In the world of investment, choosing between index funds and actively managed funds can be a daunting task. Investors often find themselves at a crossroads, trying to determine which approach aligns best with their financial goals and risk tolerance. So how do index funds compare to actively managed funds in terms of performance and associated risks? This article aims to shed light on the key differences between these two investment strategies, focusing on their performance and associated risks.

Index Fund vs Actively Managed Funds: Performance and Risk

Introduction

Investors have long sought the most effective way to grow their wealth through the financial markets. Two primary approaches have emerged – index funds and actively managed funds. Understanding the nuances of these strategies is crucial for making informed investment decisions.

Understanding Index Funds

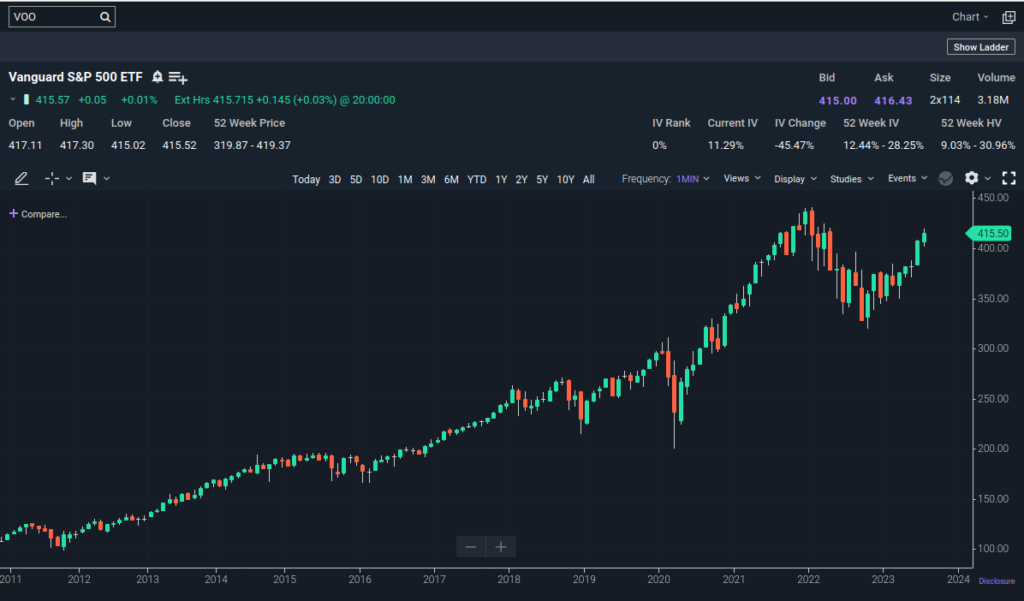

Index funds are passive investment vehicles designed to replicate the performance of a specific market index, such as the S&P 500. These funds aim to match the returns of the index they track, making them a popular choice for long-term investors seeking steady, low-cost growth.

Exploring Actively Managed Funds

In contrast, actively managed funds are overseen by professional fund managers who actively buy and sell securities in an attempt to outperform the market. The goal is to generate returns that surpass the benchmark index.

How Do Index Funds and Actively Managed Funds Differ?

Index funds and actively managed funds differ in a few key ways:

- Investment strategy: Index funds are passively managed and track a specific market index. Actively managed funds are actively managed by a team of investment professionals who aim to outperform the market.

- Fees: Index funds typically have lower fees than actively managed funds.

- Volatility: Index funds tend to be less volatile than actively managed funds.

- Performance: Over the long term, index funds have generally outperformed actively managed funds.

Performance Comparison

Historical Performance

One of the primary considerations when comparing index funds and actively managed funds is historical performance. Studies have shown that, over extended periods, index funds tend to outperform most actively managed funds. This is often attributed to lower fees and the challenge of consistently beating the market.

Expense Ratios

Index funds are known for their low expense ratios. These funds have minimal management fees since they require little intervention from fund managers. Actively managed funds, on the other hand, typically have higher expense ratios due to the costs associated with research and active trading.

Risks Associated with Index Funds

While index funds offer stability and lower costs, they are not without risks. Investors in index funds are exposed to market volatility, which can lead to losses during downturns. Additionally, there is no opportunity for outsized gains, as index funds aim to match the market’s performance.

Another risk associated with index funds is tracking error. This is the difference between the performance of an index fund and the performance of the index that it tracks.

Risks Associated with Actively Managed Funds

Actively managed funds carry their own set of risks. The success of these funds heavily depends on the skill and decisions of the fund manager. Poor management can lead to underperformance and higher fees, ultimately eroding returns.

Actively managed funds also tend to be more volatile than index funds. This is because fund managers are constantly trading in and out of securities in an attempt to outperform the market.

Choosing the Right Investment Strategy

The choice between index funds and actively managed funds depends on various factors, including:

Tax Efficiency

Index funds are tax-efficient due to their low turnover, while actively managed funds may trigger higher capital gains taxes through frequent buying and selling.

Liquidity

Index funds offer high liquidity, allowing investors to buy or sell shares at any time. Actively managed funds may have restrictions on liquidity.

Diversification

Index funds provide broad market exposure, ensuring diversification. Actively managed funds may be more concentrated in certain sectors or stocks.

Transparency

Index funds are more transparent than actively managed funds. This is because index funds are required to disclose their holdings on a regular basis. Actively managed funds are not required to disclose their holdings on a regular basis, which can make it more difficult to understand what the fund is investing in.

Investor Involvement

Index funds require minimal involvement, making them suitable for passive investors. Actively managed funds may require active monitoring and decision-making.

Market Conditions

The choice between these strategies may also depend on current market conditions. In bull markets, actively managed funds may shine, while in bear markets, index funds may be more attractive.

Investment Timeline

If you have a long-term investment horizon, then an index fund may be a good option for you. Index funds have generally outperformed actively managed funds over the long term.

If you have a short-term investment horizon, then an actively managed fund may be a good option for you. Actively managed funds may outperform index funds in the short term.

Risk Tolerance

If you have a low risk tolerance, then an index fund may be a good option for you. Index funds are less volatile than actively managed funds.

If you have a high risk tolerance, then an actively managed fund may be a good option for you. Actively managed funds have the potential to generate higher returns than index funds, but they also come with more risk.

Key Takeaways

- Index funds are passively managed and track a specific market index.

- Actively managed funds are actively managed by a team of investment professionals who aim to outperform the market.

- Over the long term, index funds have generally outperformed actively managed funds.

- Actively managed funds may outperform index funds in the short term.

- The type of fund that is right for you depends on your investment goals, investment timeline, risk tolerance, and investment knowledge and experience.

Conclusion

In the debate of index funds vs. actively managed funds, there is no one-size-fits-all answer. Each approach has its merits and drawbacks, and the choice ultimately depends on individual financial goals, risk tolerance, and investment horizon.

Frequently Asked Questions (FAQs)

- Are index funds suitable for long-term investments?

- Yes, index funds are often considered ideal for long-term investors due to their low costs and steady growth potential.

- Do actively managed funds always outperform index funds?

- No, actively managed funds do not always outperform index funds. Their performance depends on the fund manager’s skills and market conditions.

- How do expense ratios affect investment returns?

- Lower expense ratios in index funds can lead to higher net returns for investors compared to actively managed funds with higher fees.

- Are index funds less risky than actively managed funds?

- Index funds tend to offer lower risk and volatility, making them a more conservative choice for many investors.

- Can I switch between index funds and actively managed funds over time?

- Yes, investors can adjust their investment strategy based on changing financial goals and market conditions.

In conclusion, the decision between index funds and actively managed funds is a pivotal one in your investment journey. It’s crucial to carefully assess your goals, risk tolerance, and market conditions before making your choice. Both strategies have their place in a well-rounded investment portfolio, and diversifying your investments may be a prudent approach to manage risks and pursue long-term financial growth.