If you’re considering financial independence and early retirement, investing is not an option: you must invest if you ever want to have a chance to reach financial independence, by definition. In its simplest form financial independence means your money is working hard enough to cover your lifestyle so you no longer need to exchange your time for money, meaning you no longer have to work.

Also living of savings can only last for so long and there’s only so much you can save.

If you expect to retire at 40 years old, expect to spend $50,000 per year until you leave this earth, let’s say at 80 years old, to keep the math simple, that’s 40 x $50,000 = $2,000,000 you need to save by age 40. Assuming you start working at age 20, you’d need to save $100,000 per year for 20 years.

Assuming you live a lifestyle similar to what you expect in retirement, you’d need to earn a gross income of around $200,000 per year. Here goes the math:

- At $200,000, you can expect to pay around 25-30% in taxes. That leaves you with $140,000-$150,000.

- $40,000-$50,000 of living expenses

- That lives you with $100,000 saved up.

While a few jobs can allow you to earn this much, it’s unlikely for most to earn such a high income at such a young age.

And that’s where investing comes to the rescue. Sure, you need to work to start earning and saving money, but this money should not sit idle and it should also work for you, so you can reach your goal. Investing will help you boost your income, until it eventually gets you financially independent.

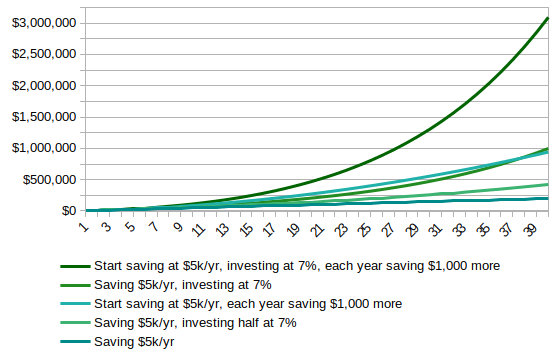

Let’s consider a few scenarios to see how they compare. The first year we start with $5,000 and each year after that we assume the following:

- Saving $5,000 per year

- Saving $5,000 per year and investing half of the money at a 7% yearly return

- Start saving $5,000 per year, and each year increase the saving by $1,000 (So the first year we save $5,000, the second year $6,000, the third year $7,000 and so on and so forth…)

- Saving $5,000 per year and investing all the money at a 7% yearly return

- Start saving $5,000 per year, and each year increase the saving by $1,000, investing all the money at a 7% yearly return

Here is the evolution over time:

By saving $5,000 per year, after 40 years you’ll end up with $200,000. Not too bad, but not enough to retire comfortably.

If you just invest half of the money each year, you’d double the money getting slightly over $420,000. It already shows how important investing is.

Now, without investing, but by increasing your savings by $1,000 each year (either by getting a raise, changing job or starting a side hustle), you end up with around $940,000. And this shows how important it is to increase your savings as your income grows.

Then, going back to the $5,000 / yr savings and investing everything, it beats increasing the saving rate and you’ll end up shy of the $1 million mark with around $998,000. Again it shows how important investing is as far as growing your wealth.

Finally, combining both the increase of savings over time and investing show the power of compounding and we’d end up with over $3,000,000 which is more than 3 times the next best results.

Now that growth happened over 40 years and this shows the importance of starting early. The earlier you start, the easiest it will be to grow your portfolio leveraging the compounding effect.

Now 40 years is still a long time, if we want to reduce the time it takes to reach our goal, whatever it is, we realize how important it will be to save aggressively to bootstrap the investment growth.