Investing in dividend-paying stocks is a popular way to secure a steady income stream while building wealth. However, the sustainability of these dividends is a crucial factor that every income-seeking investor should consider. In this article, we will delve into the world of “Ensuring Dividend Sustainability” and guide you on how to protect your investment income.

Ensuring Dividend Sustainability: A Guide to Secure Your Investment Income

Understanding Dividend Sustainability

Dividend sustainability refers to a company’s ability to maintain and even increase its dividend payments over time. It’s a measure of financial stability, indicating that the company’s earnings are sufficient to cover the dividend payments to shareholders.

Why Dividend Sustainability Matters

Ensuring dividend sustainability is vital for several reasons. First and foremost, it guarantees a consistent income stream for investors, making it a reliable source of funds for living expenses or reinvestment. This can be especially beneficial for retirees and other investors who rely on their investment income to cover their living expenses.

Moreover, sustainable dividends often indicate a company’s financial strength and long-term prospects, which can contribute to capital appreciation.

Additionally, dividend-paying companies tend to be more mature and financially stable than non-dividend-paying companies. This is because dividend-paying companies must have a track record of profitability and cash flow generation in order to maintain their dividend payments.

Key Factors Affecting Dividend Sustainability

Company Financial Health

The financial health of a company is a cornerstone of dividend sustainability. A company with strong financials, low debt, and consistent cash flow is better positioned to maintain its dividend payments, even during economic downturns.

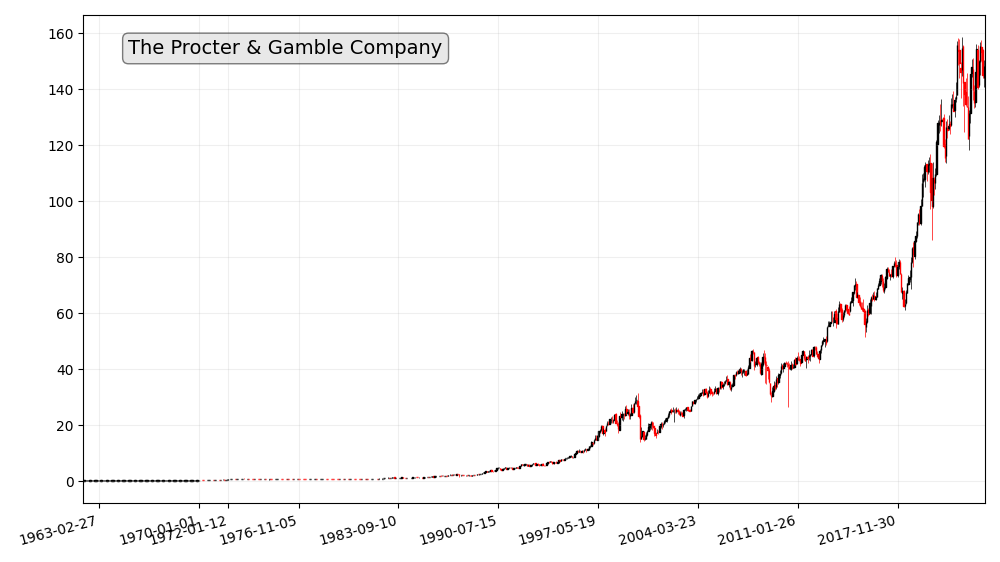

The company with the longest consecutive streak of increasing annual dividends is The Procter & Gamble Company (PG), which has raised its dividend for 66 consecutive years. PG is a leading consumer goods company that manufactures and sells a variety of household products, including Tide detergent, Pampers diapers, and Crest toothpaste.

Payout Ratio Analysis

The payout ratio, which compares the dividend payments to earnings, is a crucial metric. A lower payout ratio suggests that a company has more room to maneuver during tough times, while a high ratio could indicate vulnerability.

What is the Payout Ratio?

The payout ratio is a financial metric that measures the proportion of earnings a company distributes as dividends to its shareholders. It is expressed as a percentage and provides valuable insights into how a company manages its profits. The formula for calculating the payout ratio is as follows:

Payout Ratio = (Dividends per Share / Earnings per Share) x 100A high payout ratio indicates that a company is distributing a significant portion of its earnings to shareholders, leaving less available for reinvestment in the business. On the other hand, a low payout ratio suggests that the company retains a larger share of earnings for internal growth, debt reduction, or other uses.

Why Payout Ratio Matters to Investors

- Dividend Sustainability: For income-focused investors, the payout ratio is a critical factor in evaluating the sustainability of dividend payments. A high ratio may indicate that a company’s dividend payments are not sustainable in the long term, as it leaves little room for growth and financial stability.

- Growth Potential: A low payout ratio often suggests that a company is reinvesting a significant portion of its earnings back into the business. This can lead to growth and potentially higher future dividend payments, making the stock attractive to investors seeking capital appreciation.

- Risk Assessment: A company with a high payout ratio may be at greater risk during economic downturns or when facing unexpected financial challenges. Retaining more earnings internally can provide a cushion against such uncertainties.

Interpreting Different Payout Ratios

The interpretation of a payout ratio can vary by industry and the company’s growth stage. Here’s a rough breakdown of what different ratios might indicate:

- Payout Ratio Below 30%: This low ratio suggests that the company is retaining a significant portion of earnings for growth. Investors may anticipate future dividend increases and long-term financial stability.

- Payout Ratio Between 30% to 60%: A moderate ratio reflects a balanced approach to dividends and reinvestment. It’s often seen as a positive sign for both income and growth investors.

- Payout Ratio Above 60%: A high ratio indicates a company is distributing most of its earnings to shareholders. While it may attract income investors in the short term, it can pose challenges for future dividend growth and business sustainability.

Payout Ratio Analysis for Businesses

For businesses, managing the payout ratio is about finding the right balance between rewarding shareholders and securing the company’s financial future. Factors that influence the payout ratio include the business’s growth prospects, debt obligations, capital expenditure requirements, and cash flow position.

Companies must be cautious not to pay out too much and compromise future growth and financial stability. Conversely, overly retaining earnings can leave shareholders dissatisfied.

Dividend History

Analyzing a company’s dividend history can provide insights into its commitment to shareholders. Firms with a history of consecutive dividend increases often prioritize dividend sustainability.

Competitive landscape

The company’s competitive landscape is another important factor to consider. Companies in highly competitive industries may have difficulty maintaining their dividend payments if they are unable to compete effectively.

Management quality

The quality of the company’s management team is also an important factor. Companies with experienced and competent management teams are more likely to make sound decisions that support dividend sustainability.

Strategies for Ensuring Dividend Sustainability

Diversification

Diversifying your dividend portfolio across different sectors and industries can mitigate risk. It ensures that a setback in one sector won’t jeopardize your entire income stream.

Research and Analysis

Thoroughly research and analyze potential investments. Study the company’s financial reports, market trends, and competitive position to make informed decisions.

Long-Term Perspective

Investors should maintain a long-term perspective. Dividend sustainability is about building a reliable income source over time, not chasing short-term gains.

Monitoring Your Dividend Portfolio

Regularly monitor your dividend investments. Keep an eye on changes in the company’s financials and adjust your portfolio as needed.

Tax Implications

Understanding the tax implications of dividend income is essential. Depending on your country and tax laws, different tax rates may apply to dividends.

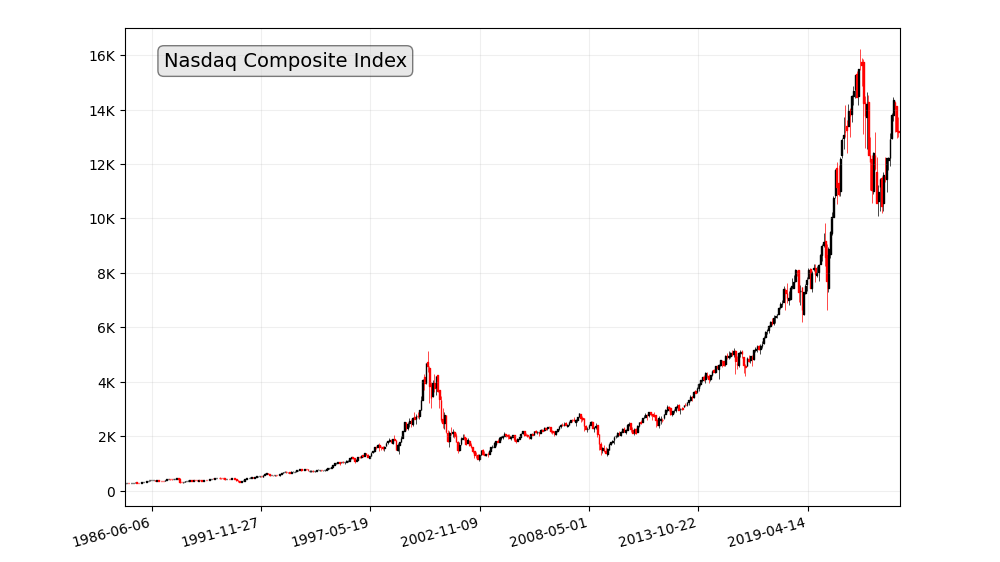

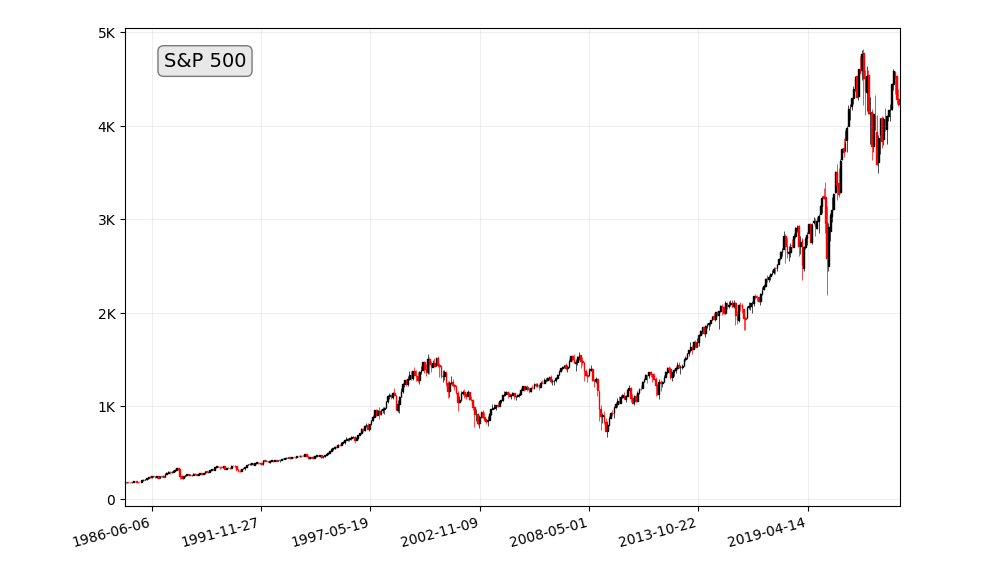

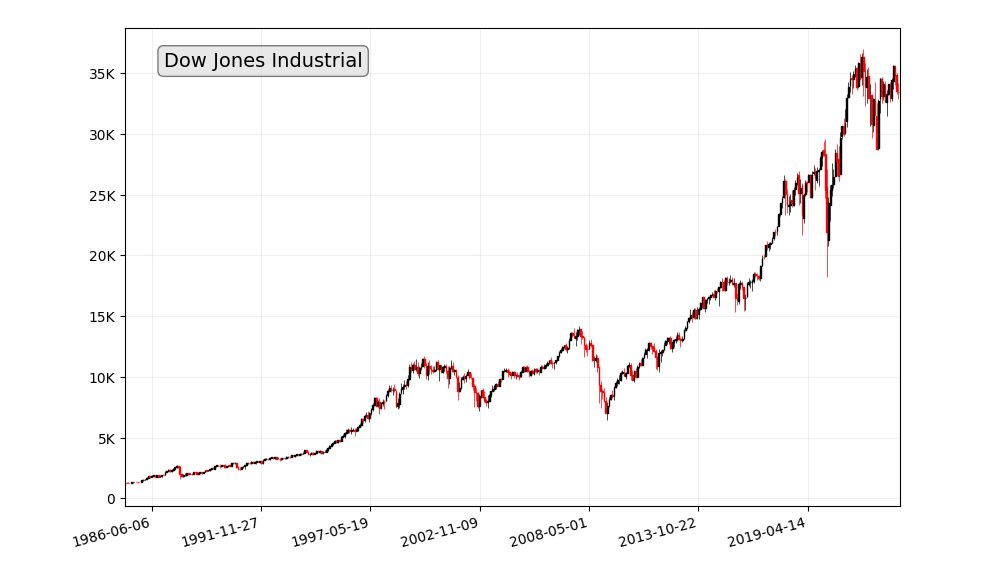

The Role of Market Volatility

Market volatility can impact dividend sustainability. Learn how to navigate market fluctuations and adjust your strategy accordingly.

Dividend Reinvestment Plans (DRIPs)

Consider using Dividend Reinvestment Plans to automatically reinvest your dividends, compounding your returns over time.

Case Studies of Successful Dividend Sustainability

Explore real-world examples of companies that have consistently provided sustainable dividends to their shareholders.

Risks and Challenges

Examine the risks and challenges associated with dividend investing, including economic downturns and industry-specific issues.

Dividend Growth vs. High Yield Stocks

Discover the difference between stocks that offer dividend growth and those with high yields and understand how to balance your portfolio.

Investing in Dividend ETFs

Learn about the benefits of investing in Dividend Exchange-Traded Funds (ETFs) as a diversified approach to dividend income.

Balancing Dividend Income with Other Investments

Consider how dividend income fits into your overall investment strategy, including other asset classes like bonds and growth stocks.

Conclusion

Ensuring dividend sustainability is a critical aspect of income-focused investing. By understanding the factors that influence dividend sustainability and implementing effective strategies, investors can secure a reliable source of income while also benefiting from potential capital appreciation.

FAQ

FAQ 1: What are some of the risks associated with investing in dividends?

Some of the risks associated with investing in dividends include:

- Dividend cuts: Companies can cut or eliminate their dividends at any time.

- Market risk: The stock market can be volatile, and dividend-paying stocks can also lose value.

- Interest rate risk: Rising interest rates can make dividend-paying stocks less attractive to investors.

FAQ 2: How can I diversify my dividend portfolio?

One way to diversify your dividend portfolio is to invest in a variety of different industries. This will help to reduce your risk if one industry underperforms.

Another way to diversify your dividend portfolio is to invest in companies of different sizes. Large-cap companies tend to be more stable and offer lower dividend yields, while small-cap companies tend to be more volatile and offer higher dividend yields.

Finally, you can also diversify your dividend portfolio by investing in different countries. This will help to reduce your risk if one country’s economy underperforms.

FAQ 3: What are some resources for learning more about dividend investing?

There are a number of resources available for learning more about dividend investing. Some of these resources include:

- Books: There are a number of books available on dividend investing. Some popular books include “The Intelligent Investor” by Benjamin Graham and “The Dividend Aristocrats: Investing in the 50 Dividend Stocks Most Likely to Go Up” by David Gardner.

- Websites: There are a number of websites that provide information on dividend investing. Some popular websites include Seeking Alpha, Dividend Investor, and Simply Safe Dividends.

- Investment advisors: If you are serious about dividend investing, you may want to consider working with an investment advisor. An investment advisor can help you to create a dividend portfolio that meets your individual needs and goals.

FAQ 4: How can I identify companies with sustainable dividends?

There are a number of ways to identify companies with sustainable dividends. Some of these methods include:

- Look for companies with a long history of paying dividends: Companies with a long history of paying dividends are more likely to continue paying dividends in the future.

- Look for companies with a strong financial position: Companies with a strong balance sheet and a history of profitability are more likely to be able to maintain or increase their dividend payments over time.

- Look for companies with a competitive advantage: Companies with a competitive advantage are more likely to be able to generate the profits needed to maintain or increase their dividend payments.

- Look for companies with a good management team: Companies with experienced and competent management teams are more likely to make sound decisions that support dividend sustainability.

FAQ 5: What should I do if a company I own cuts its dividend?

If a company you own cuts its dividend, you should first try to understand why the company made the decision. If the company cut its dividend due to financial difficulties, you may want to consider selling your shares. However, if the company cut its dividend to reinvest in its business, you may want to hold on to your shares.

Ultimately, the decision of what to do if a company you own cuts its dividend is a personal one. There is no right or wrong answer.