Investing in residential real estate can be a great way to generate cash flow and build long-term wealth. But with so many different markets to choose from, it can be difficult to know which ones are worth investing in. In this article, we’ll provide you with a comprehensive guide on how to identify residential real estate markets that are ideal for cash flow investments.

How to Identify Residential Real Estate Market to Invest in For Cash Flow

Price to Rent Ratio

The price to rent ratio (P/R ratio) is a valuable tool for real estate investors looking to identify areas with high potential for cash flow.

To calculate the P/R ratio, you would divide the purchase price of the property by the annual rental income. For example, if a property costs $500,000 and generates $30,000 in annual rent, the P/R ratio would be 16.7 ($500,000 ÷ $30,000).

In general, a P/R ratio of 13 or lower suggests that it will likely be cost-effective to buy an investment property to rent it out for cash flow, as a low P/R ratio means the price of the property is low compared to the rent you’ll collect.

While a ratio above 20 suggests that it will be much harder to find a property that is cash flowing. While it may not be impossible to find cash flowing deals, your time may be better spent looking at areas with a lower price to rent ratio.

You can look at the Zillow dataset. For a fun coding project to geek away with in Python:

https://www.youtube.com/watch?v=S22Mh-M6oHQ

For reference, here are the metropolitan areas with a price to rent ratio of 13 or below as of early 2023:

| Metropolitan Area | PRR – Price to rent ratio |

| Jackson, MS | 10.68 |

| Toledo, OH | 10.75 |

| El Paso, TX | 11.32 |

| Scranton, PA | 11.50 |

| Syracuse, NY | 11.51 |

| Pittsburgh, PA | 11.99 |

| Winston-Salem, NC | 12.13 |

| Miami-Fort Lauderdale, FL | 12.33 |

| Youngstown, OH | 12.41 |

| Memphis, TN | 12.43 |

| Greensboro, NC | 12.63 |

| Cleveland, OH | 12.64 |

| Dayton, OH | 12.68 |

| Augusta, GA | 12.74 |

| New Orleans, LA | 12.75 |

| McAllen, TX | 12.78 |

| Rochester, NY | 12.82 |

| Chicago, IL | 12.97 |

| Columbia, SC | 12.98 |

| Detroit, MI | 13.08 |

| Tulsa, OK | 13.15 |

| Baton Rouge, LA | 13.26 |

| Lakeland, FL | 13.27 |

| Oklahoma City, OK | 13.35 |

| Allentown, PA | 13.39 |

While there’s a lot of missing rent data in the Zillow dataset, there’s still quite a few.

For more rent data, you can use the Fair Market Rents estimate from the government as a proxy:

https://www.huduser.gov/portal/datasets/fmr.html#2023_data

Look for Growing Markets

Once you’ve identified potential areas with the proper price to rent ratio, the next step in identifying a market for cash flow investments is to conduct thorough market research. This involves analyzing key economic indicators, demographic data, and real estate market trends to determine which markets are most likely to provide strong returns on investment.

Some of the key factors to consider during your market research include population growth, job growth, income levels, crime rates, and rental demand. You can obtain this data from a variety of sources, including government websites, real estate industry reports, and online databases.

You should focus your attention on markets that are experiencing growth in key areas such as population, employment, and rental demand. These markets are more likely to provide strong returns on investment in the long term.

Some of the top growing real estate markets in the US currently include cities like Austin, Nashville, and Charlotte. However, it’s important to note that growth doesn’t always translate into profitability, so you’ll need to analyze the specific market conditions in each location to determine its potential for cash flow investments.

Population Growth

In general you want to invest in areas where the population is increasing, that will help ensure your property can be rented as well as potentially preserving the value of your investment as more people generally means more demand.

Macro trend is generally a good way to visualize how the population of a given area is evolving:

Memphis Metro Area Population 1950-2023.

San Francisco Metro Area Population 1950-2023.

Economic Data

censusreporter.org is a good way to visualize the main economic indicators for a given area. Some of the economic indicators to look at are:

- The median household income: since a rent shall usually not exceed roughly 30% of your revenue, that will give you how much can rent be to stay healthy.

- Renter vs Owner occupied: owners provide stability in a neighborhood. But if you only have owners, you won’t be able to rent your property. Conversely, if there are only renters while you may be able to rent your property, the neighborhood may not be very stable and you may get higher turnover in your rental. So looking for a sweet spot of 40% to 60% renters occupied is usually a good rule of thumb.

Some examples:

- Median household income in early 2023: $44,317

- Renter vs Owner occupied: 53% renter occupied

- Median household income in early 2023: $121,826

- Renter vs Owner occupied: 60% renter occupied

Look For Landlord Friendly States

When it comes to being a landlord, the state you operate in can make a significant impact on your ability to protect your property and make a profit. Landlord-friendly states typically have laws and regulations that support landlords and make it easier for them to manage their properties. Here are some key characteristics of landlord-friendly states:

Favorable Landlord-Tenant Laws

One of the most important factors in a landlord-friendly state is a favorable landlord-tenant law. These laws govern the rights and responsibilities of both landlords and tenants, and can vary widely from state to state. Landlord-friendly states tend to have laws that are more supportive of landlords, including more lenient eviction processes, less stringent security deposit requirements, and stronger landlord protections.

Low Property Taxes

Property taxes can be a significant expense for landlords, and states with low property taxes can be more attractive for investment properties. Lower property taxes can mean higher net rental income for landlords, which can make a big difference in profitability.

Business-Friendly Environment

States with a business-friendly environment can be more attractive for landlords, as they tend to have more supportive policies and regulations that make it easier to operate a rental property business. This can include lower taxes, streamlined business registration processes, and more supportive local governments.

Low Cost of Living

A low cost of living can also be attractive for landlords, as it can translate to lower property prices and operating costs. Lower costs can make it easier for landlords to make a profit on their rental properties, even with lower rental rates.

Straightforward landlord-tenant laws

Tenants rights are important but they sometimes go beyond what necessary can put landlords at financial risk. In landlord-friendly states, there’s legislation that’s fair for both parties.

Overall, landlord-friendly states are those that have a supportive legal and regulatory environment for landlords, as well as a strong rental market and low operating costs. If you are a landlord looking to invest in rental properties, it can be worth considering these factors when deciding where to operate your business.

Landlord Friendly States

North Carolina, Georgia, Florida, Texas, Arkansas are among the most landlord friendly states.

Tennessee, South Carolina are somewhat in the middle of the pack.

California, Oregon, Washington are among the least landlord friendly states.

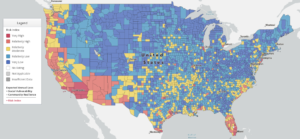

This map from rentcafe can come in handy:

Evaluate Potential Natural Disasters

Cash flow properties are usually held for the long haul, so it’s important to consider natural disasters when investing.

Most places in the US are subject to some sort of natural disaster: earthquake, floods, fire, hurricanes, tornadoes.

While insurances exist, they are expensive for natural disasters and we’re buying for the long haul, so the probability of a natural disaster over 15, 20, 25 years is not negligible.

The FEMA national risk index map is a good resource to evaluate the potential for natural disasters:

This map is to be taken with a grain of salt: some areas may be classified as ‘high risk’ but if there’s a way to mitigate it, that’s probably fine.

For example an area may be classified as high risk because of floods. But if you look at an elevation map, you see that half of the city is built in a flood zone, while the other half is not. So buying outside of the flood zone is a simple remedy.

Evaluate the Local Economy

Another key factor to consider when identifying a market for cash flow investments is the local economy. A strong and diverse economy can provide stability and growth potential for real estate investors, while a weak economy can increase the risks associated with investing.

To evaluate the local economy, look for industries that are thriving in the area, as well as any major employers or government institutions that are present. You can also research local economic development plans and initiatives to get a sense of the direction that the economy is headed in.

Wikipedia can be a good source of information. Local news outlets and generally googling around can give you a good idea if businesses are moving into an area.

Analyze Rental Demand

One of the most important considerations for cash flow investments in residential real estate is rental demand. To evaluate rental demand in a given market, you’ll need to look at vacancy rates, rent prices, and the overall availability of rental properties.

Low vacancy rates and high rent prices are typically indicators of strong rental demand, while high vacancy rates and low rent prices may indicate oversupply or weak demand. You should also consider the types of rental properties that are most in demand in the area, such as single-family homes or multi-unit buildings.

Consider the Cost of Investment

Finally, it’s important to consider the cost of investment when evaluating a market for cash flow investments. This includes the cost of properties, as well as any associated fees or expenses such as taxes, insurance, and maintenance costs.

To determine the profitability of a potential investment, you’ll need to calculate your expected cash flow based on rental income and subtract your expenses. This will give you a sense of the potential returns on investment in a given market.

In conclusion, identifying the right residential real estate market to invest in for cash flow requires careful research and analysis of a variety of factors. By considering key economic indicators, evaluating local market conditions, and analyzing rental demand, you can make informed decisions about where to invest your money for the best possible returns.

One reply on “How to Identify Cash Flow Residential Real Estate Markets”

[…] by researching and identifying the specific natural disasters that are prevalent in the target location. Different regions have varying levels of susceptibility to certain types of hazards. For example, […]