If you have $10,000 and you earn a 7% interest per year on it, you’ll end up with $10,700 at the end of the year:

10,000 + 10,000 x 7/100 = 10,700

And if you reinvest the profits, these $10,700 at 7% will become $11,449 the next year, and so on and so forth. You get the idea.

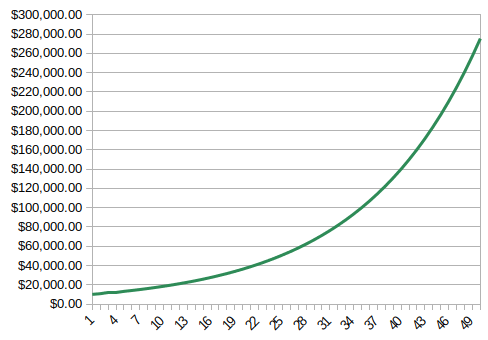

And while it does not seem like much it quickly adds up over time. Here is a chart of $10,000 at 7% compounded 50 times.

Now you may say that $280,000 is still not much over 50 years. But keep it mind, that it’s just money growing: you didn’t spend any time or any effort yet, it’s just $10,000 that you watched grow.

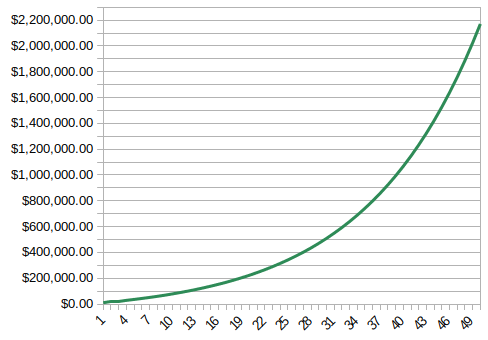

Now imagine that you’re able to save $5,000 a year and you invest them.

You’ll now cross the 1 million dollars mark after 40 years and you’ll get over 2 million dollars after 50 years.

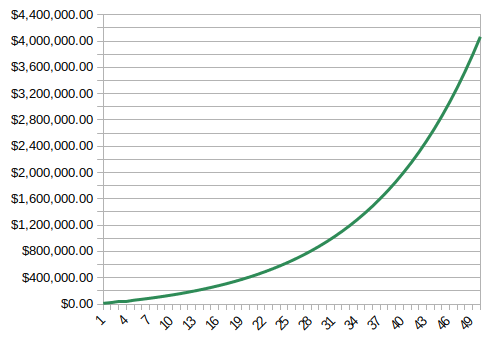

And what if you’re able to save $10,000 a year?

You’ll cross the 1 million dollars mark after 31 years, and over 4 million dollars after 50 years.

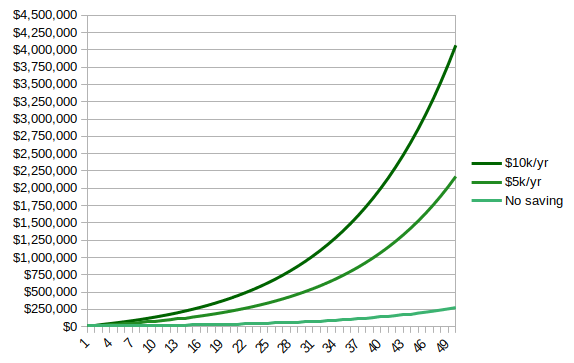

Now these charts look the same but the scale is very different, when compared to one another:

And that’s how people get rich. It’s not by earning a higher salary which has barely changed for the average US worker in past 50 years, but by investing and reinvesting the profits, also known as compounding.

That fantastic power is unfortunately one of the most underappreciated and as Dr. Albert A. Bartlett puts it, “The greatest shortcoming of the human race is our inability to understand the exponential function“.

Now, the 7% growth rate is not completely innocent. It’s give or take, the average growth rate of the stock market in the past 100 years or so and we’ll get to that in another post.

To have a better grasp of the power and the sometimes dramatic implications of an exponential growth rate, I highly recommend the exponential growth arithmetic lecture from Dr. Albert A. Bartlett.

Who said education was expensive? Like most things in life, the best ones are often free. 😜

As a closing note, let’s be honest, saving $10,000 a year on a minimum wage will be close to impossible, unless you live with your parents. It will probably take at least a $50,000 income to be able to comfortably save $10,000 a year, depending upon the cost of living in your area, the number of dependents you have and your spending habits. And yes it represents a 20% saving rate which may seem high for some, but if you’re on a quest towards financial independence this is the minimum target you’d want to aim for. More on this to come soon.

2 replies on “The Power Of Compounding”

[…] of the most powerful concepts in finance is compounding. Robbins elucidates the magic of compounding and its potential to accelerate wealth accumulation. By starting early and consistently reinvesting […]

[…] The magic of compounding interest cannot be overstated. By reinvesting your earnings, you allow your money to grow exponentially over time. The longer you invest, the more significant your wealth becomes. […]