Becoming a millionaire is a dream that many people aspire to achieve. While it may seem like an impossible feat, it is entirely attainable with the right mindset, strategies, and dedication. In this article, we will explore the various paths to fast-tracking your way to millionaire status. We’ll delve into financial planning, investments, entrepreneurship, and the power of compounding. So, let’s embark on this journey to financial success!

Fast-Track Your Way to Millionaire Status

The Power of Financial Planning

Setting Clear Financial Goals

To fast-track your way to millionaire status, it’s essential to start with a clear plan. Setting specific financial goals is the first step. Determine how much money you want to accumulate and by when. Having well-defined objectives will keep you motivated and focused on your journey.

Budgeting and Expense Management

Budgeting is a crucial aspect of financial planning. Monitor your expenses diligently and look for areas where you can cut costs. By living within your means and saving consistently, you can accelerate your wealth accumulation.

Live below your means. This means spending less money than you earn. This may seem obvious but this is key. This can be difficult, but it’s essential if you want to reach your financial goals.

Avoid Debt

Debt can weigh you down and make it difficult to save money. If you have debt, try to pay it off as quickly as possible.

Emergency Fund

Building an emergency fund is vital to avoid setbacks. It will protect your investments and help you stay on track when unexpected expenses arise.

Side Hustle and Multiple Income Streams

Having multiple streams of income can help you to reach your financial goals faster. There are many different ways to make extra money, such as starting a side hustle, investing in real estate, or renting out your spare bedroom.

Pay yourself first

When you get paid, set aside a portion of your money for savings and investments before you pay any other bills. This will help you to save money consistently and reach your financial goals faster.

The Art of Investment

Diversify Your Investments

Diversification is a key strategy for fast-tracking your millionaire status. Invest in a mix of assets, such as stocks, real estate, and bonds, to spread risk and increase your chances of higher returns.

Compound Interest

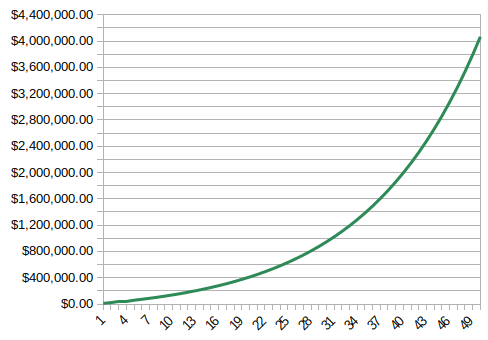

The magic of compounding interest cannot be overstated. By reinvesting your earnings, you allow your money to grow exponentially over time. The longer you invest, the more significant your wealth becomes.

Seek Professional Advice

Consider consulting with a financial advisor who can help you make informed investment decisions. Their expertise can help you navigate the complexities of the financial markets.

Entrepreneurship and Business

Start Your Own Business

Entrepreneurship offers a unique path to millionaire status. Starting your own business can be a risky endeavor, but it also comes with the potential for substantial rewards. Identify a niche, develop a business plan, and work hard to make it a success.

Innovate and Adapt

In the fast-paced business world, innovation is key. Be prepared to adapt to changing market conditions and continually improve your products or services.

Tips for Achieving Your Financial Goals Faster

Here are some additional tips for achieving your financial goals faster:

Start early

The earlier you start saving and investing, the more time your money has to grow.

They say that time is money, and when it comes to saving and investing, nothing could be truer. Starting early on your journey towards financial security can make a world of difference.

The concept of the “time value of money” is at the core of why starting early is so crucial in the world of finance. It emphasizes that money you have today is worth more than the same amount of money in the future. By saving and investing early, you give your money more time to grow and compound, resulting in a larger financial cushion.

Be consistent

The key to financial success is to be consistent with your savings and investments. Even if you can only save or invest a small amount each month, it will add up over time.

Consistency fosters financial discipline, a critical skill for managing your money wisely. It instills the habit of living within your means, budgeting effectively, and saving for the future. Over time, these habits become second nature, helping you make informed financial decisions and resist impulsive spending.

Consistency is also a valuable risk management tool. Markets can be unpredictable, and returns on investments can fluctuate. By consistently contributing to your investments, you can help mitigate the impact of market volatility. When you invest at regular intervals, you buy more shares when prices are low and fewer shares when prices are high. This strategy, known as dollar-cost averaging, can help smooth out the overall cost of your investments and reduce the risk of making costly mistakes based on market fluctuations.

Inconsistency in saving and investing can lead to financial stress. When you’re uncertain about where your money is going or when you’ll reach your financial goals, it can create anxiety. Consistency alleviates this stress by providing a sense of control and predictability. You can rest assured that your financial plan is progressing as intended.

Consistency is the bridge between setting financial goals and achieving them. Whether you’re saving for a down payment on a house, a child’s education, or a comfortable retirement, consistent saving and investing keep you on track. Regular contributions add up over time, inching you closer to your objectives. Consistency ensures that you don’t veer off course or become discouraged along the way.

Don’t be afraid to take risks

If you want to fast-track your way to millionaire status, you may need to take some risks. This could mean investing in a new business, starting a side hustle, or relocating to a new city for a better job opportunity.

Note that we talk about calculated risk, not gambling type of risk!

Learn from your mistakes

Everyone makes mistakes, but it’s important to learn from them and move on. Don’t let one setback derail your entire financial plan.

Surround yourself with positive people

The people you spend time with can have a big impact on your success. Surround yourself with positive people who believe in you and your goals.

Conclusion

Fast-tracking your way to millionaire status is a challenging but achievable goal. By setting clear financial goals, managing your expenses, diversifying your investments, and considering entrepreneurship, you can make significant strides towards becoming a millionaire. Remember that patience, discipline, and continuous learning are essential on this journey to financial success.

FAQs

1. How long does it take to become a millionaire?

The time it takes to become a millionaire varies based on factors like your savings rate, investment returns, and starting point. With consistent effort, it’s possible to achieve this goal in a reasonable time frame.

2. Are there any shortcuts to becoming a millionaire?

While there are no guaranteed shortcuts, smart financial decisions, strategic investments, and entrepreneurship can significantly speed up your path to millionaire status.

3. Is it necessary to start a business to become a millionaire?

No, starting a business is just one of many paths. You can also achieve millionaire status through disciplined saving, wise investing, and sound financial planning.

4. How important is risk management in wealth accumulation?

Risk management is crucial. Diversifying your investments and having an emergency fund are key components of risk management on your journey to becoming a millionaire.

5. Can anyone become a millionaire?

Yes, with the right mindset, dedication, and a well-thought-out financial plan, anyone can work towards becoming a millionaire. It’s a goal that’s within reach for those who are committed to achieving it.