For most people housing is the biggest expense and it’s therefore extremely important to limit spending on housing so you can save money. If you’re on a path towards financial independence, remember you need to invest money and to invest money, you need, well, money. So you need to spend it wisely and save wherever possible. So back to housing and what exactly is house hacking and how can this help you?

House hacking is a term that has been famously coined by Brandon Turner, former podcast host at BiggerPockets and seasoned real estate investor. It essentially describes several creative ways to reduce your housing expenses.

Let’s go through the different ways you can save money on housing. Depending upon your personal situation, some may be easier or more convenient to implement than others but let’s go through them anyway.

House Hacking: The Best Way to Save Money For Financial Independence

Understanding House Hacking

House hacking is a real estate investment strategy that allows you to live in your property while generating rental income from other units or portions of the property. By doing so, you can significantly reduce or even eliminate your housing expenses, creating a path towards financial independence.

The Benefits of House Hacking

Reduced Housing Expenses

House hacking provides a unique opportunity to minimize your housing costs by leveraging the income generated from renting out a portion of your property. This can free up a substantial amount of money to be invested elsewhere, ultimately accelerating your journey towards financial freedom.

Increased Cash Flow

With the rental income from house hacking, you can generate positive cash flow. This means that not only are you living in your property for free or at a significantly reduced cost, but you’re also earning extra income that can be used for savings, investments, or even paying down debts.

Building Equity

As you make mortgage payments, the value of your property appreciates over time, allowing you to build equity. House hacking enables you to expedite this process by utilizing rental income to contribute towards mortgage payments. This can help you build wealth and create a solid financial foundation for the future.

Learning Real Estate Investing

House hacking serves as a stepping stone into the world of real estate investing. It allows you to gain hands-on experience in property management, tenant relations, and the overall dynamics of the real estate market. This knowledge can be invaluable as you progress towards expanding your investment portfolio.

Consider living with roommates

Rather than renting a studio, you may want to consider renting a house with roommates and split the cost. It’s often more cost effective. I lived several years with roommates at a time where a studio was renting for around $1,500/month in my area, while the rent split among roommates was around $1,000/month, saving $500/month or $6,000 per year. While it looks like a nice saving, it’s nothing compared to what comes next.

Buy a small multi-family

Probably the most popular house hack and considered as the traditional house hack, it consists in taking an FHA loan (if you live in the US) to buy a small multi-family building, for example a duplex or a triplex or quadruplex, live in one unit and rent the other unit(s). If the price is right, meaning that you do not overpay for the property, and the interest on the loan is low enough, it is possible to have the rent cover the loan and some of the expenses and you can pretty much live for free. This strategy works best when buying a home is more advantageous than renting and it usually tends to be in cheaper housing markets. In more expensive markets, the rent will usually not cover the expenses, so while it can still reduce your expenses you’d need to verify how much would pay, should you rent in your area to see if it financially makes sense.

Why an FHA loan you may ask? It allows you to buy a property with just a 3.5% down payment. So if you look at a $100,000 property, that’s just $3,500 you need to put as a down payment.

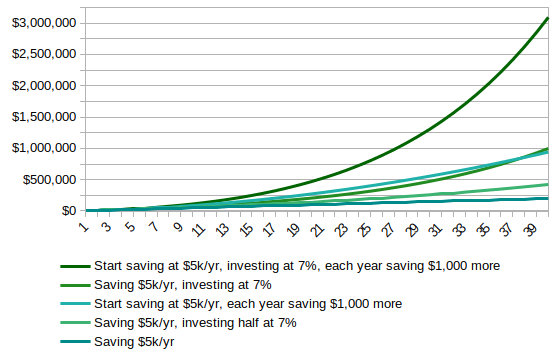

When done properly that’s how you can get rid of your biggest expense. The earlier you can do it, the more money you can save and invest.

Rent out rooms

This is somewhat a combination from the traditional multi-family house hack and the renting a place with roommates. Essentially you can buy a home, live in the living room or if the house has a basement, turn it into a livable space. Then you can rent out he remaining rooms. By renting individual rooms it may be possible to cover the cost of the house: loan, taxes, insurance, completely covering your housing cost.

Live-in flip

A live-in flip consists in finding a home below market value that needs to be renovated. You would live in house while renovating it. Live in it for at least 2 years to reduce the amount of capital gain taxes you’ll need to pay when you sell it, if you live in the US, as this relates to the US tax code. Then you finally sell it. The amount of money you make when you sell can cover your housing cost for the past couple years.

Overall there are various ways to reduce or completely eliminate your hosing cost and it’s extremely important to take a hard look at these options as reducing the biggest household expense can go a long way to boost your savings and your investment power.

Sources

[1] https://www.biggerpockets.com/blog/6-house-hacking-strategies-you