Investing in index funds can be a lucrative strategy for building wealth over time, but the key to success lies in understanding the recommended time frame for optimal results. In this article, we’ll delve into the intricacies of index fund investments, exploring the considerations that investors should bear in mind when deciding between short-term and long-term investment horizons.

Time Frame for Index Funds Investing

Understanding Index Funds

Index funds are investment vehicles that aim to replicate the performance of a specific market index, such as the S&P 500. These funds offer a diversified portfolio, typically mirroring the composition of the chosen index. The beauty of index funds lies in their passivity; they don’t rely on active management but rather track the market’s ups and downs.

Recommended Time Frame for Investing

Short-term vs. Long-term Investment Goals

Investors need to define their goals before determining the suitable time frame for investing in index funds. Short-term goals, such as saving for a down payment on a house or funding a vacation, may require a different approach than long-term goals like retirement planning.

Factors Influencing the Time Frame Decision

Several factors influence the decision between short-term and long-term investments. Market conditions, risk tolerance, and individual financial goals all play a role in determining the optimal time frame for investing in index funds.

Short-term Investment Considerations

Market Volatility and its Impact on Short-term Investments

Short-term investments are susceptible to market volatility, which can lead to unpredictable fluctuations in the value of index funds. Investors must be prepared for short-term losses and gains, understanding that market conditions can be highly unpredictable over shorter durations.

Strategies for Short-term Index Fund Investments

To navigate the volatility of short-term investments, investors may consider employing strategies such as setting clear profit targets, using stop-loss orders, and staying informed about market news and events that may impact their holdings.

Long-term Investment Considerations

Benefits of Long-term Investing in Index Funds

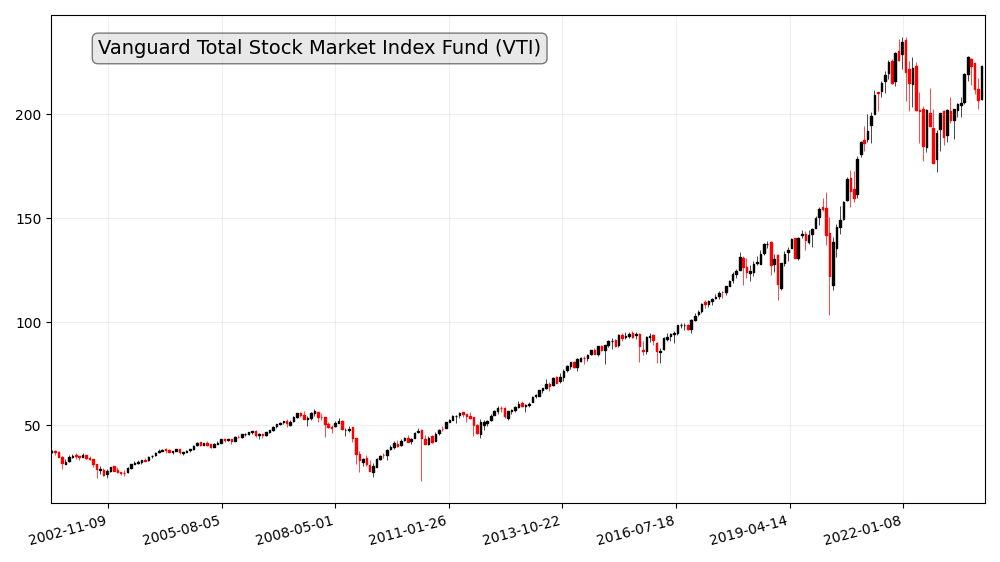

While short-term investments may be subject to market turbulence, long-term investments in index funds offer the potential for sustained growth. The power of compound interest becomes a significant advantage over time, allowing investors to capitalize on the overall upward trajectory of the market.

Compound Growth and Wealth Accumulation

Long-term investors benefit from the compounding effect, where returns generate additional returns. This compounding can result in substantial wealth accumulation over an extended period, making index funds an attractive option for those with a patient investment approach.

Long-term investors benefit from the magic of compounding, where their money earns returns on previous gains. By embracing patience and allowing investments to grow over time, investors can harness the full potential of compounding and lay the foundation for a robust financial future.

Regular Contributions and Dollar-Cost Averaging

Consistent contributions to index funds, regardless of market conditions, is a strategy known as dollar-cost averaging. This method involves regularly investing a fixed amount, smoothing out the impact of market volatility. Over time, this disciplined approach can lead to a more stable and predictable investment journey.

Market Trends and Economic Indicators

Analyzing Market Trends for Optimal Investment Decisions

Successful index fund investing requires a keen understanding of market trends. Analyzing historical data and identifying patterns can help investors make informed decisions, aligning their investments with market dynamics.

Key Economic Indicators Affecting Index Fund Performance

Economic indicators, such as interest rates, inflation, and employment figures, can significantly impact index fund performance. Investors should stay informed about these indicators to anticipate potential market movements.

Risk Management in Index Fund Investments

Diversification Strategies

Diversification is a key risk management strategy for index fund investors. By spreading investments across different sectors and asset classes, investors can reduce the impact of poor-performing assets on their overall portfolio.

Understanding and Mitigating Investment Risks

Risk is inherent in any investment, but understanding and mitigating risks are crucial for long-term success. Investors should assess their risk tolerance and make strategic decisions that align with their comfort level and financial objectives.

Perplexity in Investment Decision-making

Addressing the Complexity and Unpredictability of the Market

Investing in index funds can be perplexing, especially for beginners. The market’s complexity and unpredictability demand a thoughtful and well-researched approach. Investors should educate themselves on market dynamics and seek professional advice if needed.

Balancing Risk and Reward for Optimal Results

Finding the right balance between risk and reward is essential. While higher-risk investments may offer greater potential returns, they also come with increased volatility. Investors must strike a balance that aligns with their financial goals and risk tolerance.

Burstiness in Market Dynamics

Burstiness, or sudden and unexpected market fluctuations, is a challenge for investors. Staying calm during market turbulence and having a well-defined investment strategy can help navigate these unpredictable moments.

Strategies for Capitalizing on Burstiness in the Market

Rather than fearing burstiness, savvy investors capitalize on sudden market movements. This may involve seizing buying opportunities during market dips or having exit strategies in place to minimize losses during unexpected downturns.

Investment Horizons and Financial Goals

Aligning Investment Time Frames with Specific Financial Objectives

Investors should align their investment time frames with specific financial objectives. Short-term goals may require more conservative investment strategies, while long-term goals allow for a more growth-oriented

approach. Understanding the correlation between investment horizons and financial goals is crucial for making informed decisions that align with individual needs.

Assessing Individual Risk Tolerance and Preferences

Risk tolerance varies among investors, and understanding one’s comfort level is paramount. Some investors are more risk-averse and prefer stable, conservative investments, while others are comfortable with a higher level of risk for the potential of greater returns. Assessing personal risk tolerance helps in tailoring an investment strategy that suits individual preferences.

Active vs. Passive Investing

Comparing Active and Passive Investment Strategies

Index funds fall into the category of passive investing, where the goal is to replicate the performance of a specific market index rather than outperform it actively. While active investing involves frequent buying and selling of securities in an attempt to outperform the market, passive investing provides a more hands-off approach, often with lower fees.

How Index Funds Fit into Passive Investment Approaches

Index funds offer an accessible entry point for investors looking to adopt a passive investment strategy. Their structure aligns with the philosophy of long-term, steady growth by mirroring the overall market trends. Understanding the distinctions between active and passive strategies empowers investors to choose an approach that suits their preferences.

Case Studies: Successful Index Fund Investments

Examples of Investors Achieving Optimal Results

Real-world examples of successful index fund investments provide valuable insights. Case studies can showcase how investors strategically navigated market conditions, adhered to their chosen time frames, and ultimately achieved their financial goals through disciplined and informed decision-making.

Lessons Learned from Successful Index Fund Strategies

Analyzing successful strategies offers valuable lessons. Common themes may include the importance of patience, the power of compounding, and the impact of disciplined, long-term investment approaches. Learning from the experiences of others can inform investors’ own decision-making processes.

Common Pitfalls to Avoid

Mistakes that Investors Should Be Wary Of

While success stories inspire, understanding the common pitfalls in index fund investing is equally crucial. Pitfalls may include emotional decision-making, overreacting to short-term market movements, or neglecting to reassess and adjust the investment strategy over time. Recognizing and avoiding these pitfalls can contribute to a more successful investment journey.

Learning from the Experiences of Others

Learning from the experiences of fellow investors provides a wealth of knowledge. Shared stories of challenges and triumphs can help investors navigate their own paths, gaining insights into what to do and what to avoid in the dynamic world of index fund investments.

Staying Informed: Continuous Monitoring of Investments

Importance of Staying Updated on Market Trends

The financial landscape is dynamic, with market trends evolving over time. Staying informed about current market conditions, economic developments, and global events is crucial for making informed decisions. Regularly monitoring investments ensures that investors can adapt their strategies in response to changing circumstances.

Tools and Resources for Monitoring Index Fund Performance

Numerous tools and resources are available to help investors stay informed. From financial news outlets to investment analysis platforms, these resources provide real-time data and expert insights. Leveraging these tools empowers investors to make timely decisions aligned with their financial goals.

Conclusion

In conclusion, the recommended time frame for investing in index funds depends on individual goals, risk tolerance, and financial preferences. Whether opting for a short-term strategy to meet immediate financial needs or embracing a long-term approach for sustained growth, investors must align their investment horizons with their specific objectives. By understanding market dynamics, managing risks effectively, and learning from both successes and pitfalls, investors can navigate the complexities of index fund investing with confidence.

FAQs (Frequently Asked Questions)

- Q: Can index funds provide substantial returns over a short period?

- A: While index funds are designed for long-term growth, short-term returns can vary based on market conditions. It’s essential to align expectations with the chosen time frame.

- Q: How do economic indicators affect index fund performance?

- A: Economic indicators, such as interest rates and inflation, can influence market movements, impacting the performance of index funds. Staying informed about these indicators is crucial for investors.

- Q: What are the key differences between active and passive investing?

- A: Active investing involves frequent buying and selling to outperform the market, while passive investing, as seen in index funds, aims to replicate market performance without constant intervention.

- Q: Are there specific strategies for managing risks in index fund investments?

- A: Diversification is a common strategy to manage risks in index fund investments. Spreading investments across different assets can help mitigate the impact of poor-performing securities.

- Q: How often should investors reassess their index fund investment strategy?

- A: Regular reassessment is advisable, especially when financial goals or market conditions change. Periodic reviews allow investors to adjust their strategies to align with evolving circumstances.