Financial education is a topic of growing importance in today’s world. In an era where personal finance decisions play a significant role in our lives, the power of financial education cannot be underestimated. This article explores the significance, benefits, and various aspects of financial education, shedding light on its potential to transform lives.

The Power of Financial Education

The Significance of Financial Education

Financial education is not a mere luxury but a necessity. In a world driven by financial decisions, it equips individuals with the knowledge and skills required to make informed choices about their money. It empowers them to manage their finances wisely, setting the stage for a more secure and prosperous future.

Financial education is important for a number of reasons. First, it can help you make informed financial decisions. When you understand how money works, you can make better choices about where to spend it, save it, and invest it.

Second, financial education can help you avoid financial pitfalls. For example, if you understand how debt works, you can avoid falling into a debt trap. Similarly, if you understand how investing works, you can avoid making risky investments that could lose you money.

Finally, financial education can help you achieve your financial goals. Whether you want to save for a down payment on a house, retire early, or start your own business, financial education can help you get there.

Benefits of Financial Education

The Power of Knowledge

Knowledge is power, and in the realm of finance, this statement holds true. Financial education provides individuals with the tools to understand the complex world of money, investments, and economic systems. Armed with this knowledge, people can take control of their financial destinies.

The Impact on Personal Finances

Making Informed Decisions

Financially educated individuals are better equipped to make prudent decisions about their money. They can navigate the challenges of budgeting, saving, and investing with confidence, minimizing the risk of financial pitfalls.

Budgeting and Saving

One of the fundamental aspects of financial education is budgeting. It helps individuals allocate their resources efficiently, ensuring that they save for future goals and emergencies.

Financial education can help you create a financial plan and set financial goals. This can help you stay on track to reach your financial goals, such as saving for retirement or buying a home.

The Path to Financial Freedom

Financial education is the roadmap to financial freedom. It teaches individuals how to create wealth, reduce debt, and plan for retirement, ultimately leading to a life free from financial worries.

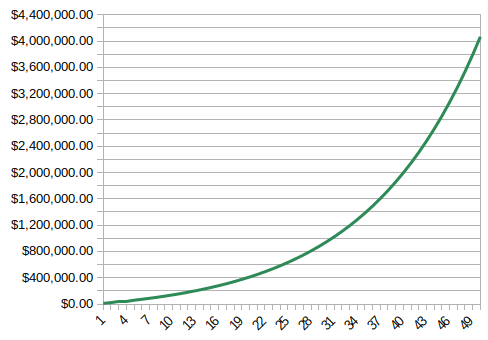

Financial education can help you learn how to invest and build wealth. This can help you achieve your long-term financial goals, such as retiring early or leaving a financial legacy for your loved ones.

Financial Education in Schools

The Need for Comprehensive Curriculum

Integrating financial education into school curriculums is vital. It equips students with essential life skills, teaching them about money management, investments, and the importance of saving from a young age.

Real-Life Applications

Financial education in schools should not just be theoretical. Real-life applications and practical exercises are key to ensuring that students can apply what they learn.

Resources for Financial Education

There are a number of resources available to help you get started with financial education. Here are a few examples:

Books and Articles

There are many books and articles available on financial education. Some popular titles include “The Total Money Makeover” by Dave Ramsey, “I Will Teach You to Be Rich” by Ramit Sethi, and “The Richest Man in Babylon” by George S. Clason.

Please take a sneak peek at the financial literacy corner on this website.

Online Resources for Financial Education

In the digital age, a plethora of online resources is available to anyone seeking financial knowledge.

Webinars and Podcasts

Webinars and podcasts provide a flexible and accessible way to learn about finance. They allow individuals to listen to experts, ask questions, and gain insights into various financial topics.

Interactive Learning Platforms

Interactive online platforms offer courses, tools, and calculators to help individuals enhance their financial literacy. These platforms make learning engaging and effective.

Financial Education for Adults

Overcoming Financial Challenges

Adults facing financial difficulties can benefit from financial education too. It equips them to overcome challenges, including debt, and set themselves on a path to financial stability.

Investing for the Future

Financial education enables adults to explore investment opportunities. They can understand the risks and rewards, making informed decisions about their financial future.

Retirement Planning

Planning for retirement is a crucial part of financial education for adults. It ensures that individuals can enjoy their golden years without financial stress.

Financial Advisors and Coaches

If you need help with financial planning or investing, you may want to consider working with a financial advisor or coach. A financial advisor can help you create a financial plan and choose the right investments for your needs. A financial coach can help you develop healthy financial habits and stay on track to reach your financial goals.

Empowering Underprivileged Communities

Bridging the Wealth Gap

Financial education plays a significant role in bridging the wealth gap. It empowers individuals in underprivileged communities to uplift themselves economically.

Nonprofit Organizations

Nonprofit organizations often lead the charge in providing financial education to those in need. Their initiatives make financial knowledge accessible to a wider audience.

Measuring the Impact

Economic Stability

Countries with a financially educated population tend to be more economically stable. This stability leads to a better quality of life for citizens.

Reducing Debt and Poverty

Financial education can contribute to the reduction of debt and poverty, fostering a more prosperous society.

The Importance of Long-Term Goals

The impact of financial education goes beyond immediate results. It lays the groundwork for long-term financial success and stability.

The Role of Government

Governments also play a crucial role in promoting financial education through policies and initiatives. Encouraging and supporting financial education benefits society as a whole.

Challenges in Financial Education

Lack of Accessibility

One of the primary challenges in financial education is accessibility. Not everyone has easy access to resources or opportunities for financial education.

Overcoming Misconceptions

There are often misconceptions about financial education, such as it being overly complex or time-consuming. Dispelling these myths is important to encourage more people to embrace financial education.

Financial Education In Practice

While there are many resources and ways to put financial education into action, the main steps usually revolve around the following:

- Set financial goals: The first step is to set financial goals. What do you want to achieve with your money? Once you know what your goals are, you can start to develop a plan to reach them.

- Create a budget: A budget is a plan for how you will spend your money. It can help you track your income and expenses, so you can see where your money is going and make sure you are spending it in line with your financial goals.

- Track your spending: Tracking your spending can help you identify areas where you can cut back. It can also help you see where your money is going, so you can make sure it is aligned with your financial goals.

- Learn about investing: Investing is one of the best ways to build wealth over time. However, it is important to understand how investing works before you start investing. There are a number of resources available to help you learn about investing, such as books, websites, and investment advisors.

- Get professional help: If you need help with financial planning or investing, you may want to consider working with a financial advisor or coach. A financial advisor can help you create a financial plan and choose the right investments for your needs.

Conclusion

In conclusion, the power of financial education is undeniable. It equips individuals with the knowledge and skills needed to take control of their financial destinies. Whether through formal education, online resources, or nonprofit initiatives, financial education has the potential to transform lives and societies.

FAQs

- What is the primary goal of financial education? Financial education aims to empower individuals with the knowledge and skills to make informed financial decisions, ultimately leading to financial stability and security.

- Can financial education benefit individuals of all ages? Yes, financial education is valuable for people of all ages. It helps children develop essential life skills, and it empowers adults to manage their finances and plan for retirement.

- How can I access financial education resources? You can access financial education through schools, online courses, webinars, podcasts, and nonprofit organizations dedicated to promoting financial literacy.

- What are the economic benefits of a financially educated population? A financially educated population contributes to economic stability, reduces debt and poverty, and fosters long-term financial well-being.

- What role does the government play in promoting financial education? Governments can promote financial education through policies and initiatives, making it more accessible to their citizens and supporting a financially literate society.