In today’s volatile financial landscape, finding stable and lucrative investment options is a top priority for many investors. One such avenue that has stood the test of time is investing in dividend stocks. These stocks offer a unique blend of growth potential and regular income, making them a popular choice for those seeking to generate passive income. In this comprehensive guide, we will explore the world of dividend stocks, uncovering the strategies, benefits, and some top picks for investors looking to build wealth over the long term.

Explore the Best Dividend Stocks for Passive Income

Introduction to Dividend Stocks

Dividend stocks represent shares in companies that distribute a portion of their profits to shareholders on a regular basis, usually quarterly. This distribution, known as dividends, can provide investors with a steady stream of income, making them an attractive choice for those looking to supplement their earnings or build wealth over time.

Why Invest in Dividend Stocks

Investing in dividend stocks offers several advantages. First and foremost, they provide a consistent source of income, which can be especially beneficial for retirees or those planning for retirement. Additionally, dividend stocks tend to be less volatile than growth stocks, making them a safer investment option during economic downturns.

How Dividend Stocks Work

Dividend stocks work by companies allocating a portion of their earnings to pay dividends to shareholders. These payments are typically made in cash, although some companies offer stock dividends, where shareholders receive additional shares instead of cash.

Different Types of Dividend Stocks

There are various types of dividend stocks, including common stocks, preferred stocks, and real estate investment trusts (REITs). Each type has its unique characteristics and benefits, catering to different investor preferences and goals.

Selecting the Best Dividend Stocks

Choosing the right dividend stocks requires careful analysis. Investors should consider factors such as the company’s financial health, dividend history, and growth prospects. Additionally, diversifying across different sectors can help mitigate risk.

Building a Diversified Portfolio

Diversification is a key strategy in dividend investing. By spreading investments across multiple dividend-paying stocks and sectors, investors can reduce the impact of poor performance in a single stock or industry.

Dividend Reinvestment Plans (DRIPs)

Many dividend stocks offer DRIPs, allowing investors to automatically reinvest their dividends to purchase additional shares. This can accelerate wealth accumulation over time.

Tax Considerations with Dividend Stocks

Understanding the tax implications of dividend income is crucial. While dividends are generally taxable, certain types of dividends may qualify for lower tax rates.

Risk Management in Dividend Investing

Although dividend stocks are considered safer than some other investment options, they are not without risk. Investors should be aware of potential risks and implement risk management strategies accordingly.

How to Choose Dividend Stocks

When choosing dividend stocks, it is important to consider factors such as the dividend yield, the company’s financial strength, and its dividend history. It is also important to diversify your portfolio by investing in a variety of different stocks.

Dividend Yield

The dividend yield is the amount of dividend paid per share, expressed as a percentage of the share price. A higher dividend yield means that the company is paying out a larger portion of its profits to shareholders. However, it is important to note that dividend yield is not the only factor to consider when choosing dividend stocks.

Financial Strength

The company’s financial strength is important because it determines the company’s ability to continue paying dividends. You should look at the company’s debt-to-equity ratio, cash flow, and earnings per share. A company with a strong financial position is more likely to be able to continue paying dividends even in difficult times.

Dividend History

The company’s dividend history is also important. A company that has a history of increasing its dividends is more likely to continue doing so in the future. However, it is important to note that even companies with a history of increasing dividends can cut their dividends in the future.

Diversification

It is important to diversify your portfolio by investing in a variety of different stocks. This will help to reduce your risk if one of your stocks performs poorly. You can diversify your portfolio by investing in different industries, countries, and asset classes.

Other Factors to Consider

In addition to the factors mentioned above, there are other factors that you may want to consider when choosing dividend stocks. These factors include:

- The company’s growth prospects.

- The stability of the company’s dividend payments.

- The company’s payout ratio.

- The company’s valuation.

It is important to do your own research and consult with a financial advisor before investing in any dividend stocks.

Top 5 Dividend Stocks for Passive Income in 2023

Please not that this not a recommendation to buy or sell any securities, only a selection of stocks that could fit the criteria mentioned above for educational purpose only. You should do your own due diligence and check with your financial advisor.

The Top 5 Dividend Stocks for Passive Income in 2023

The following are the top 5 dividend stocks for passive income in 2023, based on factors such as dividend yield, dividend growth rate, and financial strength:

- Realty Income Corporation (O)

Realty Income Corporation is a real estate investment trust (REIT) that owns and operates a portfolio of over 11,700 commercial properties in 51 states and Puerto Rico. The company has a dividend yield of 4.3%, and it has been increasing its dividend for the past 96 consecutive quarters.

- AT&T (T)

AT&T is another leading telecommunications company that provides wireless, wireline, and internet services. The company has a dividend yield of 5.7%, and it has been paying dividends for over 100 years. AT&T is a well-established company with a large customer base, making it a safe investment for dividend investors.

AT&T is also a Dividend Aristocrat, with a streak of 35 consecutive years of dividend increases. The company has a strong financial position, with a debt-to-equity ratio of 0.9. AT&T is also a diversified company, with operations in the United States, Mexico, and Latin America.

- Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare company that manufactures and distributes a wide range of products, including pharmaceuticals, medical devices, and consumer goods. The company has a dividend yield of 2.7%, and it has been paying dividends for over 100 years. Johnson & Johnson is a well-respected company with a strong financial position, making it a good choice for dividend investors.

Johnson & Johnson is also a Dividend Aristocrat, with a streak of 56 consecutive years of dividend increases. The company has a strong financial position, with a debt-to-equity ratio of 0.4. Johnson & Johnson is also a diversified company, with operations in over 60 countries.

- Coca-Cola (KO)

Coca-Cola is a beverage company that produces and distributes soft drinks, juices, and other beverages. The company has a dividend yield of 2.8%, and it has been paying dividends for over 50 years. Coca-Cola is a global brand with a strong track record of growth, making it a good choice for dividend investors.

Coca-Cola is also a Dividend Aristocrat, with a streak of 59 consecutive years of dividend increases. The company has a strong financial position, with a debt-to-equity ratio of 1.0. Coca-Cola is also a diversified company, with operations in over 200 countries.

- Procter & Gamble (PG)

Procter & Gamble is a consumer goods company that manufactures and distributes a wide range of products, including personal care products, household cleaning products, and food products. The company has a dividend yield of 2.5%, and it has been paying dividends for over 100 years. Procter & Gamble is a well-established company with a strong financial position, making it a good choice for dividend investors.

Procter & Gamble is also a Dividend Aristocrat, with a streak of 65 consecutive years of dividend increases. The company has a strong financial position, with a debt-to-equity ratio of 0.5. Procter & Gamble is also a diversified company, with operations in over 70 countries.

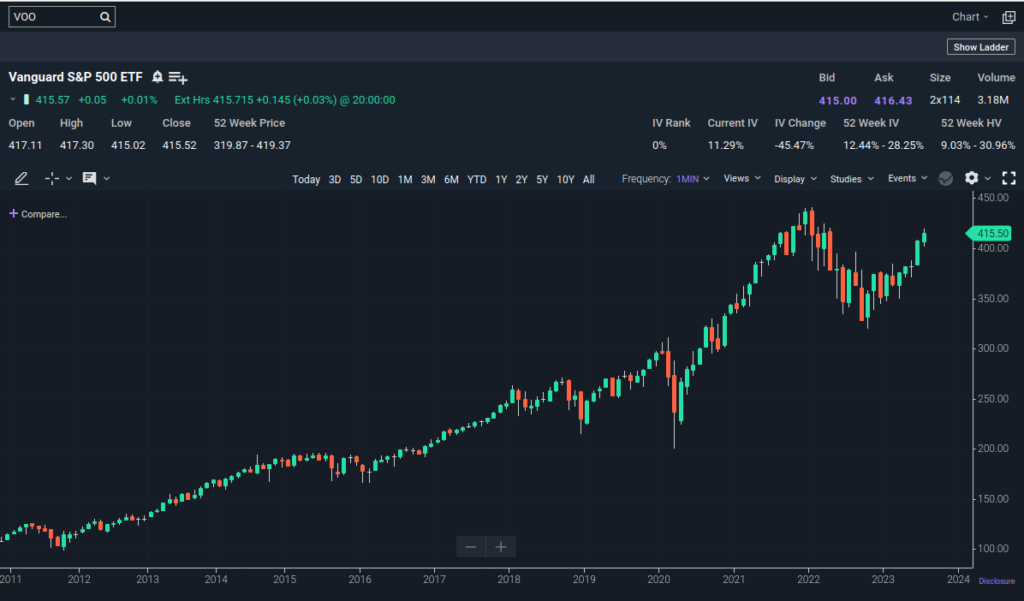

Dividend Stocks vs. Other Investment Options

Compare dividend stocks with other popular investment choices, such as bonds, real estate, and growth stocks, to make informed investment decisions.

Common Mistakes to Avoid

Avoiding common pitfalls is essential for successful dividend investing. Learn from the mistakes of others to safeguard your portfolio.

Tracking and Managing Your Dividend Portfolio

Discover effective tools and strategies for monitoring and managing your dividend portfolio to maximize returns and maintain financial stability.

Conclusion: The Power of Dividend Stocks

In conclusion, dividend stocks offer a compelling avenue for investors to generate passive income and build long-term wealth. By carefully selecting and managing a diversified portfolio of dividend-paying stocks, investors can enjoy a steady stream of income while benefiting from the potential for capital appreciation. Start your journey into the world of dividend stocks today to secure your financial future.

FAQs

- What are dividend stocks, and how do they work?

- Are dividend stocks a suitable investment for retirees?

- How can I build a diversified dividend portfolio?

- What tax considerations should I be aware of when investing in dividend stocks?

- What are some common mistakes to avoid when investing in dividend stocks?