In today’s fast-paced world, it’s never too early to start teaching kids about money. Teaching financial literacy from a young age can set a strong foundation for responsible money management in the future. And what better way to introduce the concept of money to your little one than through fun and engaging crafts? In this article, we will explore some easy money crafts specifically designed for 3-year-olds. These activities are not only educational but also loads of fun for your toddler.

Easy Money Crafts for 3-Year-Olds

Introduction

Teaching your 3-year-old about money might seem like a daunting task, but it doesn’t have to be. Through creative and interactive crafts, you can make learning about money a delightful experience for your child. These crafts will not only help them understand the concept of currency but also develop essential skills like counting, sorting, and saving.

Why Teach Money to Toddlers?

You might be wondering why it’s important to teach money to toddlers. Well, here are a few reasons:

- Early Financial Literacy: Introducing money concepts early lays the foundation for financial literacy, an essential life skill.

- Counting and Math Skills: Money crafts involve counting coins, which helps improve your child’s math skills.

- Saving Habits: Teaching the value of saving from a young age instills good money habits that can last a lifetime.

Now, let’s dive into the exciting world of money crafts for 3-year-olds.

Craft #1: Counting Coin Caterpillar

Materials Needed:

- Assorted coins

- Glue

- Googly eyes

- Pipe cleaners

- Construction paper

Instructions:

- Help your child create a caterpillar shape using construction paper.

- Glue googly eyes onto the caterpillar’s head.

- Attach coins to the body as “segments.”

- Count the coins together as you attach them.

This craft not only teaches counting but also introduces the concept of the value of different coins.

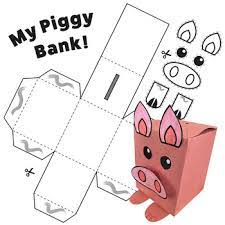

Craft #2: Paper Plate Piggy Bank

Materials Needed:

- Paper plate

- Pink paint

- Paintbrush

- Scissors

- Glue

- Pink construction paper

- Marker

Instructions:

- Paint the paper plate pink and let it dry.

- Cut out ears, eyes, and a snout from the construction paper.

- Glue the ears, eyes, and snout onto the paper plate to create a pig’s face.

- Use the marker to draw a coin slot on top.

- Your child can “feed” the piggy bank with play coins.

This craft introduces the idea of saving money in a piggy bank in a playful way.

Craft #3: Coin Rubbing Art

Materials Needed:

- Coins of various sizes

- Crayons

- Paper

Instructions:

- Place a coin under a piece of paper.

- Show your child how to rub a crayon gently over the coin to create a textured image.

- Encourage them to explore different coins and colors.

This craft combines art and money, allowing your child to appreciate the uniqueness of each coin.

Craft #4: Money Sorting Game

Materials Needed:

- A mix of coins

- Small containers or jars

- Labels (e.g., penny, nickel, dime)

- Timer

Instructions:

- Label each container with the name of a coin.

- Scatter the mixed coins on a table.

- Set a timer and challenge your child to sort the coins into the correct containers.

This game makes learning about different coins and their values exciting.

Craft #5: DIY Play Money

Materials Needed:

- White paper

- Crayons

- Scissors

Instructions:

- Cut the paper into rectangles to create play money.

- Have your child decorate the money with crayons.

- Assign values to the bills (e.g., 1, 5, 10, 20) and explain their significance.

Creating play money helps your child understand the concept of currency.

Craft #6: Treasure Hunt

Materials Needed:

- Small prizes or toys

- Coins

- Clues (simple pictures or words)

Instructions:

- Hide small prizes around the house or yard.

- Provide your child with a series of clues that lead to each hidden treasure.

- They must “pay” a coin to claim each prize.

This craft combines money with a thrilling treasure hunt.Craft #7: Savings Jar

Materials Needed:

- Empty glass jar with a lid

- Decorative materials (stickers, paint, etc.)

- Labels

Instructions:

- Decorate the jar with your child using stickers, paint, or other decorative items.

- Label the jar as a “Savings Jar.”

- Whenever your child receives a coin, encourage them to place it in the jar as savings.

This craft teaches the importance of saving money for the future.

Craft #8: Money Collage

Materials Needed:

- Old magazines or newspapers

- Glue

- Paper

Instructions:

- Cut out pictures of coins and money-related items from old magazines or newspapers.

- Help your child create a collage on a piece of paper.

- Discuss the significance of the images.

This craft enhances your child’s awareness of money-related symbols.

Craft #9: Coin Stamping

Materials Needed:

- Coins

- Paint

- Paper

Instructions:

- Dip the coins in paint and stamp them on a piece of paper.

- Create patterns or designs using different coins.

- Talk about the coins’ values as you stamp.

This craft combines creativity with learning about coins.

Craft #10: Coin Identification

Materials Needed:

- A variety of coins

- Flashcards with coin values

Instructions:

- Show your child a coin and ask them to identify its value.

- Use flashcards to reinforce their learning.

This craft helps your child become more familiar with different coins.

Craft #11: Money Mobile

Materials Needed:

- Cardboard

- String

- Coins

- Decorations (optional)

Instructions:

- Cut out shapes from cardboard and decorate them.

- Attach coins to the shapes using string.

- Hang the mobile in your child’s room.

This craft adds a fun and decorative element to learning about money.

Craft #12: Money Matching Game

Materials Needed:

- Index cards

- Stickers of coins

- Marker

Instructions:

- Place stickers of coins on index cards.

- Write the coin values on separate cards.

- Have your child match the stickers with their corresponding values.

This game reinforces your child’s knowledge of coin values.

Craft #13: Storytime with Money

Materials Needed:

- Children’s books about money

- Coins

Instructions:

- Choose a children’s book that discusses money-related themes.

- Read the book together and use real coins to illustrate the concepts.

Reading and discussing money-related stories can be both educational and entertaining.

Tips for a Successful Crafting Experience

Crafting with young children can be incredibly rewarding, but it also requires some patience and planning. Here are a few tips to ensure a successful crafting experience:

- Choose Age-Appropriate Crafts: Select crafts that match your child’s developmental stage. Crafts that are too complex can lead to frustration, while those that are too simple may not hold their interest.

- Use Safe and Non-Toxic Materials: Ensure that all crafting materials are safe for young children. Check for non-toxic labels on paints, glues, and other supplies.

- Prepare in Advance: Set up all the materials you’ll need before starting the craft. This helps keep the process smooth and minimizes interruptions.

- Encourage Independence: While it’s essential to offer guidance and supervision, allow your child to take the lead in the crafting process. Let them make choices and decisions about colors, shapes, and designs.

- Praise and Encouragement: Offer plenty of praise and encouragement throughout the crafting session. Positive feedback boosts your child’s confidence and enthusiasm.

- Keep it Mess-Friendly: Crafting can get messy, but that’s part of the fun. Lay down newspaper or a plastic tablecloth to catch spills and make cleanup easier.

- Stay Flexible: Crafting with young children often involves changes of plan. Be open to their creative ideas, even if it means deviating from the original craft.

Extending Learning Beyond Crafting

Crafting is not just about the final product; it’s also a valuable learning experience. Here are ways to extend the learning:

- Storytelling: Encourage your child to create a story around their craft. Ask them questions about what they’ve made and let their imagination run wild.

- Math Skills: Use crafting as an opportunity to introduce basic math concepts. Counting materials, comparing sizes, and discussing shapes are all valuable math exercises.

- Language Development: Engage in conversations while crafting. Use descriptive words, ask open-ended questions, and encourage your child to express their thoughts and ideas.

- Fine Motor Skills: Crafting helps develop fine motor skills, which are essential for tasks like writing and drawing. As your child cuts, glues, and colors, they’re honing these skills.

Crafting as a Bonding Experience

Crafting with your child is not just about creating art; it’s about building a bond. Spending quality time together, sharing ideas, and working collaboratively on projects strengthens your connection and creates lasting memories.

Conclusion: Embrace the Creativity of Childhood

In the world of crafting with 3-year-olds, it’s not about perfection; it’s about the joy of creation and exploration. These moments are precious and fleeting, so embrace the mess, celebrate the imperfections, and cherish the boundless creativity of childhood. Crafting with your child is a beautiful journey of discovery and connection, one that you’ll both treasure for years to come.

Teaching 3-year-olds about money doesn’t have to be dull or overwhelming. These easy money crafts not only make learning fun but also lay the foundation for financial literacy. By engaging in these creative activities, your child can develop essential skills while gaining a deeper understanding of the value of money.

FAQs

Q1: When is the right time to start teaching kids about money? A1: It’s never too early to start. You can introduce basic money concepts as early as age 3.

Q2: Are these crafts safe for young children? A2: Yes, all the crafts mentioned are safe for 3-year-olds when supervised by an adult.

Q3: How can I make learning about money more interactive? A3: Use real coins, play games, and tell stories to make the learning experience interactive and engaging.

Q4: What are the long-term benefits of teaching financial literacy to young children? A4: Teaching financial literacy early can help children develop responsible money management skills and financial independence in the future.

Q5: Where can I find more resources for teaching kids about money? A5: You can find books, online resources, and educational apps designed to teach kids about money and finance.