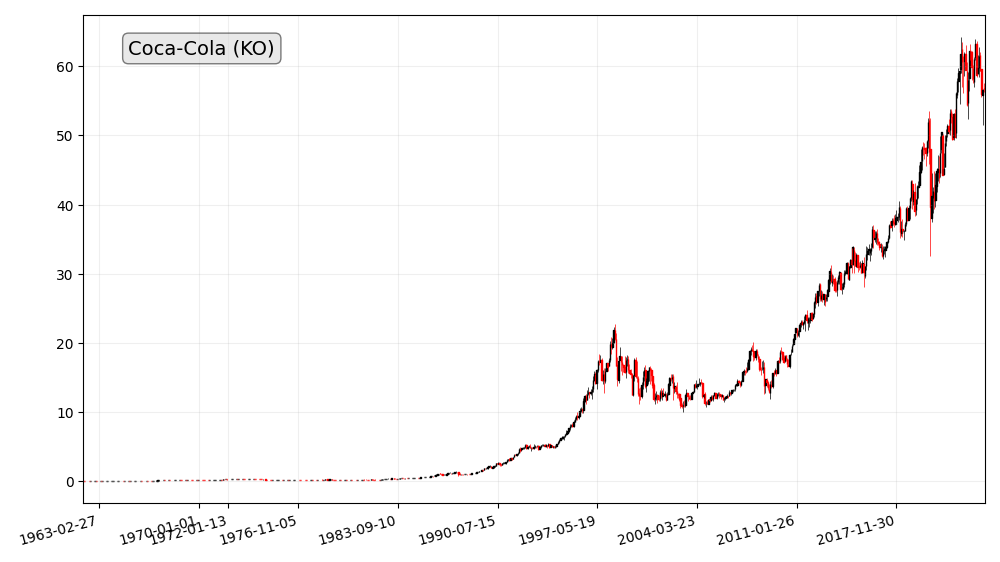

Patterns show that bear markets—where stock prices drop 20% or more—often accompany recessions. But what’s interesting is the rebound that follows. After the 2008 crash, the S&P 500 more than tripled over the next decade. The key takeaway? Downturns are often followed by strong recoveries. So preparing isn’t about timing the market perfectly, but about surviving long enough to thrive once the recovery begins.

How Economic Downturns Impact the Stock Market

Market Volatility and Investor Sentiment

Economic downturns are like earthquakes—they shake everything, and the aftershocks linger. In the stock market, this means wild swings in prices, knee-jerk reactions from investors, and a general sense of uncertainty. Fear takes the wheel, and rational thinking is often pushed into the backseat.

During a downturn, volatility spikes as investors rush to sell riskier assets. Indexes drop sharply, and the value of portfolios can nosedive within weeks—or even days. This can be terrifying, especially for newer investors. But here’s the thing: volatility isn’t always bad. It also creates opportunities for those who stay calm and think long-term.

Investor sentiment plays a major role. In good times, people chase high returns and ignore risks. But when the mood turns sour, even solid stocks get dragged down. This herd mentality can exaggerate market moves, pushing prices lower than fundamentals would justify.

Understanding this emotional cycle is crucial. When panic sets in, sticking to a disciplined investment plan can be the difference between holding steady and making costly mistakes.

Sector-Wise Impacts During a Recession

Not all sectors are created equal when the economy hits the brakes. Some industries get hammered, while others hold up surprisingly well—or even thrive.

Vulnerable Sectors:

- Travel & Leisure: People cut back on vacations.

- Luxury Goods: Non-essentials are first to go.

- Real Estate & Construction: Higher interest rates and reduced consumer spending slow demand.

Resilient Sectors:

- Consumer Staples: People still need food, hygiene products, and medicine.

- Healthcare: Demand remains stable or increases.

- Utilities: Regardless of the economy, people need power and water.

Investors who shift their focus toward recession-proof industries can reduce risk and maintain stability in their portfolios. It’s not about abandoning growth stocks altogether, but about balancing exposure and being realistic about what might dip and what might hold strong.

Identifying Early Warning Signs

Economic Indicators to Monitor

How do you know a downturn is coming before it hits full force? Fortunately, the economy leaves breadcrumbs if you know where to look.

Key indicators include:

- GDP Growth Rate: A slowdown signals trouble ahead.

- Unemployment Rate: Rising jobless numbers point to economic distress.

- Consumer Confidence Index: Declining optimism often leads to decreased spending.

- Yield Curve Inversion: When short-term interest rates exceed long-term ones, it’s historically a reliable recession signal.

Tracking these indicators doesn’t require a degree in economics. Plenty of financial websites and news outlets publish regular updates. It’s about keeping your ears to the ground and adjusting your strategy before the storm hits.

Company Financial Reports and Market Reactions

Beyond macro indicators, individual companies offer clues about economic health. Quarterly earnings reports reveal how well businesses are performing. If many firms begin missing earnings targets or issue profit warnings, it’s often a sign that broader trouble is brewing.

Pay attention to:

- Revenue Declines: Sign of slowing consumer demand.

- High Debt Levels: Can cripple a company during downturns.

- Negative Outlooks: Management forecasting tough times ahead is a major red flag.

Investor reactions to earnings reports also matter. If good news is met with tepid market response, it may suggest investors are already bracing for the worst. Conversely, overreaction to slightly bad news can indicate panic setting in.

Building a Resilient Investment Strategy

Diversification as a Risk Mitigation Tool

The golden rule of investing—don’t put all your eggs in one basket—rings especially true during downturns. Diversification spreads your risk across different assets, sectors, and geographies, cushioning the blow when one area tanks.

Let’s say you hold stocks in tech, healthcare, consumer goods, and energy. If the tech sector takes a nosedive, gains in healthcare or consumer staples can help offset the losses. It’s not just about owning more stocks—it’s about owning the right mix.

Don’t forget international exposure either. While recessions often have global impact, some regions may recover faster or remain more stable, giving your portfolio a fighting chance.

Diversification isn’t just for safety—it’s a proactive step that prepares you for the unexpected.

Asset Allocation Techniques for Tough Times

Asset allocation is like setting the right gear before climbing a hill—it determines how efficiently your investments navigate through economic turbulence. When preparing for a downturn, adjusting your asset mix can be the difference between weathering the storm and getting swept away.

Here’s how to think about asset allocation:

- Stocks vs. Bonds: During economic slowdowns, bonds often outperform stocks. Allocating more of your portfolio to government or high-quality corporate bonds can provide stability and predictable income.

- Cash and Cash Equivalents: While cash might seem boring, it gives you flexibility. Having liquidity means you can buy undervalued assets when prices drop without having to sell at a loss.

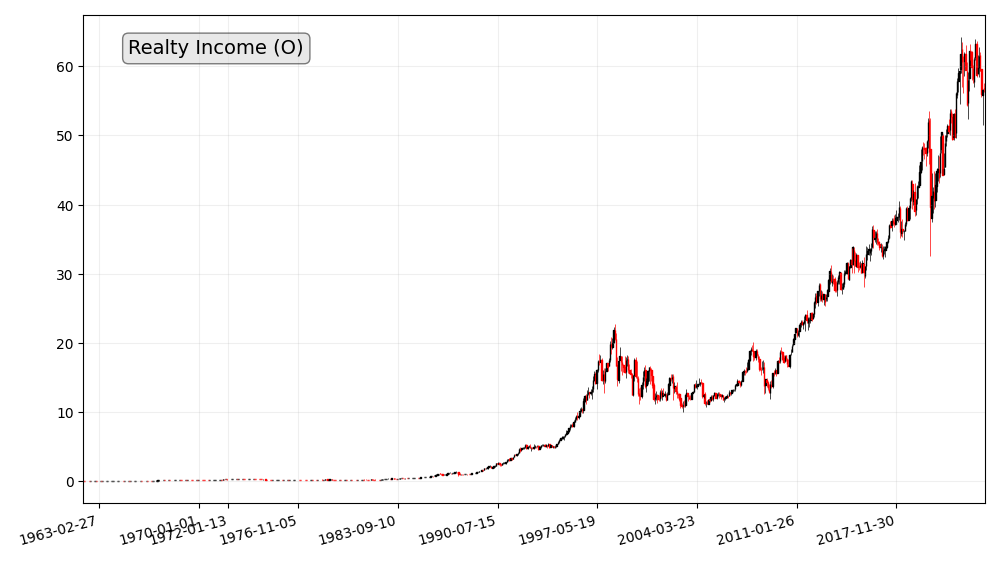

- Alternative Investments: Real estate, commodities like gold, or REITs (Real Estate Investment Trusts) can hedge against inflation or provide returns uncorrelated with the stock market.

- Risk Tolerance Assessment: During a bull market, investors often overestimate their risk tolerance. Reassess yours and reallocate accordingly.

It’s essential not to panic and dump stocks entirely. The goal isn’t to abandon growth but to tilt your portfolio toward safety while keeping a foothold in potential recovery plays.

A well-balanced portfolio should have a mix tailored to your time horizon, goals, and comfort with risk. Downturns will test that balance, and proper allocation can prevent rash decisions that undermine long-term growth.

Defensive Stocks and Safe Havens

Industries That Perform Well During Recessions

Not all businesses suffer during economic hardship. In fact, some industries experience consistent demand regardless of economic conditions—these are the backbone of a recession-resistant strategy.

Top defensive sectors include:

- Consumer Staples: These include food, household items, and personal care products—basically, stuff people buy no matter what.

- Healthcare: Regardless of the economy, people still need medical care, prescriptions, and hospital services.

- Utilities: Electricity, gas, and water usage stay relatively stable, making utility companies more reliable investments during downturns.

- Discount Retailers: In tough times, people switch from luxury brands to value stores, benefiting companies like Walmart or Dollar General.

These industries provide what’s called inelastic demand—consumption doesn’t fluctuate much with income levels. That makes them ideal for investors looking to reduce risk during a recession.

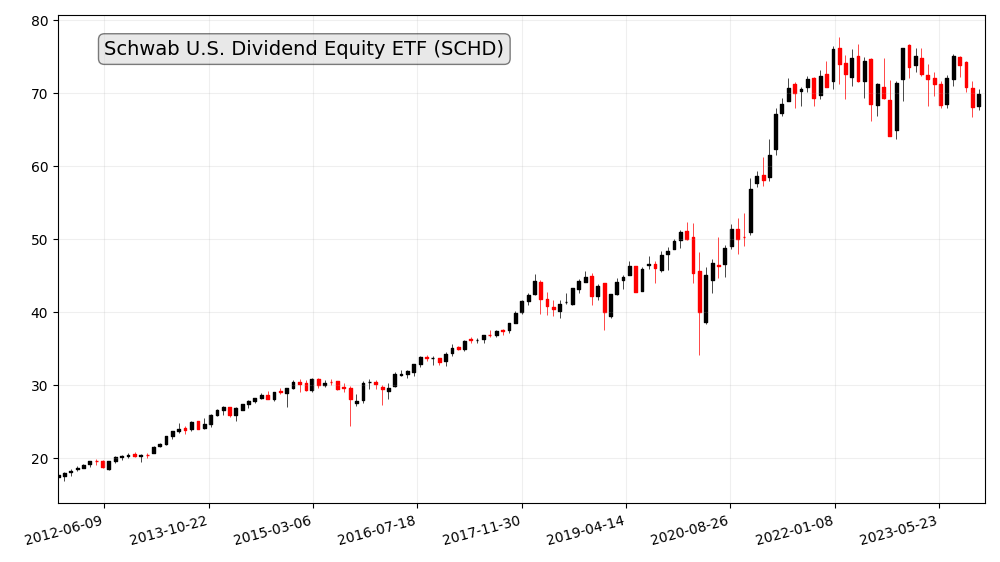

Defensive stocks might not offer explosive returns, but they shine in stability and consistent dividends, which become incredibly valuable when capital appreciation slows down.

Adding exposure to these sectors doesn’t mean abandoning your other investments—it’s about rebalancing your risk and ensuring your portfolio is built not just to grow, but to survive.

The Role of Bonds, Gold, and Cash Reserves

When the stock market falters, safe havens become the investor’s best friends. These are assets that either retain their value or even increase in price when equities fall.

1. Bonds:

- Bonds, especially U.S. Treasuries, are often viewed as safe bets.

- During downturns, central banks usually cut interest rates, which increases bond prices.

- Corporate bonds from financially strong companies can also offer a good balance between yield and risk.

2. Gold:

- Often seen as a hedge against uncertainty, gold tends to perform well when confidence in fiat currencies or stock markets drops.

- It doesn’t yield interest or dividends, but its value is driven by scarcity and historical store of value appeal.

3. Cash Reserves:

- While inflation can erode cash’s value over time, having cash on hand during a downturn gives you power.

- It allows you to buy undervalued stocks when others are forced to sell, turning crisis into opportunity.

Balancing your portfolio with these safe havens ensures you’re not caught off guard. Even a 10–20% allocation to these assets can help smooth your returns and reduce sleepless nights when markets are bleeding red.

Staying Calm and Avoiding Emotional Decisions

Let’s be honest—when you see your portfolio shedding value day after day, it’s hard not to panic. But here’s the cold truth: emotional investing is often the fastest route to permanent loss.

When fear grips the market, it becomes a seller’s frenzy. But history shows that those who stay the course often come out stronger. Let’s look at why keeping a level head is your most valuable asset during a downturn.

The Cost of Panic Selling

Selling in a panic often locks in losses that may have otherwise been temporary. Investors who bailed out during the 2008 crash and didn’t re-enter the market missed one of the greatest bull runs in history.

Here’s what usually happens:

- Markets drop → Fear kicks in → Investor sells at a loss.

- Market rebounds → Investor waits, afraid of re-entry.

- By the time confidence returns, the market has already recovered—leaving the investor permanently behind.

It’s the classic mistake of selling low and buying high—the exact opposite of successful investing.

Adopting a Long-Term Mindset

If your investment goals are years or even decades away, a downturn is just a blip. Remember: the stock market has always recovered over time. The Great Depression, dot-com bust, and global pandemics all hurt—but didn’t end—the growth trajectory of the market.

Keep your eyes on the horizon, not the daily ticker.

Using a Checklist to Stay Rational

During turbulent times, lean on a pre-set checklist:

- Has your investment time horizon changed?

- Do the companies in your portfolio still have strong fundamentals?

- Are you still diversified across sectors and asset classes?

If the answer to those is “yes,” chances are you’re still on the right track. Let your strategy, not your emotions, lead the way.

Opportunities Hidden in Downturns

Here’s a little secret the best investors know: downturns are not just periods of risk—they’re moments of opportunity. Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.” This is your chance to be just that.

Discounted Valuations

When panic selling sets in, even quality stocks often become undervalued. This is the ideal time to scoop up shares at a discount. Think of it like a clearance sale for assets that still have strong long-term potential.

You wouldn’t stop buying food just because the price dropped—investing should follow the same logic. If the fundamentals remain strong, a dip can be a buying opportunity.

Dollar-Cost Averaging (DCA)

Rather than trying to guess the perfect bottom, DCA involves investing a fixed amount of money at regular intervals. This strategy smooths out the purchase price over time and reduces the risk of investing a lump sum at the wrong moment.

It’s a great method during volatile markets because:

- You buy more when prices are low.

- You buy less when prices are high.

- Over time, it evens out, helping reduce overall risk.

Reinvesting Dividends

During downturns, reinvesting dividends can supercharge long-term gains. Since prices are lower, your dividends buy more shares, compounding your growth once recovery begins.

In essence, downturns are not the time to flee—they’re the time to prepare, pounce, and profit when the tide eventually turns.

Conclusion

Preparing for an economic downturn in the stock market is not about trying to predict the unpredictable—it’s about being proactive rather than reactive. By understanding the mechanics of downturns, recognizing early warning signs, and deploying time-tested investment strategies like diversification, defensive positioning, and emotional discipline, you put yourself in the best position not only to weather the storm but to come out stronger on the other side.

Economic downturns are part of the investing journey. While they may cause short-term pain, they also create long-term opportunities. The most successful investors are those who prepare during the calm, stay focused during the storm, and act strategically when others are frozen by fear.

So don’t wait until the market is in freefall to take action. Start positioning your portfolio today, develop a game plan, and stay informed. Your future self will thank you.

FAQs

1. What should I do with my investments during a recession?

During a recession, avoid panic-selling. Re-evaluate your portfolio, rebalance if needed, and focus on high-quality assets. Consider increasing exposure to defensive sectors and maintaining some liquidity for opportunities.

2. Are bonds a safer investment during economic downturns?

Yes, bonds—especially government and investment-grade corporate bonds—tend to perform better than stocks in recessions. They provide more stable income and are less volatile.

3. Is it smart to invest during a downturn?

Absolutely. Downturns often offer the chance to buy quality stocks at discounted prices. Using strategies like dollar-cost averaging can help you capitalize on long-term growth potential.

4. How do I know if a company is safe to invest in during a recession?

Look for strong balance sheets, consistent cash flow, low debt, and demand-resilient products or services. Defensive sectors like healthcare, utilities, and consumer staples often include recession-resistant companies.

5. How can I emotionally prepare for a market crash?

Educate yourself, set realistic expectations, and follow a solid investment plan. Avoid checking your portfolio too frequently and remind yourself of your long-term goals to keep emotions in check.