Investors seeking long-term financial growth often explore various strategies, and one such strategy gaining popularity is the Dividend Snowball. This article delves into the world of dividend stocks, explaining what the Dividend Snowball is and identifying the top dividend stocks that can help you grow your wealth over time.

Top Dividend Stocks for the Dividend Snowball

What is the Dividend Snowball?

The Dividend Snowball is a wealth-building strategy that involves reinvesting dividends earned from stocks back into the same stocks or other dividend-paying investments. This creates a compounding effect where your investments grow exponentially over time. The more dividends you reinvest, the larger your snowball becomes.

As dividends are reinvested, they purchase additional shares, which in turn generate more dividends, leading to a self-perpetuating cycle of growth. Over time, this compounding effect can transform even small initial investments into substantial portfolios.

Benefits of the Dividend Snowball Strategy

The Dividend Snowball strategy offers compelling advantages over other investment approaches, including:

- Compounding Growth: Reinvesting dividends allows investors to benefit from compounding, where the earned dividends are reinvested to purchase additional shares, leading to exponential growth over time.

- Passive Income: Dividend-paying companies provide shareholders with a steady stream of income, which can supplement retirement savings or provide a secondary source of income.

- Diversification: Investing in various dividend stocks spreads risk.

- Long-Term Wealth Building: The strategy is ideal for long-term investors.

- Reduced Volatility: Dividend-paying stocks tend to be less volatile than the overall market, providing a measure of stability during periods of economic uncertainty.

How to Build Your Dividend Snowball

To start building your Dividend Snowball, follow these steps:

- Set Clear Goals: Determine your financial goals and how much income you want from your investments.

- Create a Diversified Portfolio: Invest in a mix of dividend stocks to minimize risk.

- Reinvest Dividends: Instead of cashing out, reinvest your dividends.

- Regularly Contribute: Continue adding to your portfolio over time.

Criteria for Selecting Dividend Stocks

To harness the power of the dividend snowball, it’s crucial to identify companies that exhibit the following characteristics when selecting dividend stocks for your portfolio:

- Consistent Dividend Growth: A history of consistent dividend growth indicates a company’s commitment to returning value to shareholders and its ability to generate sustainable profits.

- Strong Financial Fundamentals: Sound financial fundamentals, such as healthy cash flow, low debt levels, and strong profitability, demonstrate a company’s resilience and its ability to maintain dividend payments even during challenging times.

- Sustainable Dividend Payout Ratio: The dividend payout ratio, which measures the proportion of profits paid out as dividends, should be within a manageable range, ensuring that the company retains sufficient earnings to fund future growth initiatives.

- Attractive Dividend Yield: While dividend yield represents the annualized return on investment, it’s important to consider the company’s overall financial health and growth prospects.

- Stability: Choose companies with a history of steady dividend payments.

- Growth Potential: Assess a stock’s potential for long-term growth.

Top Dividend Stocks for Your Portfolio

Tech Giants with Dividend Payouts

Many technology giants now offer dividends to shareholders. These companies include Apple, Microsoft, and Intel, which have a track record of both dividend payments and growth.

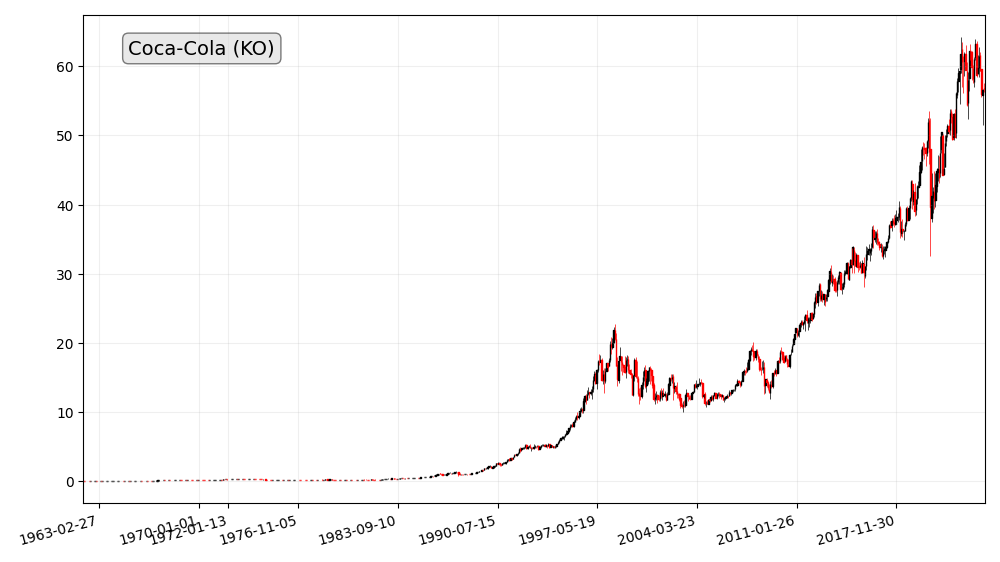

Blue-Chip Companies

Blue-chip companies like Coca-Cola, Procter & Gamble, and Johnson & Johnson have consistently paid dividends over the years. They are renowned for their stability and reliability.

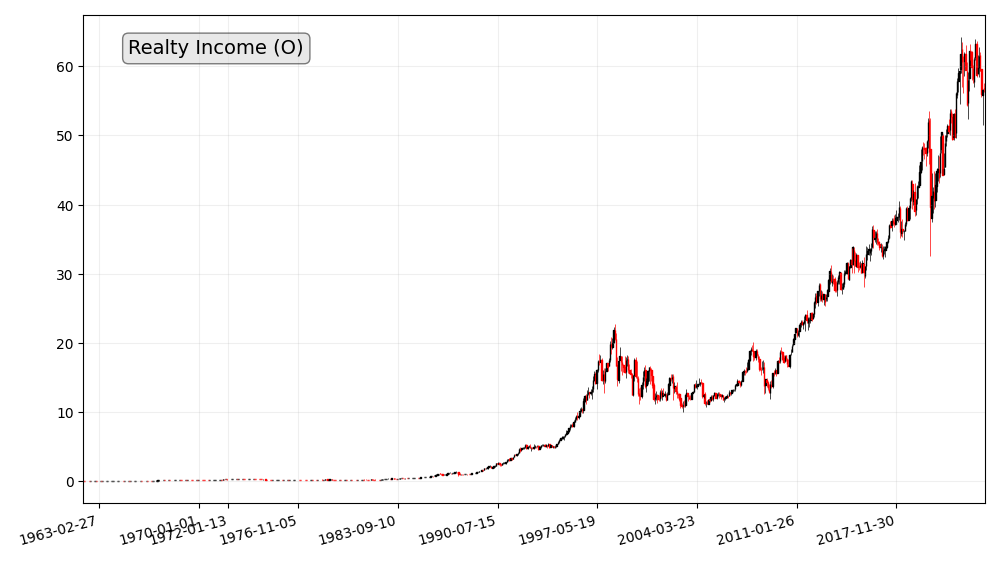

REITs (Real Estate Investment Trusts)

Real Estate Investment Trusts, such as Realty Income (O) and Simon Property Group (SPG), provide attractive yields and diversification opportunities.

Utility Stocks

Utility companies like Dominion Energy and Duke Energy are known for their reliable dividends, making them a safe bet for income-seeking investors.

Dividend Kings

This exclusive group comprises companies that have increased their dividends for an incredible 50 consecutive years or more, showcasing their long-term financial strength and dedication to rewarding shareholders.

These companies have achieved a remarkable milestone, increasing their dividends for over 50 consecutive years, solidifying their reputation as dividend stalwarts. These include companies such as Coca-Cola (KO), AbbVie (ABBV), Procter & Gamble (PG).

| Company (ticker) | Sector | Years of dividend growth |

| Dover (DOV) | Industrials | 68 |

| Procter & Gamble (PG) | Consumer staples | 67 |

| Genuine Parts (GPC) | Consumer discretionary | 67 |

| Emerson Electric (EMR) | Industrials | 66 |

| 3M (MMM) | Industrials | 65 |

| Cincinnati Financial (CINF) | Financials | 63 |

| Coca-Cola (KO) | Consumer staples | 61 |

| Colgate-Palmolive (CL) | Consumer staples | 61 |

| Nordson (NDSN) | Industrials | 60 |

| Johnson & Johnson (JNJ) | Health care | 60 |

| Kenvue (KVUE) | Consumer staples | 60 |

| Hormel Foods (HRL) | Consumer staples | 57 |

| Federal Realty Investment Trust (FRT) | Real estate | 56 |

| Stanley Black & Decker (SWK) | Industrials | 55 |

| Sysco (SYY) | Consumer staples | 53 |

| Target (TGT) | Consumer staples | 52 |

| PPG Industries (PPG) | Materials | 52 |

| Illinois Tool Works (ITW) | Industrials | 52 |

| W.W. Grainger (GWW) | Industrials | 51 |

| AbbVie (ABBV) | Health care | 51 |

| Becton Dickinson (BDX) | Health care | 51 |

| Abbott Laboratories (ABT) | Health care | 51 |

| Kimberly-Clark (KMB) | Consumer staples | 51 |

| PepsiCo (PEP) | Consumer staples | 51 |

| Nucor (NUE) | Materials | 50 |

| S&P Global (SPGI) | Financials | 50 |

| Archer-Daniels-Midland (ADM) | Consumer staples | 50 |

| Walmart (WMT) | Consumer staples | 50 |

Dividend Aristocrats

Dividend Aristocrats are S&P 500 companies with a history of increasing dividends for at least 25 consecutive years. Examples include Clorox (CLX), Exxon Mobil (XOM), Realty Income (O).

| Company (ticker) | Sector | Years of dividend growth |

| Consolidated Edison (ED) | Utilities | 49 |

| Lowe’s (LOW) | Consumer discretionary | 49 |

| Automatic Data Processing (ADP) | Industrials | 48 |

| Walgreens Boots Alliance (WBA) | Consumer staples | 47 |

| Pentair (PNR) | Industrials | 47 |

| McDonald’s (MCD) | Consumer discretionary | 46 |

| Medtronic (MDT) | Health care | 46 |

| Clorox (CLX) | Consumer staples | 46 |

| Sherwin-Williams (SHW) | Materials | 44 |

| Franklin Resources (BEN) | Financials | 42 |

| Aflac (AFL) | Financials | 41 |

| Air Products & Chemicals (APD) | Materials | 41 |

| Exxon Mobil (XOM) | Energy | 40 |

| Amcor (AMCR) | Materials | 40 |

| Cintas (CTAS) | Industrials | 39 |

| Brown-Forman (BF.B) | Consumer staples | 39 |

| McCormick & Co. (MKC) | Consumer staples | 37 |

| T. Rowe Price (TROW) | Financials | 37 |

| Cardinal Health (CAH) | Health Care | 37 |

| Atmos Energy (ATO) | Utilities | 36 |

| Chevron (CVX) | Energy | 36 |

| General Dynamics (GD) | Industrials | 32 |

| Roper Technologies (ROP) | Information technology | 31 |

| Ecolab (ECL) | Materials | 31 |

| West Pharmaceutical Services (WST) | Health care | 30 |

| Linde (LIN) | Materials | 30 |

| A.O. Smith (AOS) | Industrials | 30 |

| Realty Income (O) | Real estate | 30 |

| Expeditors International of Washington (EXPD) | Industrials | 30 |

| Chubb (CB) | Financials | 30 |

| Albemarle (ALB) | Materials | 29 |

| Essex Property Trust (ESS) | Real estate | 29 |

| Brown & Brown (BRO) | Financials | 29 |

| NextEra Energy (NEE) | Utilities | 29 |

| Caterpillar (CAT) | Industrials | 29 |

| International Business Machines (IBM) | Information technology | 28 |

| Church & Dwight (CHD) | Consumer staples | 27 |

| J.M. Smucker (SJM) | Consumer staples | 26 |

| C.H. Robinson Worldwide (CHRW) | Industrials | 25 |

Dividend Challengers

These companies have increased their dividends for at least 10 consecutive years and are on track to join the ranks of Dividend Aristocrats, indicating their potential for sustained dividend growth.

Importance of Diversification

Diversifying your dividend stock portfolio is crucial to spread risk. Invest in stocks from various sectors and industries to ensure that your Dividend Snowball remains resilient.

Spread your investments across various sectors and industries to reduce exposure to sector-specific risks and benefit from growth opportunities across different segments of the economy.

Monitoring Your Dividend Snowball

Keep a close eye on your investments. Regularly review your portfolio’s performance, ensure that companies continue to meet your criteria, and consider adjustments when necessary.

Rebalance your portfolio’s allocation as needed to maintain your desired asset allocation and ensure that your portfolio remains aligned with your investment objectives and risk tolerance.

Risks and Challenges

While the Dividend Snowball strategy is generally low-risk, there are factors to be aware of, such as market fluctuations, economic conditions, and company-specific risks.

Dividend investing is a long-term strategy, requiring patience and a willingness to ride out market fluctuations. By focusing on the long-term growth potential of your investments, you can reap the rewards of compounding and dividend reinvestment.

Tax Implications

Understand the tax implications of dividend income, including qualified and non-qualified dividends, to optimize your tax strategy.

Conclusion

The Dividend Snowball is a compelling strategy for investors looking to build wealth steadily over time. By reinvesting dividends and selecting top dividend stocks, you can watch your investments grow into a substantial financial asset.

Frequently Asked Questions (FAQs)

1. What is the Dividend Snowball strategy?

The Dividend Snowball strategy involves reinvesting dividends earned from stocks to accelerate wealth growth.

2. How do I start building a Dividend Snowball?

To start, set clear financial goals, create a diversified portfolio, reinvest dividends, and regularly contribute to your investments.

3. What criteria should I consider when selecting dividend stocks?

Consider dividend yield, stability, growth potential, and the financial health of the company.

4. Are there any risks associated with the Dividend Snowball strategy?

While generally low-risk, the strategy is not immune to market fluctuations, economic conditions, and company-specific risks.

5. What are the tax implications of dividend income?

Dividend income can be classified as qualified or non-qualified, each with its own tax implications. It’s important to understand these for tax optimization.