Welcome to the world of index fund investing, where simplicity and diversification meet outstanding returns. Index funds have gained immense popularity among investors due to their low-cost structure and ability to replicate the performance of a market index. However, once you’ve dipped your toes into the waters of index fund investing, you might be wondering how to take it to the next level and maximize your investment potential. In this article, we will explore advanced strategies that can help you achieve greater success with index fund investing.

Taking Your Index Fund Investing to the Next Level: Advanced Strategies for Success

Introduction

Index fund investing provides a straightforward way to gain exposure to a wide range of assets with minimal fees, making it an ideal choice for many investors. However, to truly excel in the world of index funds, it’s essential to develop a comprehensive strategy tailored to your unique financial goals and risk tolerance. In this article, we will explore advanced techniques and strategies that can take your index fund investing to new heights and help you achieve even greater success.

1. Understanding Index Funds

What are Index Funds?

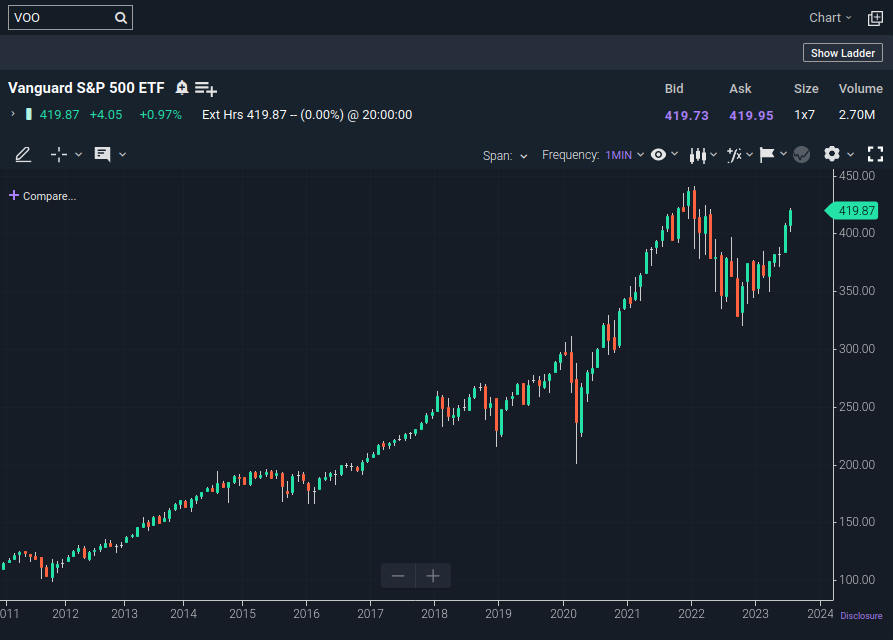

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500 or the Nasdaq. By investing in an index fund, you essentially own a slice of the entire index, providing instant diversification across a broad selection of companies.

The Benefits of Index Funds

Index funds offer several advantages over actively managed funds, including lower expense ratios, reduced portfolio turnover, and consistent returns that closely mirror the overall market. Additionally, they are an excellent choice for investors seeking long-term, low-maintenance investment solutions.

2. Assessing Risk Tolerance and Goals

Analyzing Your Risk Tolerance

Before delving deeper into index fund investing, it’s crucial to assess your risk tolerance. This will help determine the appropriate asset allocation and level of exposure to equities and bonds. Factors such as age, financial responsibilities, and investment horizon play a role in understanding your risk tolerance.

Setting Clear Investment Goals

Establishing clear investment goals is the foundation of a successful index fund strategy. Whether you’re saving for retirement, a down payment on a house, or funding your child’s education, defining your objectives will guide your investment decisions.

3. Diversification: Beyond the Basics

Exploring Sector-Based Diversification

While index funds inherently offer diversification, you can further enhance your portfolio by exploring sector-based index funds. These funds focus on specific industries or sectors, allowing you to capitalize on market trends and potential growth areas.

International Diversification Opportunities

Incorporating international index funds can provide exposure to global markets and reduce reliance on the domestic economy. Diversifying across regions can mitigate risks and open up new opportunities for higher returns.

4. Leveraging Exchange-Traded Funds (ETFs)

How ETFs Complement Index Funds

ETFs offer a unique way to enhance your index fund strategy. These funds trade on stock exchanges, providing intraday liquidity and flexibility to buy or sell at any time during market hours. Adding ETFs to your portfolio can enable you to fine-tune your asset allocation more frequently.

Leveraged and Inverse ETFs: A Cautionary Note

Leveraged and inverse ETFs are designed for short-term trading and speculative purposes. These funds use derivatives to amplify returns, but they also magnify risks significantly. As a long-term investor, it’s crucial to approach these funds with caution, as they are not suitable for most portfolios.

5. Smart Beta Strategies

What is Smart Beta?

Smart beta strategies aim to enhance returns or reduce risk by selecting and weighting stocks based on specific factors rather than traditional market capitalization. These factors could include value, momentum, volatility, or other quantitative metrics.

Evaluating Factors in Smart Beta Strategies

Selecting the right factors for your smart beta strategy requires careful analysis and consideration. Factors may perform differently over various market conditions, so it’s essential to understand how each factor aligns with your investment objectives.

6. Tax Optimization Techniques

Understanding Tax Efficiency in Index Funds

Index funds are generally tax-efficient due to their low turnover and long-term approach. However, investors can take additional steps to optimize their tax situation further. Strategies like tax-loss harvesting can offset capital gains and reduce tax liabilities.

Tax-Loss Harvesting and its Benefits

Tax-loss harvesting involves selling investments at a loss to offset gains from other investments, thereby reducing taxable income. This technique can help maximize after-tax returns and improve the overall tax efficiency of your index fund portfolio.

7. Dollar-Cost Averaging vs. Lump-Sum Investing

Pros and Cons of Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can provide a sense of discipline and reduce the impact of short-term market fluctuations.

Lump-Sum Investing in Favorable Market Conditions

On the other hand, lump-sum investing entails investing a significant amount of money all at once. While it carries higher short-term risks, lump-sum investing can yield greater returns in favorable market conditions.

8. Rebalancing Your Portfolio Effectively

The Importance of Regular Rebalancing

As market values change, your portfolio’s asset allocation may deviate from your original target. Regularly rebalancing your portfolio helps maintain your desired risk profile and ensures that you stay on track to meet your financial goals.

Avoiding Emotional Decisions

It’s essential to approach portfolio rebalancing methodically and avoid making emotional decisions based on short-term market movements. Sticking to a predetermined rebalancing schedule helps prevent knee-jerk reactions.

9. Monitoring Performance and Staying Informed

Utilizing Financial News and Resources

Staying informed about market trends, economic indicators, and industry news can provide valuable insights for your index fund investing strategy. Utilize reputable financial news sources and stay updated on changes in the financial landscape.

Tracking Your Index Fund’s Performance

Monitoring the performance of your index fund holdings is critical for evaluating the effectiveness of your investment strategy. Regularly review your portfolio’s performance and compare it to relevant benchmarks.

10. Understanding Market Volatility

Staying Calm During Market Fluctuations

Volatility is a natural part of the financial markets. As an index fund investor, it’s essential to stay calm and avoid making impulsive decisions during periods of market turbulence.

Using Volatility to Your Advantage

Volatility can create buying opportunities for long-term investors. Consider using market downturns to add to your positions and take advantage of potential discounts in stock prices.

11. Avoiding Common Mistakes

Chasing Performance: The Pitfalls

Trying to time the market or chase after recent top-performing funds can lead to suboptimal results. Focus on your long-term investment goals and avoid making investment decisions based solely on short-term performance.

Market Timing and its Dangers

Attempting to predict market movements is a challenging and risky endeavor. Time in the market is generally more critical than trying to time the market.

12. Embracing Long-Term Investing

The Power of Compounding Returns

Long-term investing allows you to benefit from the compounding effect, where your investment gains generate additional gains over time. This compounding effect can significantly boost your wealth.

Patience as a Virtue

Successful index fund investing requires patience and discipline. Stick to your investment plan and resist the temptation to make frequent changes to your portfolio.

13. The Rise of Artificial Intelligence in Index Fund Management

AI and Its Impact on Investing

Artificial intelligence is revolutionizing the financial industry, including index fund management. AI tools can analyze vast amounts of data and make data-driven investment decisions.

Combining Human Expertise with AI Tools

While AI can enhance investment strategies, human expertise remains essential. Combining human judgment with AI-driven insights can lead to more informed and successful investment choices.

14. Conclusion

Index fund investing offers a reliable and efficient way to grow your wealth over the long term. By incorporating advanced strategies such as sector-based diversification, smart beta techniques, and tax optimization, you can take your index fund investing to new heights. Remember always to consider your risk tolerance, investment goals, and time horizon when implementing these strategies. Stay informed, embrace a long-term mindset, and be patient with your investments. By doing so, you can achieve greater success and build a more secure financial future.

FAQs

Q1: Can index funds outperform actively managed funds?

Index funds typically aim to match the performance of a specific market index rather than outperforming it. However, due to their low expenses and consistent returns, index funds can often outperform many actively managed funds over the long term.

Q2: Are there any risks associated with smart beta strategies?

Yes, smart beta strategies carry certain risks. The performance of smart beta funds depends on the factors they are based on, and these factors may not always perform well under all market conditions.

Q3: How often should I rebalance my index fund portfolio?

The frequency of portfolio rebalancing depends on your investment strategy and risk tolerance. Some investors rebalance annually, while others may do so quarterly or semi-annually.

Q4: Can I invest in both index funds and individual stocks?

Yes, many investors combine index fund investments with individual stock holdings to achieve a balanced and diversified portfolio.

Q5: Should I consider consulting a financial advisor for my index fund investing?

Consulting a financial advisor can provide valuable insights and personalized guidance tailored to your specific financial situation and goals. It may be especially beneficial if you’re new to investing or require assistance with more complex investment strategies.